Lidya is a leading African fintech company focused on providing accessible financial services to small and medium-sized enterprises (SMEs) across Africa.

Founded in 2016 by Ercin Eksin and Tunde Kehinde, Lidya aims to bridge the financial gap faced by SMEs by offering business loans, financial management tools, and other tailored services designed to help businesses grow.

The platform has established itself as a key player in the financial inclusion space, particularly for businesses in emerging markets that often struggle to access traditional banking services.

Lidya leverages technology to make lending and financial services faster, more efficient, and more accessible for SMEs in Africa, helping them scale and reach their full potential.

With an emphasis on data-driven decision-making, Lidya uses alternative data sources to assess the creditworthiness of businesses and ensure fair and transparent lending.

Read also – A comprehensive overview of Payhippo: key features, Valuation, Funding & Investors

Overview of Lidya

Lidya offers a range of services, including business loans, working capital financing, and financial management tools, all designed to help businesses grow and scale.

The platform utilizes alternative data to assess creditworthiness, making it easier for businesses without traditional financial records to access loans.

With a focus on speed, transparency, and flexibility, Lidya provides businesses with quick access to funding, enabling them to cover operational expenses such as payroll, inventory, and supplier payments.

The platform also offers a business dashboard for financial management, giving entrepreneurs real-time insights into their cash flow, revenue, and expenses.

Lidya has attracted significant investment from notable backers such as Accel, Bamboo Capital Partners, and AHL Venture Partners, raising millions to expand its services across Africa.

With its innovative approach and data-driven solutions, Lidya is helping drive financial inclusion and empower SMEs to thrive in Africa’s dynamic economy.

Key Features of Lidya

Here are some features of lidya:

1. SME Business Loans

Lidya’s flagship service is its business loan product, designed to provide small and medium-sized businesses with the capital they need to grow.

The company offers short-term loans with flexible repayment terms, enabling businesses to access working capital quickly without going through the lengthy approval processes typical of traditional banks.

- Loan Amounts: Loan amounts can range from a few thousand dollars to significant sums depending on the business’s size, credit profile, and history with the platform.

- Loan Terms: Businesses can access loans with terms that range from a few weeks to several months, giving them the flexibility to repay based on their cash flow.

- Repayment Plans: Flexible repayment plans that suit the borrower’s revenue cycle.

2. Alternative Data Credit Scoring

One of the distinguishing features of Lidya’s lending process is its use of alternative data to assess the creditworthiness of businesses.

Instead of relying solely on traditional financial records, Lidya considers factors such as payment history, business performance metrics, and even the company’s social media activity to evaluate credit risk.

This approach makes it easier for businesses without access to formal credit history or traditional banking services to qualify for loans.

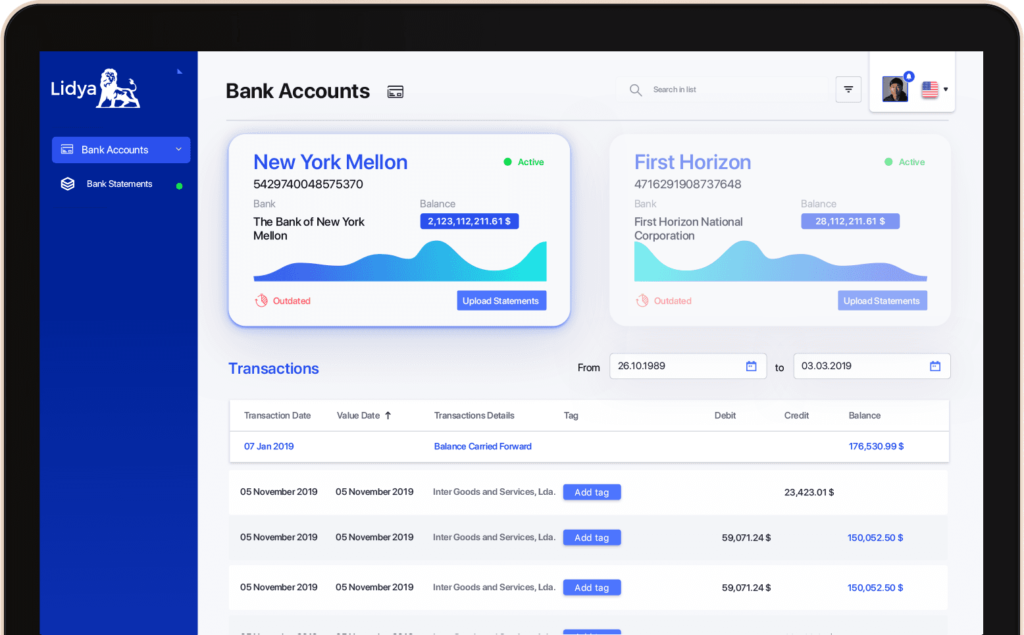

3. Lidya Business Dashboard

Lidya provides businesses with a financial management platform that helps track and analyze key financial metrics.

This business dashboard allows entrepreneurs to manage their finances, monitor revenue, expenses, and cash flow, and make more informed decisions.

4. Working Capital Financing

In addition to loans, Lidya provides working capital financing, which helps businesses cover day-to-day operational expenses, such as inventory, payroll, and supplier payments.

