PiggyVest (formerly known as Piggybank.ng) makes it simple for people to save money for their necessities.

Anyone can use PiggyVest to invest or save money in companies and investment funds and quickly see returns of at least 25% or higher. (In as short as 9 months or less). The platform offers interest rates for savings that can reach 13%.

PiggyVest is recognized as one of Nigeria’s most commonly used and well-liked savings and investing services.

There are several ways to save money on the website. You can use a feature that lets you save individually or even as a group.

This means that you can share financial savings with your spouse, closest friend, co-worker, or other family members.

With more than a million downloads, the platform is among the most popular Nigerian apps in the Google Play Store.

You can invest or save the extra money you have instead of going on a shopping frenzy. Savings can eventually be turned into an emergency fund. Saving money is a wise move if you want to ensure your financial stability.

Read also – Paga Review: What it Means, how it Works, Requirements & Alternatives

An overview of Piggyvest

PiggyVest is Nigeria’s leading online savings and investment platform. It was launched in the first quarter of 2016. Back then, the website was named “Piggybank.ng, ” and its main focus was on saving money.

The platform established a solid reputation for integrity, superior customer service, and money management in its first three years of operation.

The domain “Piggybank.ng” changed its name to “PiggyVest” in 2019. Since then, it expanded the list of services it offered to include “offering of investment opportunities.”

PiggyVest currently has over a million highly satisfied customer base. The business has built a solid reputation for excellent financial management services, as well as accountability, effectiveness, and ease, after only six years in business.

The platform’s high capital adequacy ratio is proven by investing and saving more than 1,000,000,000 Naira every month.

PiggyVest wants to make financial growth and management easier. They have never even once strayed from that objective.

How does Piggyvest work?

When you have a financial objective that you want to achieve It can be to pay rent, start a business, or for any other reason. Maybe all you want to do is save a million, ten million, or more.

You register for a PiggyVest account and begin saving. They give you interest on your savings of up to 3%. You can save whenever you wish, whether daily, weekly, or monthly. You have the choice to enable automatic saving.

You may choose to set aside, for instance, between ₦50 – ₦20,000 or more each day. Your desired amount will be automatically debited from your account each day once you set it up.

If you want to save weekly or monthly, you can also program it so that money is taken out automatically from your bank account every week or monthly.

There is also the option to save money by having it withdrawn automatically from your bank account. It is called QuickSave. You get to decide when to save. simply access the piggyvest app

The option to save with a friend, family member, spouse or group of individuals is also available. How much money you wish to save and for how long must be decided upon with the other people. and begin saving! The funds will be sent to each saver’s account on the day you specify.

There aren’t many withdrawals dates every year when you save. The reason is to keep you disciplined to save. However, you can withdraw at any time with a penalty after the withdrawal date.

The ability to lock funds is available. if you wish to avoid touching whatever money you have.

You might also like – Exploring Kuda’s Features: What Makes It Unique?

How Safe is PiggyVest for Saving Money in Nigeria?

Many Nigerians wonder “is PiggyVest safe to save money?” The answer is yes—PiggyVest safety features ensure users’ funds are protected.

The platform uses two-factor authentication, encryption, and device approval to safeguard accounts. Unlike traditional banks, PiggyVest is not insured by NDIC, but funds are kept with regulated partners like Microfinance banks and SEC-licensed asset managers, ensuring compliance with the Securities and Exchange Commission Nigeria.

On the PiggyVest app, users can track their balance, savings, and investments in real-time. Reviews in Lagos and other cities rate it highly for reliability, user experience, and timely withdrawals.

Interest rates range from standard PiggyVest savings interest rate (around 8% annually) to PiggyVest Safelock interest rates 2025, which offer higher fixed returns.

While not risk-free, PiggyVest is safer than informal savings and scams. For Nigerians seeking disciplined saving, PiggyVest is trustworthy, legit, and regulated, making it one of the best savings apps in Nigeria.

Key Features of piggyvest

Piggyvest has put in place some features to help you not only save money but to invest your money.

The following are some of the interesting features that make piggyvest a very interesting platform:

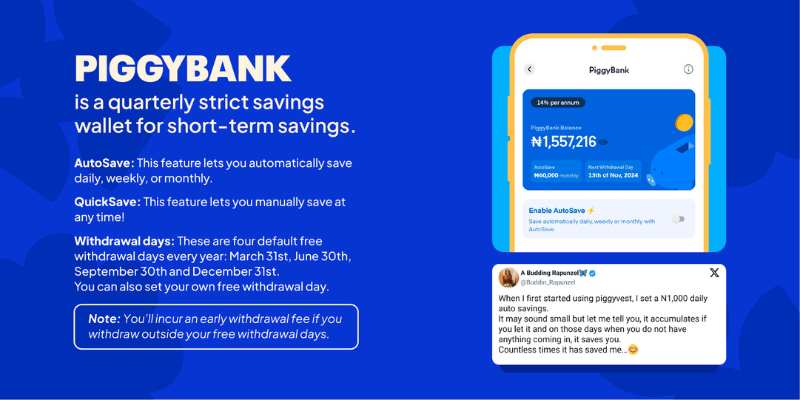

1. Piggybank

The piggybank enables you a little or a large amount of money, this money will be deducted automatically from your bank balance, so you don’t have to be depositing money to your piggyvest savings every day.

