Bamboo is a leading digital bamboo app based in Nigeria that aims to democratize access to global investment opportunities.

With a user-friendly interface, robust features, and a mission to empower Africans to grow wealth through diverse financial tools, bamboo investment has positioned itself as a key player in Africa’s evolving fintech landscape.

Additionally, bamboo app offers fixed returns, and an extensive collection of investment content and education tools designed for users investing in US stocks, which make up almost 75% of its client base. This strong focus on user education and market access strengthens its reputation in many bamboo investment app review discussions.

Currently, the platform claims to have over 500,000 registered users and hosts Bamboo Bootcamp, a West African investment event with over 14,000 registered attendees.

This bamboo app review delves into its features, benefits, and user experience, highlighting why many believe is bamboo investment legit is answered with a resounding yes.

Read also – The complete overview of Lidya: key features, Valuation, Funding & Investors

Overview of Bamboo

Bamboo was co-founded by Yanmo Omorogbe and Richmond Bassey in 2019 with the vision of bridging the gap between African investors and global markets.

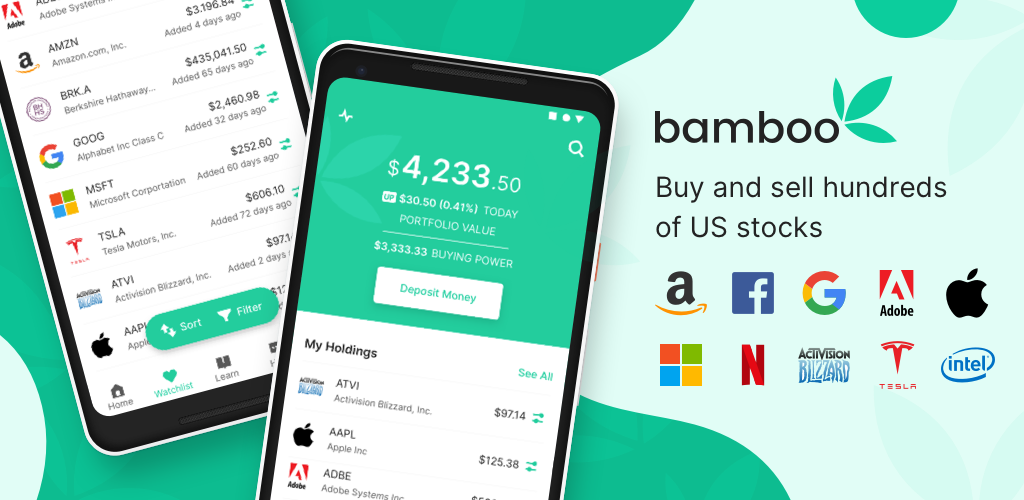

At its core, Bamboo provides access to over 3,000 stocks, ETFs, and mutual funds listed on the U.S. stock market, as well as options in the Nigerian market.

By leveraging technology, Bamboo eliminates traditional barriers to investment, such as geographic restrictions, high entry costs, and lack of financial literacy.

Through Bamboo, users can buy fractional shares, meaning they can invest in high-value stocks like Apple or Amazon with as little as $10.

This accessibility is a game-changer, especially in a market where such opportunities were previously out of reach for many.

Key Features of Bamboo

1. Access to U.S. and Nigerian Stocks

Bamboo provides access to a wide range of investment options across multiple markets. The platform connects users to U.S. equities, which include major corporations, ETFs, and mutual funds. Recently, Bamboo also introduced Nigerian stock options, allowing users to invest locally while diversifying their portfolios globally.

2. Fractional Investing

A standout feature is the ability to buy fractional shares. With this, users can invest in high-value stocks without the need for substantial capital.

For instance, an investor can own a fraction of a Tesla stock for a fraction of its market price. This feature lowers the barrier to entry and encourages first-time investors to participate in the market.

3. Intuitive Mobile App

Bamboo’s app is available on both Android and iOS, offering a seamless and intuitive user interface. The app is designed to make investing straightforward, even for beginners.

Features like real-time price tracking, one-tap buying/selling, and detailed performance analytics enhance the user experience.

4. Educational Resources

Financial literacy is a cornerstone of Bamboo’s mission. The platform offers educational resources, including blogs, newsletters, and in-app guidance, to help users make informed investment decisions. These materials cater to users at different levels, from novices to seasoned investors.

5. Security and Regulation

Bamboo places a high priority on security and compliance. User funds are insured up to $500,000 through their U.S. partner, DriveWealth LLC, a FINRA-registered brokerage firm. Locally, Bamboo adheres to all regulations set by the Nigerian Securities and Exchange Commission (SEC).

