Let’s face it, managing our finances can be a real hassle: from waiting in a queue at the bank to finding an ATM or carrying wads of cash around. But what if you could transact anywhere, any time by simply knowing how to use Interswitch? Sounds too good to be true, right?

Well, it’s not! With Interswitch, you can bid those stressful moments your goodbye and welcome easy, seamless transactions into your life.

Interswitch is made in such a user-friendly way that its usage has become quite plausible for any person possessing a smartphone. The Interswitch app opens you up to a world of easy transactions.

This is a basic tutorial in which we will put you through how to use Interswitch app like a pro; you’ll learn to use the App, know how to go around its interface, setting up accounts, and eventually starting off with your transaction in an instant.

We’ll explain everything in very simplified terms because, so you don’t need to be a techie to understand. So let’s get into it!

Table of Contents

What is Interswitch All About?

Interswitch is a revolutionary digital payment platform that’s changing the way we make transactions. But what exactly is Interswitch all about? Let’s dive in and find out!

At its core, Interswitch is designed to make financial transactions easy, fast, and secure. With knowledge of how to use Interswitch, you can pay bills, transfer money, and even shop online with just a few taps on your phone.

Interswitch use is about convenience, flexibility, and peace of mind.

How does it work? The Interswitch App opens one to a whole new world of seamless transactions. Knowing the use of the Interswitch mobile app will let one easily set up his account, link means of payment, and get him started on transacting at once.

Whether you want to make life easy when it comes to finances, shop online, or even send money to your loved ones, be sure Interswitch has got your back.

By understanding how to use Interswitch, it means being in control of your finances for a less stressful life.

Related – A Step-by-Step Guide to Using Moniepoint App for Daily Transactions

What Features Does Interswitch Offer?

Interswitch is an innovative digital payment platform that offers a broad portfolio of invented features designed to make financial life easy. Let us look in detail at what Interswitch offers.

- Payment Processing: Supports e-commerce, in-store, and recurring payments.

- Verve Card Services: Domestic Debit card with secure transaction options.

- Quickteller: A platform for bill payment, money transfer, and airtime purchase.

- Paydirect: Enterprise solution for receiving payments easily.

- Mobile Apps: Quickteller and Verve World to perform seamless transactions or loans.

- Developer APIs: Allows for integration of payment solutions on several applications.

The above innovative features are a number of ways Interswitch is revolutionizing the way we carry out our transactions: be it making your financial life a lot easier, shopping online, sending money to friends and family members, it is got you covered.

Also Read – How to Use OPay on Your Mobile Device: A Beginner’s Guide to Mobile Finance

How to Use Interswitch: Step-by-Step Guide

Are you ready to meet the convenience at Interswitch? Let’s take you through how to use Interswitch so that you can get right into seamless transactions in no time.

Step 1: Download the Interswitch App

First things first, you are going to have to download the Interswitch app. Simply head to your phone’s app store, search for “Interswitch,” and click “download.” Easy peasy!

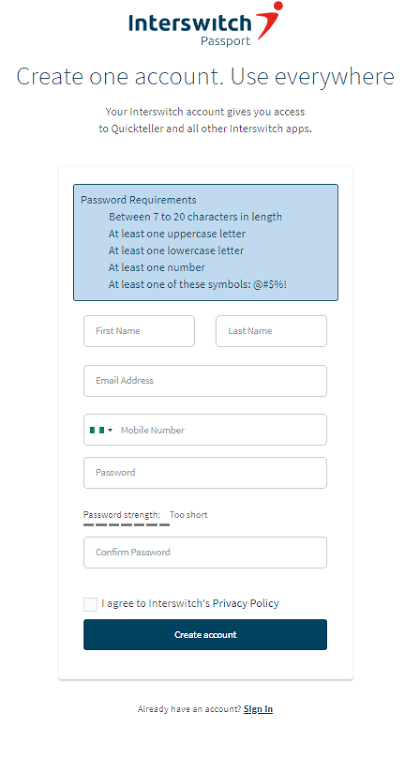

Step 2: Sign Up for an Account

Once you’ve downloaded the app, it’s time to sign up for an account. Tap “sign up” and follow the prompts to enter your details. Don’t you worry, it’s quick and easy!

Step 3: Link Your Payment Methods

Now that you’ve got your account set up, it’s time to link your payment methods. This could be your debit card, credit card, or bank account. Simply tap “add payment method” and follow the instructions.

Step 4: Do Your First Transaction

You are almost there! Now that you have your payment methods added, go ahead and make your first transaction. Be it bill payments, sending money to a friend, or online shopping, know that Interswitch has got you covered.

Step 5: How to Use Interswitch

Now that you’ve made your first transaction, let me show you some cool things you could do on Interswitch: from viewing your transaction history down to earning rewards, the list just goes on and on.

