Chipper Cash, founded in 2018, is one of the leading fintech companies addressing this challenge in Africa and beyond.

The rise of financial technology has transformed the way money moves across borders, particularly in regions where traditional banking systems are either inefficient or expensive.

Chipper Cash is a mobile app that has changed the narrative of sending and receiving money across Europe, America and Africa.

It allows people to securely and conveniently send and receive money across international borders with ease, low fees and speed.

The Chipper Cash app has made international transactions seamless and stress-free for all by providing a cost-effective alternative to traditional money transfers.

This review explores the platform’s offerings, how it operates, its unique features, and how it compares to alternatives.

Read also – A Comprehensive Overview of Branch: Analyzing Its Services, Features & User experience

Company Profile

Chipper Cash is a mobile-based cross-border payment platform designed to facilitate fast, affordable, and seamless money transfers.

It was founded by Ham Serunjogi, a Ugandan, and Maijid Moujaled, a Ghanaian, with the mission to eliminate the high costs and complexities of sending money across African countries and to/from global regions.

Headquartered in San Francisco, the company operates in several African countries, including Nigeria, Kenya, Ghana, South Africa, Uganda, Rwanda, and Tanzania, with expansions into Europe and North America.

Key Achievements and Growth

- Customer Base: Over 5 million active users across multiple countries.

- Funding: Backed by leading venture capital firms and notable investors, including Jeff Bezos’ Bezos Expeditions and Ribbit Capital.

- Services Expansion: Initially focused on free peer-to-peer payments, Chipper Cash has since expanded into cryptocurrency trading, stock investments, airtime purchases, and bill payments.

Chipper Cash’s success lies in its ability to leverage mobile technology and local financial infrastructures, making financial services accessible even to unbanked populations.

Key Features of Chipper Cash

Chipper Cash offers a wide range of features that make it a versatile and user-friendly platform for financial transactions, particularly in Africa. Here are the platform’s key features:

1. Free Peer-to-Peer Transfers

- Intra-Country: Send and receive money within the same country at no cost.

- Cross-Border: Seamlessly transfer funds between countries with minimal fees, making it ideal for both personal and business transactions.

2. Instant Transactions

- Most transactions are processed instantly or within minutes, ensuring quick access to funds for the recipient.

3. Multi-Currency Support

- Allows users to send and receive money in various African currencies and U.S. dollars.

- Converts funds automatically at competitive exchange rates.

4. Cryptocurrency Trading

- Buy, sell, and hold cryptocurrencies like Bitcoin and Ethereum directly in the app.

- Offers a simple interface for new and experienced crypto investors.

5. Stock Investments

- Users in select regions can invest in U.S. stocks through fractional trading, making it affordable to invest in companies like Apple, Tesla, and Amazon.

6. Bill Payments

- Pay utility bills (electricity, water, etc.) directly through the app.

- Offers convenience for recurring payments.

7. Airtime Purchases

- Top up airtime or data for any mobile network, either for yourself or others.

8. Low Transfer Fees

- No fees for local transfers and low costs for cross-border transactions.

- Offers significant savings compared to traditional money transfer services.

How Chipper Cash Works

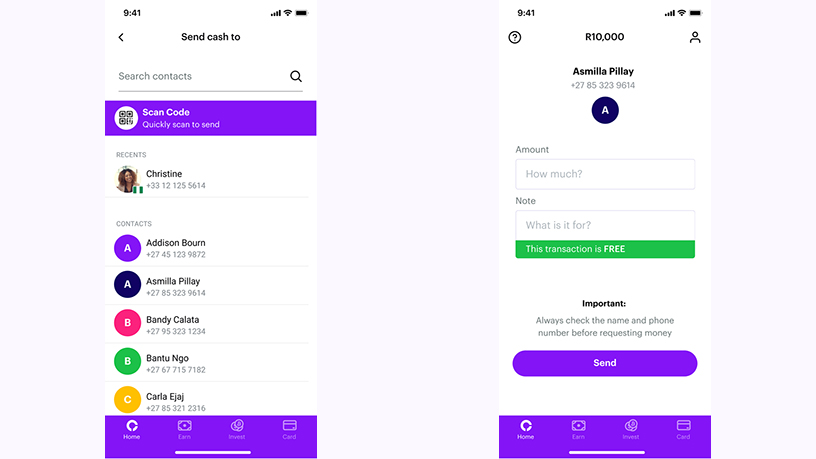

Chipper Cash simplifies financial transactions through its intuitive mobile app available on both Android and iOS. Here’s a step-by-step guide to its functionality:

1. Account Registration

- Download the App: The app is free to download from Google Play Store or Apple App Store.

- Sign Up: Users register with their phone number and email address.

- Verification: Complete the Know Your Customer (KYC) process by uploading a government-issued ID and proof of residence. Verification is quick, enabling immediate access to basic features.

2. Funding the Wallet

- Link a bank account, mobile money account, or card to deposit funds into the Chipper Cash wallet. Supported payment methods vary by country.

3. Making Transactions

- Send Money: Users can transfer funds to other Chipper Cash users (free) or non-users (minimal fees) across supported countries.

- Request Money: Users can also request payments from other individuals or businesses.

4. Additional Services

- Cryptocurrency Trading: Users can buy, sell, or hold cryptocurrencies like Bitcoin and Ethereum directly in the app.

- Airtime Purchases: Buy airtime or mobile data for any network.

- Bill Payments: Pay utility bills (electricity, water, etc.) through the app.

- Stock Investments: In select regions, users can invest in U.S. stocks via fractional trading.

