Branch International, popularly known as the branch loan app is a Kenya-registered business with operations in Nigeria, Tanzania, and India.

They are fully licensed by the Central Bank of Nigeria, CBN, as a money institution in Nigeria that has the facility for instant loan credit to its users.

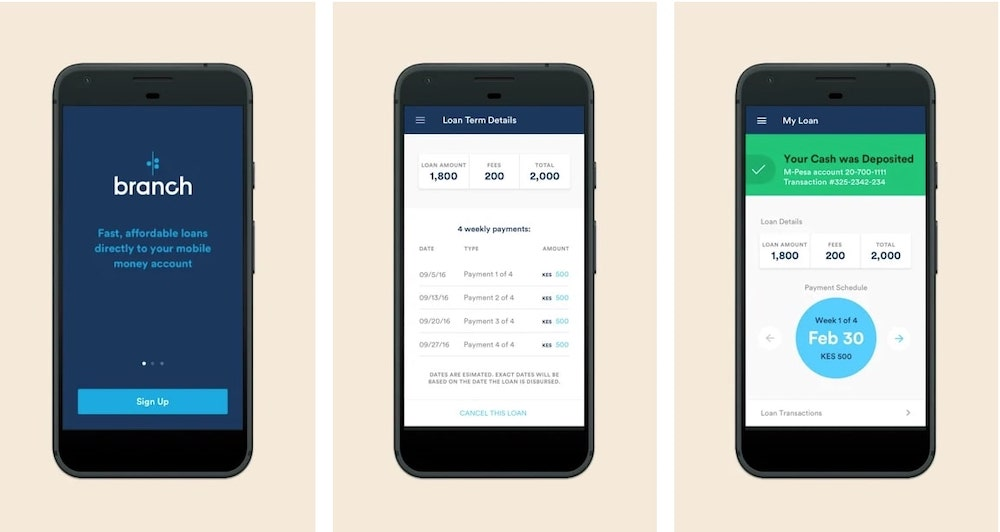

By using Branch, loan application and disbursement can be allowed without necessarily going for physical documentation.

Branch application has been receiving a lot of positive reviews from users all over the country, not only because of their excellent customer service but also because of its user-friendly design.

Unlike other loan applications in Nigeria, branch loan applications have global investors such as VISA, Foundation Capital, Trinity Ventures, Triple Point Capital, etc.

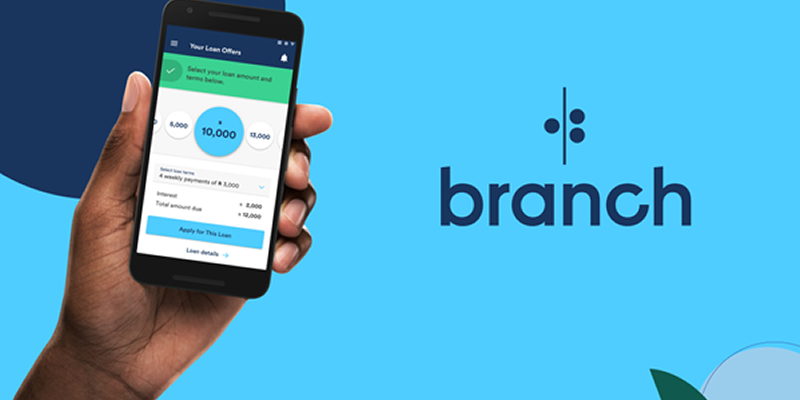

With Branch, you get to apply and receive an instant loan between ₦ 2000 to ₦ 1,000,000. The app relies on a Machine Learning algorithm to evaluate the user’s credit score and chances of defaulting the loan via the user’s smartphone.

Let’s take a closer look at the features of the Branch Loan App.

Read also – A comprehensive overview of Payhippo: key features, Valuation, Funding & Investors

Overview of Branch

Branch International is a leading digital financial services platform designed to provide quick, accessible, and inclusive financial solutions for underserved populations.

Founded in 2015 by Matt Flannery, the company aims to bridge the gap in financial inclusion by offering mobile-based personal loans and other financial services.

Branch operates entirely through its mobile app, leveraging advanced algorithms and smartphone data—such as transaction histories, SMS logs, and behavioral patterns—to assess creditworthiness.