Step 6: Get Help When You Need It

And finally, keep in mind that with Interswitch, there’s support. Should you require anything or have any queries, just tap “Support” in the app for help.

And that is all! With these basic steps, you are good to go. How to use Interswitch is simple: this is what Interswitch usage is for in making your life easier.

Read Also – How to Use Payday App

Setting Up Your Interswitch Account

To set an Interswitch account, you can follow these steps:

- Go to Quickteller Business

- Click on Get Started

- Input your First name, Last name, Email address, and password

- Click Create account

- An account verification mail will be sent to you; just follow the instructions

- You can create a business by giving your company name and kind of business, your country where the business is operating, number of employees, etc.

- Proceed to my Dashboard

- If you are an individual business, enter your BVN and identification documents as required

- Upload your passport photograph and a valid means of identification

Your account is instantly created and activated; your documents will be verified within 24–48 hours. If your account is approved, you can:

- Activate all the different payment options you will like to make use of.

- Integrate with the interswitch API to onboard a customized payment flow.

- Engage third parties

- Showcase your business on the mini eCommerce platform.

- Draw data and insight using the reporting portal.

Also Read – The Benefits of Using KiaKia: A Comprehensive Review

How to Make Interswitch Payments Easily

Below are ways to make payments on the interswitch network.

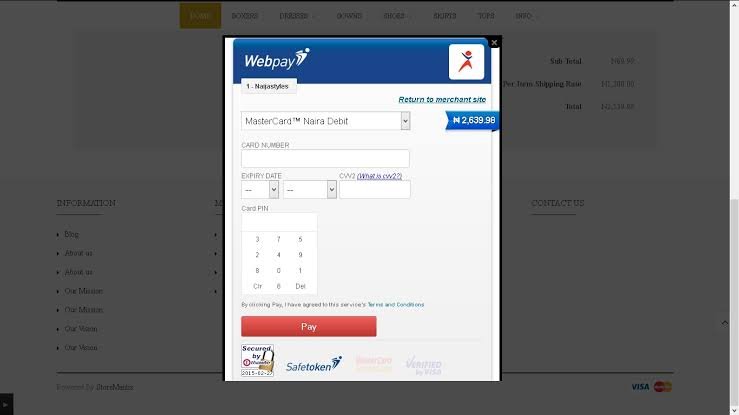

- Quickteller: Open the Quickteller app, select the loan to be repaid, confirm the amount, enter card details, and complete the repayment.

- USSD: Perform a transaction by using a unique code.

- Transfer: This can be a dynamic transfer, which is tied to a specific transaction and can only be used once, or a static transfer, which can be used more than once.

- QR Code: Use a QR code to initiate a transaction.

- Wallet: It accepts any wallet provider, such as OPAY, MOMO, PalmPay, or Pocket, for transaction execution.

- Verve Paycode: An 8-digit code that allows cardless withdrawals and deductions from a bank account or mobile money wallet in a retail outlet.

Interswitch also provides web-based solutions for corporate payment processes. Such processes include payroll and a number of other expenses.

Read Also – How to use Risevest for dollar investment, stocks & more

Troubleshooting Common Interswitch Usage Issues

Interswitch usage might be simple, but problems do occur. Here’s how you troubleshoot its common problems and then get going with the Interswitch app.

First, in order to know how to use Interswitch, you have got to set up an account and, after logging in with your credentials, go into user management and manage your profile.

Common Issues and Solutions

- Login Problems: Sometimes users are not able to login in. Re-check your username and password. Change your password if required.

- Transaction Failures: Ensure your card details are correct. In case of failed transactions, check that your account is funded.

- App Functionality: Restarting and updating to the latest version resolves the problem if it appears unresponsive.

This helps further in using Interswitch and makes the application all the more smooth in working.

Frequently Asked Questions

How can I download and install the Interswitch app?

Just visit your phone’s app store-Google Play Store for Android, Apple App Store for iOS-search for “Interswitch,” and click “download” or “install.”

What are the payment methods that can be linked to my account?

You can link the following to your Interswitch account: a few payment methods, including Visa, Mastercard, Verve debit/credit cards, bank accounts, and mobile money.

How do I pay using Interswitch?

To make a payment through Interswitch, log into the app, select the biller or recipient, enter the amount to be paid, and confirm your transaction.

Is Interswitch secure for transactions?

Yes, Interswitch is very secure for transactions. It deploys strong encryption and secure servers that will keep your transactions and personal data safe.

Can I use Interswitch for online shopping?

Of course, you can shop online using Interswitch. Just check out and select the Interswitch option, log in, and confirm the payment.

Conclusion

And there you have it! With this simple guide, you’re now equipped with the knowledge of how to use Interswitch for seamless transactions.

From downloading the application to making payments, we have gone through it in steps which are simple. Using the Interswitch is as convenient as it is flexible.

By learning how to use Interswitch app appropriately, you will be able to manage your finances with more responsibility and live a less stressing life.