CredPal is a trailblazer in Nigeria’s fintech industry, providing innovative consumer credit solutions that address the financial needs of individuals and businesses.

With its “buy now, pay later” (BNPL) model and extensive partnerships with merchants, CredPal is helping to reshape how Nigerians access and manage credit.

Back in 2018, CredPal Pay initially emerged as a point-of-sale financing solution, primarily as a plugin integration for eCommerce retailers including Slot, Dreamwork, Pointek, and various online sellers.

However, by November 2021, the concept underwent a transformation, evolving into an embedded finance platform.

This guide offers an in-depth analysis of CredPal’s features, mobile app, functionality, and alternatives to help you decide if it’s the right financial tool for you.

What is CredPal?

CredPal is a financial technology platform that allows individuals and businesses to buy goods and services now and pay later in installments.

Founded in 2018, by Fehintolu Olaogun and Oluwaseun Akinlade, CredPal aims to bridge the gap in credit accessibility in Nigeria by enabling installment payments for various transactions, from retail purchases to professional services.

Its services are built on the principles of convenience, accessibility, and flexibility, making it an appealing choice for consumers who need financial breathing room without traditional loan hassles.

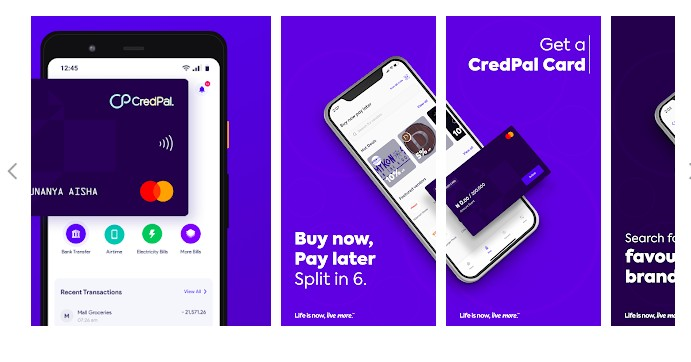

CredPal operates primarily through its mobile app and a network of partner merchants, offering both virtual and physical credit cards for seamless transactions.

Key Features of CredPal

1. Buy Now, Pay Later (BNPL)

CredPal’s flagship offering allows customers to shop with partnered merchants and spread payments over a defined period.

The BNPL feature is ideal for users seeking to manage expenses while maintaining financial stability. Repayment plans are customizable and typically range from 30 days to 12 months.

2. Virtual and Physical Credit Cards

Users can access virtual credit cards for online transactions or request physical cards for in-store purchases.

These cards are tied to their CredPal accounts, enabling easy credit use at partnered and non-partnered merchants.

3. Flexible Loan Plans

CredPal provides flexible loan terms to suit diverse financial needs. Customers can select repayment schedules based on their income and cash flow, ensuring affordability.

4. Merchant Integration

CredPal has a vast network of merchants across Nigeria, making it convenient for users to access credit at their favorite stores.

Merchants also benefit by attracting more customers who prefer installment payment options.

5. Mobile App Functionality

The CredPal app provides an intuitive interface for credit applications, tracking spending, managing repayment schedules, and interacting with merchants.

6. Instant Credit Decisions

CredPal leverages technology to deliver instant credit decisions. Once users apply for credit, the platform evaluates their financial profile and provides approval within minutes.

7. Business Financing

Beyond individual users, CredPal extends its services to businesses, enabling them to access credit for operational expenses or bulk purchases.

8. Financial Management Tools

CredPal equips users with tools to monitor their spending, manage credit limits, and plan repayments, promoting responsible borrowing habits.

How CredPal’s Mobile App Works

The CredPal mobile app is central to its operations, offering a seamless and user-friendly experience for all users.

- App Setup:

- Download the app from Google Play Store or Apple App Store.

- Sign up by providing personal information and verifying your identity.

- Credit Application:

- Users can apply for credit directly within the app by submitting relevant details, such as income and financial history.

- The platform uses proprietary algorithms to assess eligibility, delivering instant decisions.

- Browsing Merchants:

- The app includes a directory of partner merchants, allowing users to shop and access installment plans directly through CredPal.

- Transaction Management:

- Users can monitor their spending, track repayment schedules, and manage their credit limits all from the app.

- Secure Payments:

- The app supports secure payment methods for credit repayment, including bank transfers and direct debits.

- Notifications and Updates:

- CredPal sends reminders and updates to ensure users stay informed about their repayment schedules and account activity.

Functionality and User Experience

CredPal’s functionality is centered on simplicity and accessibility, catering to both tech-savvy users and those new to digital credit systems. Here’s what sets its functionality apart:

- Ease of Use:

The app’s design prioritizes simplicity, making navigation easy for users of all skill levels. Key features, such as credit application and repayment tracking, are clearly laid out. - Speed:

Instant credit approvals and quick transactions enhance user convenience, allowing immediate access to funds when needed. - Accessibility:

CredPal accommodates a wide range of users by offering credit solutions tailored to varying income levels and financial histories. - Merchant Collaboration:

Integration with numerous merchants ensures users can access a wide variety of products and services. - Security:

CredPal employs advanced encryption and data protection measures to safeguard user information and transactions.