Chipper Cash’s user-friendly interface and instant processing time make it a preferred choice for digital transactions in Africa.

Read also – Credpal Review: A comprehensive guide to it features, Mobile App, Functionality, and Alternatives

Requirements to Use Chipper Cash

To create and use a Chipper Cash account, users must meet the following criteria:

- Age Requirement: Be at least 18 years old.

- Identification: Provide a valid government-issued ID (e.g., passport, national ID card, or driver’s license).

- Smartphone: Own a smartphone to access the app.

- Bank or Mobile Money Account: Link an account for funding and withdrawals.

Exchange Rates

One of Chipper Cash’s competitive advantages is its affordable exchange rates, particularly for cross-border transfers. The platform offers:

- Mid-Market Exchange Rates: Chipper Cash applies the mid-market rate with minimal markup, ensuring competitive rates compared to traditional banks.

- Transparency: Users are shown the exact exchange rate and transaction amount before confirming a transfer, eliminating hidden fees.

While Chipper Cash’s rates are generally favorable, users conducting large transactions may still benefit from comparing rates with specialized remittance services.

Transfer Fees

Chipper Cash is renowned for its low or zero fees, depending on the type of transaction. Below is a breakdown:

- Intra-Country Transfers: Free within the same country, making it cost-effective for local payments.

- Cross-Border Transfers: Minimal fees for international transfers, often significantly lower than banks or traditional money transfer services like Western Union.

- Cryptocurrency Transactions: Trading fees vary by cryptocurrency and transaction size.

- Bill Payments and Airtime: Often free or attract a nominal convenience fee.

The affordability of Chipper Cash makes it particularly appealing for small to medium-sized transactions.

Advantages of Chipper Cash

- Low Costs: Free intra-country transfers and minimal cross-border fees provide significant savings.

- Fast Transactions: Transfers are processed instantly or within a few minutes, ensuring quick access to funds.

- User-Friendly Interface: The app is easy to navigate, making it accessible even to first-time users.

- Diverse Services: Beyond money transfers, features like cryptocurrency trading, stock investments, and bill payments enhance its versatility.

- Accessibility: Operates in multiple countries and supports mobile money, bank accounts, and cards.

- Financial Inclusion: Helps unbanked and underbanked populations participate in digital finance.

Limitations of Chipper Cash

- Limited Global Reach: While expanding, Chipper Cash primarily focuses on Africa, with limited coverage for global transactions.

- Dependence on Mobile Money: Functionality in some regions relies on mobile money infrastructure, which may not always be robust.

- Customer Support: Reports of slow responses to customer inquiries remain a challenge.

- Exchange Rate Margins: Although competitive, rates may not always be the lowest compared to alternatives like Wave or WorldRemit.

Read Also – An In-Depth review of Bamboo: Understanding its Features, Benefits, and User Experience

8. Alternatives to Chipper Cash

Several fintech platforms compete with Chipper Cash, each catering to specific user needs. Below is a comparison:

1. Wave

- Focus: Mobile money transfers within Africa.

- Advantages: Zero transfer fees for intra-country transactions and direct-to-mobile payments.

- Limitations: Fewer supported countries compared to Chipper Cash.

2. Sendwave

- Focus: Remittances to Africa from countries like the U.S., U.K., and Canada.

- Advantages: No transfer fees; relies on exchange rate margins.

- Limitations: Limited services beyond money transfers.

3. WorldRemit

- Focus: International money transfers.

- Advantages: Multiple payout options (bank accounts, cash pickup, mobile wallets).

- Limitations: Higher fees compared to Chipper Cash for some transactions.

4. PayPal

- Focus: Global payments.

- Advantages: Broad international reach and high trust level.

- Limitations: High fees and exchange rate markups make it less suitable for Africa-specific transactions.

5. Remitly

- Focus: International remittances to developing regions.

- Advantages: Competitive exchange rates and flexible transfer options (Express vs. Economy).

- Limitations: Fees depend on speed and destination.

FAQs

What is Chipper Cash?

Chipper Cash is a mobile-based platform for fast, low-cost cross-border money transfers, bill payments, cryptocurrency trading, and investment in U.S. stocks across multiple African countries.

How do I send money with Chipper Cash?

Simply download the app, register, link your bank or mobile money account, and choose the recipient’s phone number or Chipper tag to send money instantly, with low or no fees for transfers within the same country.

What are the fees for using Chipper Cash?

Chipper Cash offers free local transfers and minimal fees for cross-border transfers. There may be additional fees for cryptocurrency trading or certain services like expedited payments.

Is Chipper Cash safe to use?

Yes, Chipper Cash uses bank-grade encryption and complies with local financial regulations, ensuring secure transactions and data protection for its users.

Which countries can use Chipper Cash?

Chipper Cash is available in several African countries, including Nigeria, Kenya, Ghana, Uganda, South Africa, and Rwanda, with plans to expand further.

Conclusion

Chipper Cash has emerged as a game-changer in Africa’s fintech space, offering affordable, fast, and accessible financial services.

By addressing the inefficiencies of traditional banking systems, it empowers millions of users to participate in the global economy.

For users seeking convenience and low fees within Africa, Chipper Cash is a top choice. However, those with global remittance needs or specific preferences may consider alternatives like Wave, WorldRemit, or Remitly.

Recommendations

An In-Depth review of Bamboo: Understanding its Features, Benefits, and User Experience

Credpal Review: A comprehensive guide to it features, Mobile App, Functionality, and Alternatives

A Comprehensive Overview of Branch: Analyzing Its Services, Features & User experience