This will imbibe a saving culture in you and will make you very pleased on withdrawal date.

A withdrawal date will be set by you, and you usually are not supposed to withdraw before that date, but if you do, piggyvest will charge you 5% on your saved money.

This will most likely discourage you from withdrawing before the date that you set, making it easier to save money in a long term.

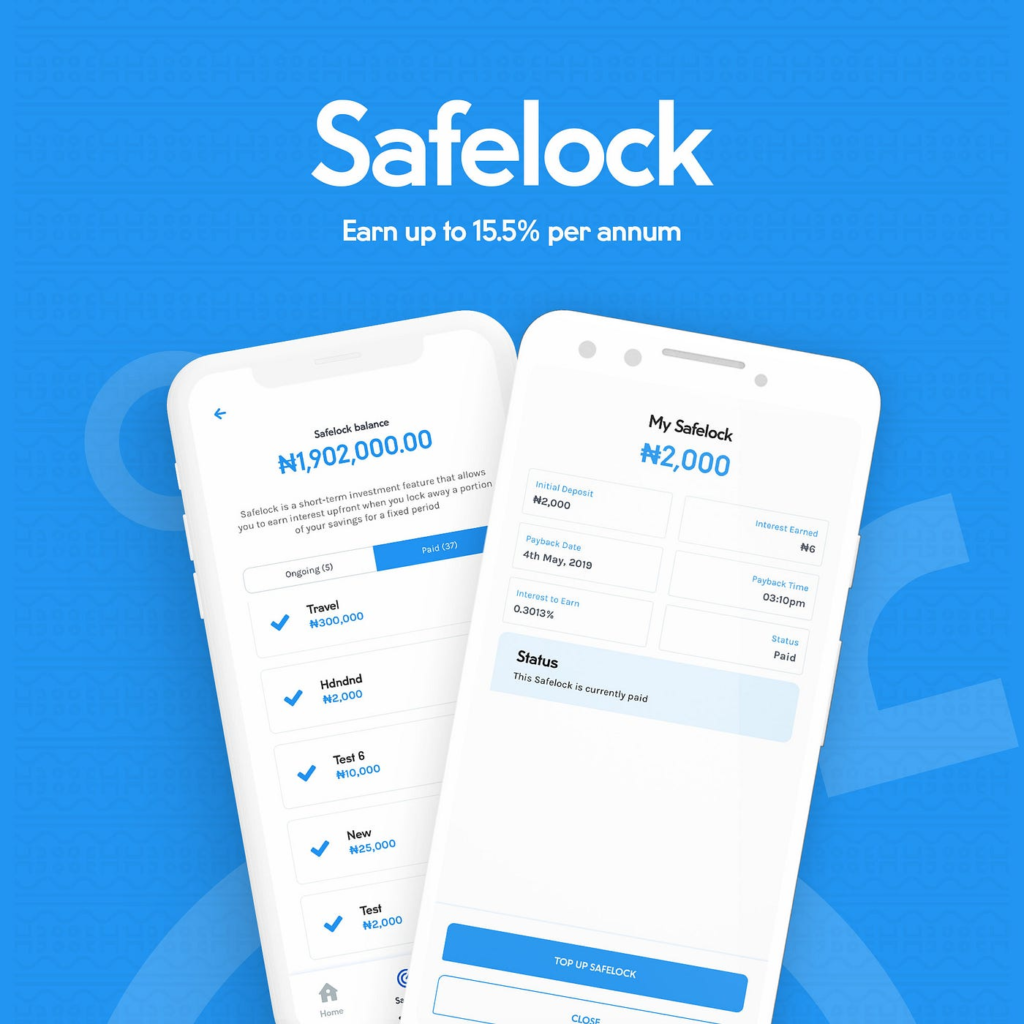

2. Safelock

This is piggyvest’s equivalent of a bank fixed account. Unlike the piggybank, you can’t withdraw this money before the set withdrawal date.

The safelock allows you to set money aside for a fixed period of time, without having access to it until it has reached maturity.

The difference between a piggyvest safelock and a bank’s fixed account is the interest that piggyvest pays you. With piggyvest, you can get up to 12% interest on saved money annually.

You can safelock your money on piggyvest for a minimum of 10 days and up to 1000 days.