This approach eliminates the need for traditional credit scores, making it possible for individuals without formal banking histories to access loans.

With operations in countries like Kenya, Nigeria, Tanzania, India, and Mexico, Branch caters to a diverse audience in emerging markets.

It prides itself on simplicity, offering a user-friendly experience with instant loan approvals and disbursements.

Additionally, Branch rewards loyal customers with higher credit limits and lower interest rates over time.

Services Provided by Branch

Branch operates primarily as a mobile-based lending platform and offers several financial services:

1. Digital Loans

Branch’s primary service is short-term personal loans. Key features include:

- Loan Amounts: Typically range from small amounts for first-time users, increasing based on repayment history.

- Loan Tenure: Flexible repayment periods, often between 4 and 52 weeks.

- Interest Rates: Varies by region but designed to remain competitive and sustainable.

2. Savings & Investments

- Allows users to save money securely.

- May offer interest-bearing accounts or other financial products to encourage savings.

3. Bill Payments

- Enables users to pay utility bills directly through the app.

4. Credit Score Building

- Helps users build or improve their credit scores by reporting positive repayment behavior to credit bureaus in applicable regions.

Key Features of Branch

Branch’s appeal lies in its simplicity, accessibility, and customer-centric features:

1. Mobile-Only Platform

- No Collateral: Branch does not require any physical collateral, making it accessible to a broad audience.

- Smartphone Penetration: Users only need a smartphone and internet connection to access services.

2. Data-Driven Risk Assessment

Branch employs advanced algorithms to assess creditworthiness using:

- Smartphone Data: Analyzing SMS logs, call patterns, and financial activity (with user consent).

- Behavioral Metrics: Evaluating repayment history and in-app interactions. This approach allows Branch to offer loans even to users without traditional credit histories.

3. Speed and Convenience

- Quick Approvals: Loan approvals can take as little as a few minutes to hours.

- Instant Disbursement: Funds are typically transferred directly to users’ mobile money wallets or bank accounts.

4. International Reach

Branch operates in multiple countries, including:

- Africa: Nigeria, Kenya, Tanzania

- Asia: India

- Latin America: Mexico This global presence allows the platform to tailor services to diverse economic environments.

User Experiences of the branch app

Branch is celebrated for its intuitive user interface and seamless experience:

1. Onboarding Process

- Easy-to-follow registration process requiring minimal documentation.

- AI-powered risk analysis ensures efficient credit decisions.

2. Loan Management

- Simple repayment options, including mobile wallets and bank transfers.

- Clear repayment schedules and reminders minimize defaults.

3. Customer Support

- Multiple channels for support, including in-app chat, email, and FAQs.

- Users appreciate prompt responses and effective resolutions.

4. Trust and Security

- Secure data encryption to protect user information.

- Transparent loan terms and conditions, fostering user trust.

Read also – A comprehensive Review of Carbon: Understanding Its Features, Mobile App, Functionality, and Alternatives

Advantages of Using Branch

Branch offers numerous benefits that cater to individuals in emerging markets, particularly those underserved by traditional financial systems. Below is an in-depth look at the key advantages:

1. Accessibility

Branch stands out for making financial services available to a broad audience, including those traditionally excluded from formal banking systems.

- Unbanked Populations: By leveraging mobile technology, Branch caters to users who lack access to physical bank branches or financial institutions.

- No Collateral Required: Unlike traditional banks that often demand collateral, Branch uses alternative data-driven credit assessments, enabling even low-income users to qualify.

- Geographic Flexibility: Operates in countries with high mobile penetration, ensuring coverage even in rural and remote areas.

2. Convenience

Branch’s entirely digital ecosystem eliminates the need for physical interactions or extensive paperwork:

- 24/7 Availability: Users can apply for loans or manage their accounts anytime, without relying on banking hours.

- Mobile Wallet Integration: Direct disbursement to mobile wallets ensures a seamless and fast transaction process.

- Quick Loan Approvals: With approval times as short as a few minutes, it caters to users needing emergency funds.

3. Affordability

Branch aims to keep its services as affordable as possible while balancing risk and sustainability:

- Competitive Interest Rates: While first-time borrowers might face higher rates, repeat borrowers with strong repayment histories can access better terms.