Alternatives to CredPal

While CredPal stands out for its BNPL services and user-centric approach, there are other fintech platforms offering comparable features. Here are some alternatives:

- Carbon (formerly Paylater):

- Offers personal loans, bill payments, savings options, and BNPL services.

- Features a robust app with additional financial tools, such as expense tracking and credit score monitoring.

- Ideal for users seeking a more comprehensive financial platform.

- FairMoney:

- Provides quick micro-loans and bill payment services.

- Offers loans with flexible repayment terms but lacks a dedicated BNPL feature.

- Best for users prioritizing immediate cash loans over installment payments.

- Migo (formerly Kwikmoney):

- Focuses on short-term, instant loans integrated with telecom and banking services.

- No dedicated BNPL functionality but excels in fast credit disbursement.

- Okash:

- Specializes in short-term loans with competitive interest rates.

- Targets users needing immediate credit for emergencies rather than installment purchases.

- Flutterwave’s Barter:

- Offers virtual dollar cards and seamless payments for international transactions.

- Provides credit payment features but lacks BNPL-focused services.

- Payflex (South Africa):

- A BNPL provider offering payment plans across various merchants.

- Similar to CredPal but operates outside Nigeria, primarily in South Africa.

Strengths of CredPal

- Dedicated BNPL Services:

CredPal focuses heavily on installment-based credit, distinguishing itself from other platforms that primarily offer personal loans. - Merchant Partnerships:

Its extensive network of partner merchants makes CredPal highly convenient for retail shoppers and businesses. - Accessibility:

CredPal’s flexible repayment plans and quick credit approvals make it an attractive choice for a wide audience. - Mobile-First Experience:

The app’s robust functionality ensures users can manage all aspects of their credit journey from their smartphones. - Business Solutions:

CredPal caters not just to individuals but also to businesses, offering credit for operational needs.

Challenges with CredPal

- Interest Rates:

Interest rates on installment payments can be relatively high, especially for new users with limited credit histories. - Limited Geographic Reach:

Currently focused on Nigeria, CredPal has yet to expand to other African markets or globally. - Dependence on Partner Merchants:

While CredPal supports general credit use, its primary BNPL offerings are tied to specific merchants, limiting flexibility for some users. - Regulatory Risks:

As a credit provider in a rapidly evolving fintech space, CredPal faces potential regulatory changes that could impact its operations. - Competition:

Growing competition from platforms like Carbon, FairMoney, and Migo could challenge CredPal’s market position.

How credpal compares to other fintech platforms

CredPal distinguishes itself in the Nigerian fintech landscape with its Buy Now, Pay Later (BNPL) model, allowing users to make purchases at partner merchants and pay in installments.

This makes it a convenient option for those seeking financial flexibility. In comparison to other fintech platforms like Carbon, FairMoney, and Migo, CredPal focuses heavily on consumer credit for retail purchases, offering both virtual and physical credit cards for seamless transactions.

Carbon provides a broader range of financial services, including loans, savings, and bill payments, but lacks a dedicated BNPL feature.

FairMoney also focuses on personal loans with flexible terms but doesn’t offer BNPL. Migo, like FairMoney, specializes in short-term, unsecured loans with a focus on quick access to funds rather than installment payments.

Flutterwave, on the other hand, focuses on international payments and cross-border transactions rather than consumer credit or BNPL.

In terms of merchant partnerships, CredPal excels by offering installment payment options across a broad range of retail sectors.

While Carbon and FairMoney provide broader financial services, they don’t have the same retail focus or BNPL functionality.

Migo and Flutterwave are more focused on providing quick loans or business solutions. Overall, CredPal stands out for those seeking flexible payment plans for retail purchases.

FAQs

What is CredPal?

CredPal is a fintech platform that offers “buy now, pay later” (BNPL) services, allowing users to purchase goods and services and pay in installments.

How do I apply for credit on CredPal?

You can apply for credit directly through the CredPal mobile app by providing necessary information, such as income and financial details. Credit decisions are made instantly.

Can I use CredPal for both online and in-store purchases?

Yes, CredPal provides both virtual and physical credit cards, enabling purchases online and in-store at partnered merchants.

What repayment options does CredPal offer?

CredPal offers flexible repayment plans ranging from 30 days to several months, tailored to individual users’ needs.

Are CredPal’s services available outside Nigeria?

Currently, CredPal primarily operates in Nigeria. There are no plans for expansion into other countries at the moment.

Conclusion

CredPal is a game-changing fintech platform in Nigeria, providing a seamless “buy now, pay later” experience that caters to the needs of individuals and businesses.

Its user-friendly mobile app, extensive merchant network, and flexible repayment plans make it a top choice for consumers seeking financial flexibility.

While CredPal faces competition and challenges like interest rates and geographic limitations, its focus on BNPL services and innovative credit solutions positions it as a leader in the market.

For users prioritizing installment-based payments and a mobile-first approach, CredPal is a highly recommended option.