This is useful if for example, you want to save up for something like a car, you can safelock it on piggyvest so you won’t be tempted to touch it until it has reached maturity.

3. Flexnaira

Piggyvest flexnaira is a feature on piggyvest which permits you to transfer, accept and build emergency funds with ease and zero charges.

4. Target savings

This feature on piggyvest enables you save towards a certain goal in mind and you can only withdraw your money when you reach that set goal.

For example, if you intend to save up to buy a car that maybe costs 1 million naira, you can use the piggyvest target savings feature to achieve this goal.

Saving a 100,000 naira every month for 10 months will help you reach your target, this is basically the primary use of the piggyvest target savings feature.

5. Autosaves

Autosaves is a piggyvest feature that allows you to save a certain amount of money daily, weekly or monthly.

With the autosaves feature, piggyvest automatically deducts a certain amount of money from your account daily, weekly or monthly.

With Autosaves, you don’t need to remember to transfer money to your piggyvest savings account, it automatically deducts the money.

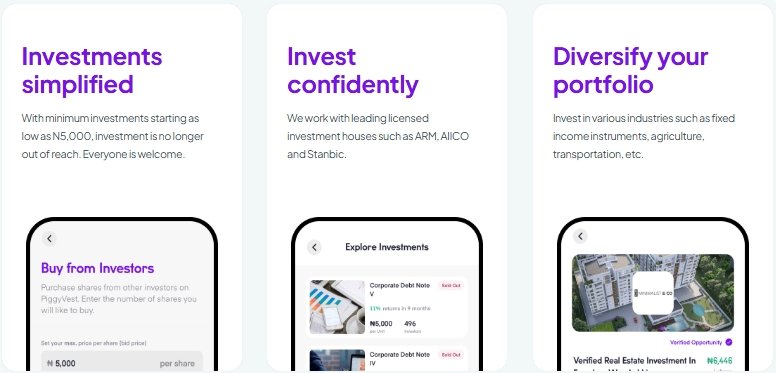

6. Investify

This another interesting piggyvest feature. Back in 2016 when piggyvest first launched, it was completely a savings platform, all it did was help you save and withdraw your money once it got to withdrawal date.

Over the last few years, piggyvest has expanded its business from just being a savings only platform and has added some other interesting features. One of these features is “investify”.

Investify is a feature on piggyvest that enables to make money by investing on agriculture, production and industries directly from the app.

You get up to 25% interest with investify. This means you can not only save money but make extra money on the side.

7. Piggy points

Piggy points are another way to make extra money on piggyvest. Simply put, piggy points are a way piggyvest rewards you for saving on its platform.

You will need to save at least 2000 naira at one on your piggyvest wallet to begin earning piggy points.

Here is how the point system works:

- 2,000 – 4,999 naira = 1 points

- 5,000 – 9,999 naira = 2 points

- 10,000 – 49, 999 naira = 10 points

- 50,000 – 99,999 naira = 25 points

- 100,000 naira & above = 55 points

1 point is worth 10 naira and you can convert your points to cash on your piggyflex account.

8. Piggyvest referral program

Another way to make extra money on piggyvest is through the piggyvest referral program. You get 1,000 naira for every person you get to sign up on piggyvest.

That means you can make up to 10,000 naira quickly if you refer 10 people to the platform, cool right?

All funds must be sent to your piggyflex account before you can withdraw it directly to your local bank account.

Read also – An In-Depth Analysis of Cowrywise: Features, Benefits, and User Experience

Piggyvest customer care number

PiggyVest is at Tesmot House, 3 Abdulrahman Okene Close, off Ligali Ayorinde, Victoria Island, Lagos. However, you can use several dedicated channels to contact a customer care representative if you have issues.

Here are PiggyVest customer care details:

- Email: contact@piggyvest.com

- Twitter: @PiggybankNG

- Instagram: @PiggybankNG

- Facebook: PiggyBankNG

- Contact Number: 0700 933 933 933 or 07009339339

There are many scammers out there, so ensure you ONLY use these channels if you want to solve a problem with your PiggyVest account.

What are PiggyVest Interest Rates in 2025?

PiggyVest offers some of the most competitive rates in Nigeria’s fintech savings industry. As of 2025, the PiggyVest savings interest rate on Flex Naira accounts averages about 8–10% per annum, credited daily.

For users who choose to lock their money, the PiggyVest Safelock interest rate 2025 can reach up to 13% annually, similar to fixed deposits but with more flexibility.

Additionally, target savings on PiggyVest earn competitive rates, encouraging users to achieve financial goals like rent or tuition. The PiggyVest app features Nigeria include an interest calculator, showing users how much they earn per month based on deposits.

Compared to banks where a savings account earns about 1–2%, PiggyVest provides higher returns on investment. Reviews highlight PiggyVest’s reliability and transparency in crediting interest.