The platform also employs bank-level encryption to ensure the safety of user data and transactions.

6. Local Currency Integration

To cater to its Nigerian user base, Bamboo allows deposits and withdrawals in Nigerian Naira (NGN) and U.S. Dollars (USD). This flexibility is vital in a market where currency fluctuations and forex scarcity are common challenges.

7. Automated Investment Options

For users who prefer hands-off investing, Bamboo offers automated features such as recurring investments. This allows users to set up periodic contributions to their portfolios, promoting consistency in wealth-building.

Read also – A Comprehensive Overview of Branch: Analyzing Its Services, Features & User experience

Benefits of Using Bamboo

1. Financial Inclusion

Bamboo’s fractional investing and low barriers to entry make it a tool for financial inclusion. It empowers individuals from various socioeconomic backgrounds to participate in global markets and grow their wealth.

2. Portfolio Diversification

Access to both U.S. and Nigerian markets allows users to diversify their portfolios. This is crucial for risk management and long-term financial growth, as users can balance investments in stable international markets with high-growth local opportunities.

3. Transparent Fee Structure

Bamboo’s fee structure is transparent, with no hidden charges. It charges a flat rate for transactions, and the app clearly outlines any associated fees before users confirm trades. This transparency builds trust with users.

4. Seamless Onboarding Process

Signing up on Bamboo is straightforward. Users can complete the Know Your Customer (KYC) process digitally, using government-issued IDs and other required documentation. The verification process is typically swift, allowing users to start investing within minutes.

5. Global Exposure

Investing via Bamboo offers exposure to international markets, enabling users to tap into global economic growth. This feature is especially appealing to Nigerians seeking to hedge against local currency devaluation.

6. Enhanced Financial Literacy

Through its educational resources, Bamboo plays a critical role in enhancing financial literacy among its users. By empowering individuals with knowledge, the platform not only attracts investors but also cultivates a financially savvy community.

User Experience on Bamboo

Bamboo’s design prioritizes simplicity and functionality, making it suitable for both beginner and experienced investors. Below is a breakdown of key aspects of the user experience:

1. Account Setup

Creating an account is quick and hassle-free. Users download the app, provide basic details, and upload necessary documentation. The intuitive layout ensures that even first-time users can navigate the process with ease.

2. Deposit and Withdrawal Process

Users can fund their accounts via bank transfers, debit cards, or dollar cards. The process is seamless, with funds reflecting in the account almost instantly. Withdrawals are also straightforward, with a typical processing time of 1–2 business days.

3. Trading Experience

The trading dashboard is well-organized, providing real-time data on stock prices and performance. Users can easily search for specific stocks, view detailed analytics, and execute trades with minimal delays. The app’s responsiveness ensures a smooth trading experience.

4. Customer Support

Bamboo offers reliable customer support through multiple channels, including email and in-app chat. Their team is responsive, addressing queries and concerns promptly. The platform also provides a comprehensive FAQ section to assist users with common issues.

5. Community Engagement

Bamboo fosters a sense of community through its active social media presence and user forums. These platforms serve as spaces for investors to share insights, ask questions, and learn from one another.

Challenges and Areas for Improvement

While Bamboo offers a host of benefits, there are areas where it could improve:

1. Limited Local Market Options

Although Bamboo recently added Nigerian stocks, the options are still relatively limited compared to the vast U.S. market. Expanding its local offerings could attract more users seeking to invest domestically.

2. Forex Constraints

The reliance on U.S. dollar funding can be challenging for users during times of forex scarcity in Nigeria. Introducing multi-currency options or stablecoin integration might help address this issue.

3. Advanced Trading Tools

Experienced traders might find Bamboo’s tools somewhat basic. Incorporating advanced features like options trading, margin trading, or algorithmic trading could broaden its appeal to seasoned investors.

4. Enhanced Educational Content

While Bamboo offers commendable educational resources, introducing interactive courses or webinars could further boost user engagement and financial literacy.

Read also – Credpal Review: A comprehensive guide to it features, Mobile App, Functionality, and Alternatives

How Bamboo compares to similar fintech platforms

1. Bamboo vs. Rise (formerly Risevest)

- Bamboo:

- Direct access to U.S. and Nigerian stocks, ETFs, and mutual funds.

- Ideal for hands-on investors.

- Features fractional stock trading.

- Emphasizes user independence in managing portfolios.

- Rise:

- Focuses on curated portfolios (U.S. stocks, real estate, fixed income).

- Designed for passive, goal-oriented investing.

