The PalmPay app is a mobile money service and financial technology platform that allows users to make digital payments and access other financial services, including loans, savings, and so on.

As one of the leading fintech apps in Nigeria, the PalmPay app has become a popular option for many users looking to carry out financial transactions digitally.

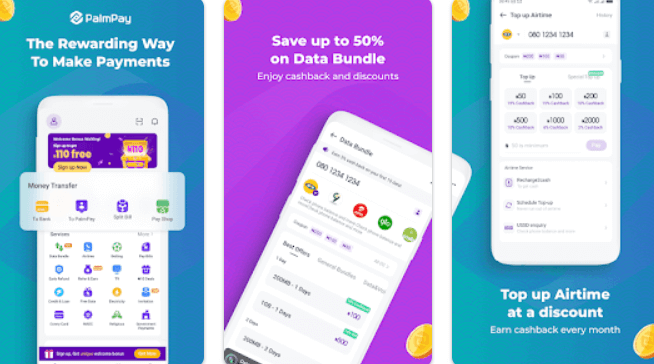

PalmPay App offers a simple and intuitive user interface that makes common tasks like sending and receiving money, paying bills, and purchasing airtime easy with just a few taps.

The app also provides helpful security features like biometric authentication to protect users’ transactions.

PalmPay has established itself as a convenient platform for digital payments and money transfers in Nigeria.

In this review, we will take a deeper look at PalmPay app’s essential services and functionality.

An overview of PalmPay?

PalmPay is not just a mobile payment platform; it’s a gateway to a problem-free and secure financial experience.

Functioning exclusively online, PalmPay eliminates the need for physical banking activities, providing users with a convenient solution for various financial transactions.

The app offers fundamental services such as mobile money transfer, airtime purchases, and the easy payment of utility bills, empowering users to manage their finances with unprecedented ease.

Features of the PalmPay App

The PalmPay app provides users with a convenient and secure platform to manage their finances on the go. Here are some of the key features:

1. Sending and Receiving Money

Sending and receiving money on PalmPay is an easy process. Receivers do not need a PalmPay account – you can send money to any bank account in Nigeria, not just other PalmPay users. The receiver will receive an SMS notification once the funds are received.

Money transfers happen instantly within seconds of hitting send, allowing for real-time transactions. PalmPay charges a very low transaction fee, usually around 1-2% of the amount sent, making it much more affordable than bank transfer charges.

2. Bill Payments

PalmPay allows users to pay various utility bills and services conveniently from the app. Some of the significant bill payment options include:

Electricity bills from providers like PREMIUM, EKO, and Ikeja Electricity can be settled using PalmPay.

Cable TV/satellite subscription amounts for DSTV, GOTV, Startimes, and others are also paid for through the app.

Water bills from water boards across Nigeria are payable on PalmPay as well. Additionally, internet/fiber bills, gas bills, school fees and more can be managed through the app.

3. Buying Airtime and Data Bundles

In addition to money transfers and bill payments, PalmPay allows users to easily purchase airtime for themselves or others. This can be done with just a few taps directly from the PalmPay app.

Pros of PalmPay App

The PalmPay app has amazing advantages which includes:

- It allows users to send and receive money easily and faster.

- PalmPay has a large network of merchants and vendors that accept payments through the app, making it convenient for shopping and payments.

- The app offers other financial services like bill payments (electricity, Dstv, Gotv, etc), and airtime purchases.

- Customers can access loans using the PalmPay app.

- PalmPay app has savings options for users who want to save their money, and they offer good interest on the savings.

- Users can convert their airtime to cash easily on the PalmPay app, which can help in transferring airtime across different networks (From MTN to Airtel, From Glo to MTN, etc.)

- This makes it a one-stop platform for banking and payments.

- It has a simple and intuitive user interface that is easy to navigate, even for first-time users.

Cons of PalmPay App

The PalmPay app has amazing benefits, but it also has its downsides, which includes:

- Like other fintech apps, it requires users to have a smartphone and internet access to use the services.

- There are transaction and service fees associated with certain payments and financial services on the app.

- Security and privacy are always a concern with digital payment platforms. Users need to take precautions to safeguard their accounts and financial information.