- Flexible Loan Sizes and Tenures: Branch allows users to borrow small amounts and repay in flexible installments, which reduces the financial burden.

- No Hidden Fees: The transparent fee structure ensures users fully understand costs upfront.

5. Challenges and Criticisms

- High Interest Rates: For first-time users or those with lower credit scores, interest rates can be relatively high.

- Data Privacy Concerns: Some users worry about the extent of data collected from their devices.

- Limited-Service Range: In some regions, Branch focuses solely on loans, with fewer additional financial services.

Customer Reviews on Branch App

Customer reviews and feedback are very important in determining the performance and reliability of any application, and the branch application is no exception.

The application is only available on Google Play Store, with over 10 million downloads and phone and tablet variations.

Over 1.6 million users of the branch loan app cumulatively rate the app 4.5 over 5, and below are some of the things they have to say.

These reviews highlight the experiences of customers who have used the app. Most are talking about the Branch Loan App interest rates, but Branch has come to clear that, saying it is their algorithm that decides both the price and the interest rate.

However, it is always prudent to go through the terms and conditions of any loan app before applying for a loan.

Read also – The complete overview of Lidya: key features, Valuation, Funding & Investors

How branch compares to other fintech platforms

Branch competes with several fintech platforms in the digital lending space, such as Tala, FairMoney, Carbon, and Okash. Here’s a comparison based on key factors:

1. Credit Assessment Model

- Branch: Leverages smartphone data (SMS logs, transaction history, and behavior) to evaluate creditworthiness.

- Others (Tala, Carbon): Also use similar alternative data models but may incorporate additional metrics, such as social media activity or utility payment records.

- Advantage: Branch’s AI-powered risk assessment system is robust and globally scalable.

2. Geographic Presence

- Branch: Operates in Africa (Kenya, Nigeria, Tanzania), Asia (India), and Latin America (Mexico).

- Tala: Has a similar footprint but is more prominent in Asia (Philippines, India) and parts of Africa.

- Advantage: Branch’s presence in diverse economic landscapes positions it as a global player.

3. Loan Offerings

- Branch: Primarily offers short-term personal loans with flexible repayment schedules.

- FairMoney & Carbon: Broader offerings include SME loans, bill payments, and savings accounts.

- Advantage: Branch’s focused lending model works well but limits diversification compared to competitors with more services.

4. User Experience

- Branch: User-friendly app with quick loan approvals and instant disbursements.

- Carbon & FairMoney: Offer additional financial tools (credit cards, expense tracking) for a more comprehensive experience.

- Advantage: Branch excels in simplicity but may need to broaden its feature set for higher engagement.

5. Interest Rates and Loan Flexibility

- Branch: Rates decrease with positive repayment history but are initially higher.

- Okash: Known for lower starting rates but stricter eligibility requirements.

- Advantage: Branch’s dynamic rate adjustments build long-term customer loyalty.

FAQs

What is Branch, and how does it work?

Branch is a digital lending platform that provides quick personal loans via a mobile app. It uses alternative data, such as smartphone activity, to assess creditworthiness and disburse loans instantly to approved users.

What are the interest rates on Branch loans?

Interest rates vary based on your borrowing history and creditworthiness. First-time borrowers may face higher rates, but consistent repayments lead to reduced rates and higher credit limits.

Does Branch require collateral for loans?

No, Branch does not require any collateral. Eligibility is based on data-driven assessments from your smartphone usage and repayment history.

Which countries does Branch operate in?

Branch is available in Kenya, Nigeria, Tanzania, India, and Mexico, with services tailored to meet the needs of each market.

How can I repay my Branch loan?

Loans can be repaid through mobile money platforms or bank transfers, depending on the options available in your region. Payment schedules and details are easily accessible within the app.

Conclusion

Branch International has established itself as a leader in digital lending, particularly in emerging markets, by leveraging technology to make financial services accessible to underserved populations.

With a focus on simplicity, speed, and innovation, it provides a valuable alternative to traditional banks, particularly for first-time borrowers.

As it expands its product portfolio and geographic footprint, Branch has the potential to play a significant role in promoting financial inclusion globally.

Recommendations

The complete overview of Lidya: key features, Valuation, Funding & Investors

A comprehensive overview of Payhippo: key features, Valuation, Funding & Investors