This service aims to provide businesses with the necessary funds to keep operations running smoothly without worrying about cash flow constraints.

5. Cross-Border Business Support

Lidya is focused on supporting SMEs across multiple countries in Africa, allowing businesses to access loans and financial tools that are tailored to the unique challenges of operating in different African markets.

This includes providing cross-border financing options for businesses looking to expand across Africa.

Valuation of Lidya

As of 2023, Lidya’s valuation has been reported to be in the range of $100 million to $200 million.

The company has seen significant growth since its inception, largely driven by the increasing demand for SME-focused financial products in emerging markets.

Lidya’s ability to tap into the underserved SME market has made it an attractive player in the African fintech space, especially as financial inclusion becomes an increasingly important goal for economic development in Africa.

However, like many startups in emerging markets, Lidya’s valuation is subject to market dynamics, investor sentiment, and its ability to scale effectively across multiple countries.

The company’s strong growth trajectory and impact on SME financing in Africa have positioned it well for future expansion and continued success.

Read also – An In-Depth Analysis of Paystack: Features, Benefits, and User Experience

Funding and Investors

Lidya has attracted notable investors and funding throughout its development, which has helped fuel its growth and expansion. Some of the key rounds of funding and investors involved include:

1. Seed Funding

Lidya’s initial seed funding came from local investors and venture capital firms that recognized the potential of the platform to address the financial needs of SMEs in Africa.

The initial investment allowed the company to develop its platform, build out its credit scoring technology, and begin its early-stage operations.

2. Series A Funding (2019)

In 2019, Lidya raised a Series A round of funding to further expand its reach across Africa and improve its technology infrastructure.

The round was led by Accel, a global venture capital firm, and included contributions from Bamboo Capital Partners, AHL Venture Partners, and other angel investors.

This round raised $6.9 million for the company, providing the necessary capital to accelerate growth, increase marketing efforts, and enhance product development.

3. Partnerships and Strategic Investments

Lidya has formed key partnerships with various financial institutions and development organizations to boost its impact on African SMEs.

The company has partnered with Mastercard, which has enabled Lidya to tap into Mastercard’s extensive network to facilitate cross-border payments and expand its reach.

4. Impact Investment

Lidya has attracted funding from impact investors who are focused on promoting economic development, financial inclusion, and the growth of SMEs in Africa.

These investors include organizations such as The Development Bank of Africa (DBA) and FMO, a Dutch development bank that provides financing for projects in emerging markets.

5. Other Notable Investors

Other prominent investors in Lidya include Global Innovation Fund, which focuses on funding innovative companies in developing markets, and Blue Haven Initiative, a family office with a focus on impact investing.

Read also – A comprehensive Review of Carbon: Understanding Its Features, Mobile App, Functionality, and Alternatives

Future Prospects and Challenges

Lidya’s ability to scale and expand across the African continent remains one of its main advantages.

By tapping into the huge and largely untapped SME market, Lidya stands in a strong position to continue growing its customer base and increasing its loan book.

However, some challenges remain, including competition from other fintech startups such as Carbon, Paystack, and Flutterwave, as well as the risks associated with lending in emerging markets.

The company’s reliance on alternative data for credit scoring is a strategic advantage but requires continuous refinement to ensure accuracy and fairness.

Additionally, while the African market is ripe with opportunities, regional and regulatory differences across countries can present challenges for fintech companies looking to expand.

Lidya will need to navigate these challenges while continuing to build strong partnerships with local financial institutions, governments, and other stakeholders to ensure sustainable growth.

FAQs

What is Lidya?

Lidya is a Nigerian fintech that offers credit and other financial solutions to SMEs across the African continent through its data-driven credit scoring approach.

When was Lidya founded?

Lidya was founded in 2016.

What does Lidya stand for?

Simplifying the funding process for SMEs by using digital technologies and streamlining their credit processes.

How much has Lidya raised to date?

Lidya has raised about $16.5 million to date.

Who are Lidya’s investors?

Lidya has been backed by key investors including Alitheia Capital and Omidyar Network.

In what markets does Lidya operate?

In addition to Nigeria, Lidya also operates in other African markets and in Europe, with the inclusion of Poland and the Czech Republic.

How does Lidya determine creditworthiness?

The platform scrutinizes more than 100 data points, including transaction history and behavioral patterns, to generate customized credit scores.

What services does Lidya offer?

Lidya offers collateral-free loans, through which the company disburses funds to qualified businesses within 48 hours.

Conclusion

Lidya is a pioneering fintech company that is making significant strides in improving financial access for SMEs in Africa.

By providing tailored loan products, leveraging alternative data for credit scoring, and offering financial management tools, Lidya has positioned itself as a key player in the African fintech ecosystem.

With strong backing from investors and an impressive track record of growth, Lidya is well-positioned to continue expanding its services and empowering businesses across Africa.

However, it must continue to address regulatory, operational, and competitive challenges as it scales its operations in a dynamic and rapidly evolving market.

Recommendations

A comprehensive Review of Carbon: Understanding Its Features, Mobile App, Functionality, and Alternatives

A comprehensive overview of Payhippo: key features, Valuation, Funding & Investors

An In-Depth Analysis of Paystack: Features, Benefits, and User Experience