Learning how to use Risevest enables you to buy shares in leading companies, earn income from real estate, or secure fixed returns through low-risk bonds.

The platform is designed to address the growing need for financial independence and wealth preservation in the face of local currency fluctuations.

By providing diverse investment opportunities, Risevest allows users to grow their funds while minimizing risk.

This article will serve as a comprehensive guide on how to use Risevest effectively. From setting up your account to managing and withdrawing your earnings, you’ll learn the steps required to take full advantage of this powerful investment tool.

Read on to discover how you can grow your wealth and secure your financial future with Risevest.

Related: How to use Chipper cash app to send and receive payment

What is Risevest, and how does it work?

How to use Risevest is simple and straightforward, making it feel like having a personal investment manager and adviser right in your pocket. The only difference? This manager isn’t a person—it’s an intuitive app that lives on your mobile phone. Convenient, right?

With Risevest, you can carefully invest in dollar-denominated assets designed to deliver safe and consistent returns over time. Whether your investment horizon is 4 months, 6 months, or a year, knowing how to use Risevest ensures your money is working for you.

Risevest focuses on investing in profitable, globally recognized companies like Google, Apple, Alibaba, and Tesla. Essentially, the platform offers two main services to its users:

- Investment Options – After taking control of your funds, Risevest provides three distinct investment products to choose from. These options allow you to decide where to invest based on your risk appetite and expected returns.

- Fund Management – How to use Risevest eliminates the guesswork of picking individual stocks. Instead, Risevest manages your money and invests it strategically on your behalf.

Is it safe to use Risevest?

Risevest also ensures your investments are secure and protected from cyber threats. The platform upholds the same high-security standards as top-tier banks worldwide, giving you peace of mind while investing.

Risevest operates under strict regulatory oversight. The app is regulated by the Securities and Exchange Commission (SEC) in partnership with ARM Trustees, ensuring compliance with financial laws and best practices.

Additionally, the founder of Risevest is registered as an investment adviser with the United States SEC, further solidifying the platform’s credibility and reliability.

When learning how to use Risevest, security is a key consideration. With robust encryption protocols and regulatory oversight, you can confidently invest knowing your money and personal information are well-protected.

Risevest mobile app download

First, you can click here to register. Android phone users can download the Risevest mobile app from the Google play store. If you use an iOS device, you can also download and install Risevest from the Apple App Store.

What investments can you make on Risevest?

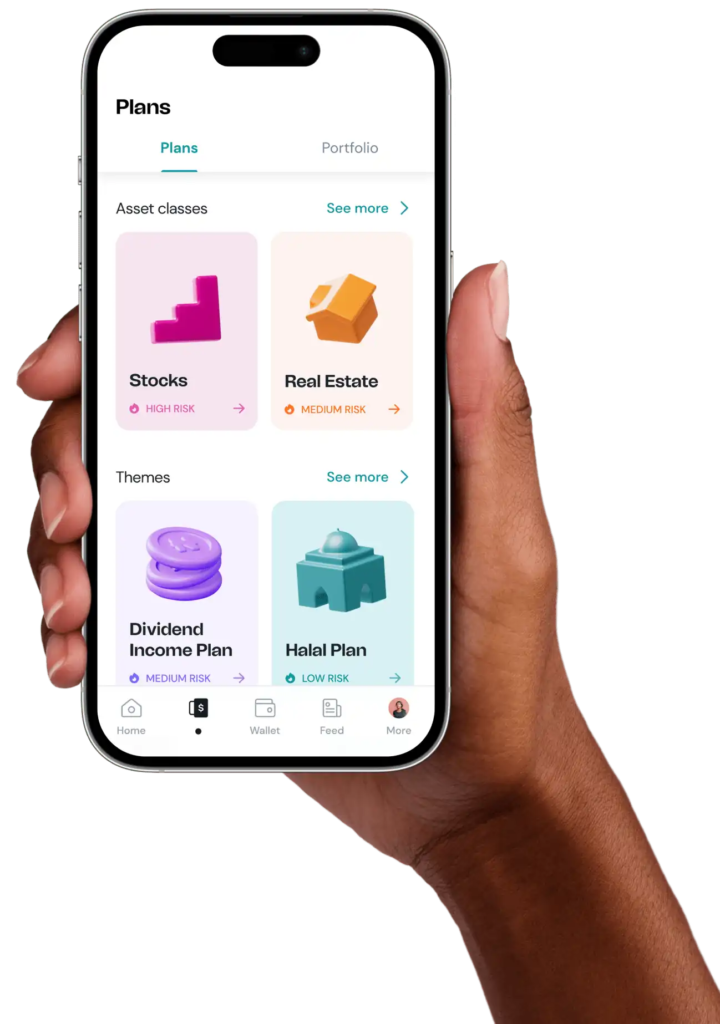

After downloading the app and registering an account, it’s time to start investing. Risevest offers three asset classes to its users. They can invest in any of them with a price as low as $10.

1. Fixed Income (low risk)

Within the allotted investment time, this kind of investment will pay a set amount of interest. There are three, six, or twelve months.

Because of its particular interest and time, fixed income is known by that name. Additionally, it offers a lower risk and more certain rewards. Those who have a very low tolerance for risk can invest in this kind of venture.

2. Real Estate (more risk, more reward)

How to use Risevest includes exploring diverse investment options, one of which is Real Estate.

This asset class allows users to invest in high-demand commercial properties, offering opportunities for higher returns compared to other options like Fixed Income.