- Customer support is sometimes slow.

PalmPay Customer Care Number

As one of the leading fintech platforms in Nigeria, PalmPay understands the importance of providing excellent customer support.

They have a dedicated customer care team to assist users with queries or issues regarding their PalmPay accounts or services.

PalmPay Phone Number

The primary contact number for PalmPay customer care is +234 813 888 6888. Representatives are available on this number daily from 9:00 AM to 6:00 PM WAT.

You can call this number for assistance regarding account access, payment failures, transaction disputes, and app issues. An IVR system will guide you to the appropriate department.

Other Contact Options

In addition to calling, PalmPay customers can also reach out to customer care via:

- Email: support@palmpay.com

- Social Media: Facebook, Twitter, Instagram

- Online Chat: Available on the PalmPay website and app

- Postal Address: PalmPay Limited, 20 Opebi Road, Lagos, Nigeria

Most queries are addressed within 24 hours when contacted via phone, email or social media. For issues that may require more research, PalmPay aims to provide a resolution within three working days.

Opay vs Palmpay: Which is Better?

Both OPay and PalmPay are among the leading fintech platforms in Nigeria, offering different features and services that would increase banking and financial transaction usage.

Let’s compare Palmpay and Opay which is better based on a few key aspects.

1. User Interface and Experience

- The OPay user interface is pretty friendly, and various features can be comfortably managed.

- The PalmPay interface is intuitive to work with, making it rather simple for any user to operate and manage their finances.

2. Services Offered

- OPay covers more areas, including money transfers, bill payments, airtime recharges, and food delivery using cab services.

- PalmPay provides mainly financial services such as money transfers, bill payments, and savings options.

3. Security Measures

- OPay claims assurance of security for users through encryption technologies and two-factor authentication.

- PalmPay claims to have strong security because it adopts advanced encryption and biometric authentication methods for transactions.

4. Transaction Fees and Charges

- OPay charges several transaction fees, depending on the various services one may intend to use.

- On the contrary, PalmPay has transaction fees, which are primarily competitive and transparent.

5. Customer Support

- OPay supports customers through in-app chat, email, and phone support.

- PalmPay also does support within the application and on the websites; support agents are pretty responsive to users’ inquiries.

6. Accessibility

- OPay and PalmPay are downloadable on Android and iOS devices for easy access.

7. Integration with Other Services

- OPay is smoothly integrated into other services that might form part of its ecosystem, making users enjoy the experience.

- PalmPay focuses highly on the delivery of financial services and does only a few integrations with third-party platforms.

From a condensed view on “Palmpay vs OPay” or Opay and Palmpay which is better, it will depend on individual needs, such as the type of services one wants or would like to be offered.

FAQs

What is PalmPay?

PalmPay is a fully mobile payment platform for transferring money, bill payments, airtime, and earning rewards on transactions. This was done to make it user-friendly and to ensure financial inclusion.

Is PalmPay reliable and secure?

Yes, PalmPay is secure, and licensed by regulatory bodies where it operates. It uses encryption and authentication to prevent leakage of user data or transparency of transactions, hence trusted to make and receive payments.

What have users said about PalmPay?

Some users like it for its cash back rewards, low transaction fees, and speedy transfers. Yet, other reviews have spoken to app glitches and inability to timely resolve issues thrown up by customer support.

Conclusion

In conclusion, PalmPay has proven itself as a leading fintech platform in Nigeria. The app offers convenient features for digital payments, money transfers, bill payments, airtime top-ups and savings. It ensures the security of transactions and insures user deposits.

While customer support could be faster, PalmPay provides an affordable alternative to traditional banking.

For individuals and businesses in Nigeria seeking an easy way to manage finances on their phones, PalmPay is a reliable option.

With its large user base and room for growth, the company is well-positioned to introduce new services and expand its reach in the fintech space.

Recommendations

A Comprehensive Overview of Flutterwave : Analyzing Its Services, and Features

FairMoney Review: Understanding Its Features, Mobile App, Functionality, and Alternatives

A Comprehensive Review of PiggyVest: Analyzing Its Features and Benefits