- Managed by professionals for long-term growth.

2. Bamboo vs. Chaka

- Bamboo:

- Intuitive app for self-directed investing.

- Offers real-time analytics and a transparent fee structure.

- Focus on both U.S. and Nigerian markets.

- Chaka:

- Also provides access to global and local stocks.

- Strong regulatory focus as Nigeria’s first SEC-licensed platform.

- Offers a more guided approach to portfolio building.

3. Bamboo vs. PiggyVest

- Bamboo:

- Specializes in stock trading and wealth-building.

- Provides global market exposure.

- PiggyVest:

- Focuses on savings and low-risk investments.

- Helps users automate savings for financial discipline.

How to use Bamboo app

How to use Bamboo app is simple and beginner-friendly, especially if you’re new to investing. The app allows you to buy and sell U.S. and Nigerian stocks right from your phone. Follow these steps to get started:

- Download and Sign Up

- Get the Bamboo app from your phone’s app store.

- Sign up using your email, phone number, and create a secure password.

- Verify Your Account

- Complete your KYC (Know Your Customer) by uploading a valid ID and a selfie.

- This step ensures your account is secure and compliant.

- Fund Your Wallet

- Deposit money using bank transfer, debit card, or other payment methods provided in the app.

- Start Investing

- Browse through available U.S. and Nigerian stocks and ETFs.

- Tap on a stock to view details, then click “Buy” to invest.

- Track Your Portfolio

- Monitor your investments’ performance and withdraw profits anytime.

How to make money on bamboo app

If you’re interested in investing, learning how to make money on Bamboo app can be a smart move. Bamboo is a platform that allows Nigerians and other users to invest in U.S. and Nigerian stocks easily from their smartphones. It gives you access to a wide range of companies, ETFs, and other investment opportunities.

To get started, download the app, sign up, and fund your account using a bank transfer or debit card. Once your account is funded, you can buy shares of companies you believe will grow in value over time. As the prices of these stocks increase, your investment grows, and you can sell your shares for a profit.

Another way how to make money on Bamboo app works is through earning dividends. Some companies pay dividends regularly, and Bamboo deposits them directly into your account, allowing you to reinvest or withdraw them as cash.

Bamboo investment app review

Bamboo investment app review shows that the platform is a secure and reliable way to invest in U.S. and Nigerian stocks from your phone. The bamboo app offers access to hundreds of companies and ETFs, allowing users to build diversified portfolios.

One standout feature in this bamboo app review is its robust security. It uses advanced data encryption and 2FA authentication to protect user accounts.

When exploring how to use bamboo app, you simply download it, sign up, complete verification, and fund your account using bank transfer or debit card. From there, you can start buying stocks and ETFs.

Many people ask, is bamboo investment legit? Yes, it is. Bamboo is protected by the Nigerian and U.S. SEC, and each account is insured for up to $500,000.

Overall, this bamboo investment app review confirms that bamboo investment is a safe and effective platform for anyone looking to grow their wealth through stock investing.

FAQs

What is Bamboo?

Bamboo is a digital investment platform that allows users in Nigeria to invest in U.S. and Nigerian stocks, ETFs, and mutual funds with as little as $10.

How secure is Bamboo?

Bamboo uses bank-level encryption, and investments are insured up to $500,000 through its U.S. partner, DriveWealth LLC. It complies with Nigerian SEC regulations.

What makes Bamboo unique?

Bamboo offers fractional investing, global market access, real-time analytics, and educational resources, empowering users to manage their own investments.

How do I start investing on Bamboo?

Download the app, complete the KYC process with valid ID, fund your account in Naira or USD, and start trading stocks.

Who can use Bamboo?

Anyone over 18 with a valid Nigerian ID or residence in a supported region can use Bamboo to invest globally.

Conclusion

Bamboo stands out as a pioneering platform in Nigeria’s investment landscape, offering users access to global markets, robust security measures, and a user-friendly experience.

Bamboo is not just a tool for wealth creation but a vehicle for economic empowerment.

As it continues to evolve, Bamboo has the potential to reshape how Africans view and participate in investments.

With a few enhancements, such as expanding local offerings and introducing advanced trading tools, it could solidify its position as the go-to investment platform in Africa.

For anyone looking to begin their investment journey or diversify their portfolio, Bamboo presents a compelling choice.

Recommendations

Credpal Review: A comprehensive guide to it features, Mobile App, Functionality, and Alternatives

A Comprehensive Overview of Branch: Analyzing Its Services, Features & User experience

The complete overview of Lidya: key features, Valuation, Funding & Investors