However, it’s important to understand the risk factors associated with Real Estate investments. Unlike Fixed Income, which provides stable and predictable returns.

That said, how to use Risevest effectively involves balancing risk and reward. While Real Estate carries higher risks, it also offers the potential for greater long-term gains.

Investors with a higher risk appetite may find this option particularly attractive for growing wealth over time.

Realted: How To Use Zeepay to Send and Receive Money in Ghana

3. Stocks (Highest risk, highest reward)

Stock investments are the riskiest when compared to fixed income and real estate investments. So is the prize, though.

There is a chance that your money may double in a year if you invest in stocks. There’s also a chance that all of your assets may lose value in a year.

As a result, only those with lofty goals and a high tolerance for risk participate in equities.

Related: How to use Bamboo: A beginner’s comprehensive guide

How to fund your Risevest wallet

Knowing how to use Risevest starts with funding your wallet to enable investments. Before making any investment, you need to deposit a minimum of USD 10 into your Risevest wallet. Here’s a step-by-step guide on how to add funds:

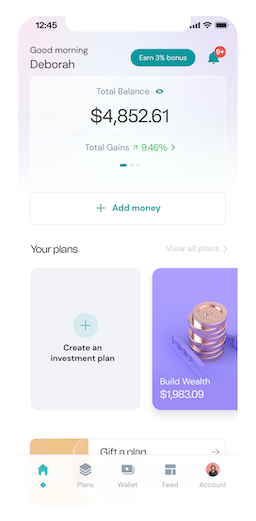

- Access the Dashboard – Log in to your Risevest account and click on the “Add Money” button.

- Choose a Funding Option – On the next page, you’ll see five payment options:

- Naira Bank Transfer

- Crypto Wallet

- Naira Debit Card (your regular ATM card)

- Direct Debit

- USD Credit/Debit Card

- Select Your Preferred Payment Method – Pick the most convenient option and follow the prompts to complete your deposit.

Important Notes:

- Deposits made via USD debit/credit cards may take up to 1 working day to process.

- All other payment methods, including Naira bank transfer, typically process within 15 minutes.

By following these steps on how to use Risevest, you can quickly fund your account and start building your investment portfolio.

How to invest on Risevest

The next step is to make an investment when your deposit has been verified. To invest in Risevest, take the actions listed below.

- Click on “create an investment plan” from your dashboard.

- Choose from a variety of classes, including fixed income, real estate, and corporate stocks, and begin investing.

- You will see the projected risks and benefits for each option you select. Enter the desired investment amount. On Risevest, the minimum investment amount is $10 USD.

You can choose your duration based on the asset class you choose. Three, six, or twelve months may pass.

How to withdraw funds from your Risevest account

You can withdraw money from your investments on Risevest after they’re mature. To withdraw funds to a local bank account, follow these steps.

- Click the “Account” button from your dashboard.

- Select “Bank & Cards.”

- The “+” sign can be used to add your bank account.

- Enter the credit, debit, or ATM card information that is connected to your bank account.

- After selecting “save,” return to your dashboard.

- From your dashboard, choose “Withdraw.”

- Choose the bank information you already selected.

- Enter the desired withdrawal amount from your Risevest account.

- Enter the PIN for your transaction.

Withdrawals typically take three to five business days. Your money is invested in the United States, which explains why.

The liquidation process will take some time.

Risevest transaction fees and service charges

To learn how to use Risevest, it’s important to understand the service fees they charge based on your investment returns. These fees range from 1.5% to 2% of the total investment and returns. Here’s how it works:

- If your investment returns are below 10%, Risevest does not charge any service fee.

- If your investment with returns falls between 10% and 15%, a 1.5% service fee will apply.

- If your investment with returns is 15% or higher, the service fee will increase to 2%.

The service fee will depend on how much Risevest manages and earns for you throughout the year. To learn more about Risevest’s management and service charges, you can visit their website.

Read also – The Comprehensive guide on How to use Credpal

Risevest customer care and email address

For complaints and enquiries, you can reach out to Risevest via their customer care hotline, social media channels, and email address.

- Youtube

- Phone Calls: +234 01 888 3519

- Email address: hello@risevest.com

FAQs

What is Risevest?

Risevest is an investment platform that allows you to invest in global assets, such as stocks, bonds, and real estate, with the goal of growing your wealth over time

How do I start using Risevest?

Simply sign up for an account on the Risevest platform, choose your preferred investment plan, and deposit funds to begin investing.

What are the service fees for using Risevest?

Risevest charges a service fee based on your returns: 0% for returns below 10%, 1.5% for returns between 10% and 15%, and 2% for returns above 15%.

How do I track my investment performance on Risevest?

You can monitor your investment performance through the Risevest dashboard, which shows your returns and account balance in real-time.

Can I withdraw my investment from Risevest at any time?

Yes, you can withdraw your funds at any time, subject to the platform’s withdrawal policies and procedures.

Conclusion

Risevest offers a simple and accessible way to invest in global assets, allowing users to grow their wealth over time.

With flexible investment plans and a transparent fee structure based on returns, it caters to both new and experienced investors.

The platform charges service fees ranging from 0% to 2%, depending on your investment performance, with no fees if your returns are below 10%.

Learning how to use Risevest is easy—simply sign up, deposit funds, and choose an investment plan. Users can track their progress and withdraw funds when needed, making Risevest a user-friendly and effective investment tool.

Recommendations

How To Use Zeepay to Send and Receive Money in Ghana

How to use Chipper cash app to send and receive payment