Whether saving long-term or short-term, PiggyVest offers attractive interest structures for Nigerians seeking disciplined financial growth.

Is PiggyVest Approved by CBN and Licensed in Nigeria?

Yes, PiggyVest is approved to operate in Nigeria. While it is not a bank and doesn’t hold a microfinance bank license directly, it partners with a CBN-licensed and SEC-regulated entity known as PV Capital Limited to secure funds.

This structure ensures compliance with Nigerian financial regulations. Users often ask “is PiggyVest safe Nigeria?”—the platform uses advanced security features, including encryption, device approval process, and BVN verification, to protect accounts.

Although PiggyVest is not NDIC insured, customers’ money is secured through regulated investment partners.

On the PiggyVest dashboard, users can access savings plans, investments, and the PiggyVest Safelock feature, which offers attractive interest rates in 2025.

Reviews show Nigerians trust the platform because it provides higher returns compared to banks, flexible withdrawal options, and tools to build financial discipline. In conclusion, PiggyVest is a legit and reliable savings and investment platform in Nigeria.

What is PiggyVest Investify and How Does it Work?

PiggyVest Investify is the platform’s investment marketplace, allowing users to invest in pre-vetted opportunities.

These include agriculture, real estate, and fixed income assets. Returns vary but often range between 12% and 25% annually, depending on the risk level.

Many Nigerians ask, “how does PiggyVest investment work?”—users simply select an available investment option from the PiggyVest dashboard, fund it, and track returns within the PiggyVest app. Minimum investment amounts are flexible, making it accessible to young professionals.

PiggyVest Investify reviews Nigeria are positive, with many highlighting reliability, transparency, and regulated partners. While PiggyVest is not NDIC insured, it works with SEC-regulated investment companies, ensuring compliance.

For those comparing PiggyVest vs Cowrywise, Investify is often preferred for its wider variety of options. Overall, Investify helps users go beyond savings, offering legit, regulated investment opportunities with competitive returns.

Is there a Piggyvest app?

Yes, PiggyVest does have a mobile application that is both Android and iOS friendly. The platform enables saving, investments, and reaching financial goals with much ease. On this platform, users can save automatically or manually through the flexible plans.

- Use the Safelock feature for fixed savings at higher rates of interest.

- Browse Investify for curated investment opportunities.

- Set goals and track financial progress through goal-setting tools and analytics.

The PiggyVest mobile application is free to download from the Google Play Store for Android users and Apple App Store for iOS users, guaranteeing convenience and safety with its on-the-go approach to personal finance management.

PiggyVest vs Cowrywise: Which is Better in Nigeria?

The PiggyVest vs Cowrywise brand comparison is a common debate among Nigerians looking for safe digital savings platforms.

Both are legit savings apps, but they have unique strengths. PiggyVest features and benefits include Safelock, Flex Naira, and Investify, which provide flexible savings and investment options with PiggyVest interest rates ranging from 8% to 13% per annum.

Cowrywise, on the other hand, focuses more on mutual funds and automated savings. In terms of user experience, the PiggyVest app features Nigeria like Piggy Points, referral bonuses, and flexible withdrawal dates give it an edge.

Reviews indicate PiggyVest reliability is strong, with consistent payouts and solid security features Nigeria like device approval. Both apps are regulated by SEC Nigeria, ensuring user funds are safe.

The choice depends on goals: PiggyVest for higher interest and savings flexibility, and Cowrywise for long-term investments in mutual funds.

FAQs

Will I Be Charged by My Bank When Deductions Are Made?

No bank fees of any kind! When PiggyVest takes money out of your account, you won’t pay any bank fees.

Is the information on my debit card secure and safe with PiggyVest?

PiggyVest places a high priority on security at all times. To process your bank card information, the platform uses Paystack, a reputable payment gateway system.

How secure is my money when I use PiggyVest?

Licensed as Piggytech Cooperative Multipurpose Society Limited, PiggyVest is a cooperative organization. Additionally, they worked along with two microfinance organizations.

Is there a PiggyVest app?

Absolutely! The PiggyVest app is available on the Apple Store and Google Play Store. Signup via this link to download both the Android and ios versions.

Conclusion

PiggyVest provides a very easy and secure way of saving and investing, thereby enabling its customers to be financially disciplined for the fulfillment of their long-term goals.

From the mobile application, ease of use in its Safelock and Investify features, through to relatively high returns/interest rates and approval from the CBN, PiggyVest has managed to merit its trust in Nigeria’s fintech space.

It promotes savings culture and opens more avenues for financial inclusion of both individuals and businesses through accessibility, transparency, and innovation.

Recommendations

Paga Review: What it Means, how it Works, Requirements & Alternatives

Exploring Kuda’s Features: What Makes It Unique?

An In-Depth Analysis of Cowrywise: Features, Benefits, and User Experience