How to use Opay on your Mobile Device. Life moves so quickly these days, and it feels like we’re always on the go. That’s why apps like OPay have become such a big deal. They make it super easy to handle our money without even leaving the house.

OPay is a popular app in Nigeria that lets you do all sorts of things with your money right on your phone. You can pay bills, send money to friends and family, top up your phone, and much more.

But if you’re new to OPay, it might seem a bit confusing at first. Don’t worry, though! This guide will walk you through the whole process, step-by-step. We’ll cover everything from downloading the app to making your first payment.

Learning how to use OPay effectively can really change how you manage your money. It’s like having a powerful financial tool right in your pocket.

Imagine paying your electricity bill without even leaving your bed, or sending money to a loved one in seconds. That’s the kind of convenience OPay offers.

So, whether you’re a tech-savvy person or just starting to explore the world of mobile finance, this guide will help you get the most out of the OPay app.

Table of Contents

What is OPay?

OPay is a comprehensive mobile money platform that enables users to perform various financial transactions with ease.

Launched in 2018 by Opera Group, OPay was designed to cater to the growing demand for digital payment solutions in Nigeria.

The platform quickly gained popularity due to its user-friendly interface and wide range of services.

History and Background

Initially focused on ride-hailing and logistics services, OPay pivoted towards becoming a super app for financial transactions after recognizing the potential of mobile payments.

In 2021, Opera Group increased its stake in OPay, reflecting its commitment to the platform’s growth and success.

Today, OPay offers a plethora of services including:

- Money transfers

- Bill payments

- Airtime purchases

- Food delivery

- Transportation services

This diverse range of offerings positions OPay as a key player in Nigeria’s mobile finance landscape.

Read Next: How to Use Payday App

Getting Started with OPay

Here’s how to get started with Opay:

How to Download and Install the OPay App

To begin using OPay, you first need to download the app on your mobile device. Here’s how:

1. For Android Users: – Open the Google Play Store. – Search for “OPay” in the search bar. – Tap “Install” to download the app.

2. For iOS Users: – Open the Apple App Store. – Search for “OPay.” – Tap “Get” or “Install” to download the application.

After downloading, open the app and follow these steps for initial setup:

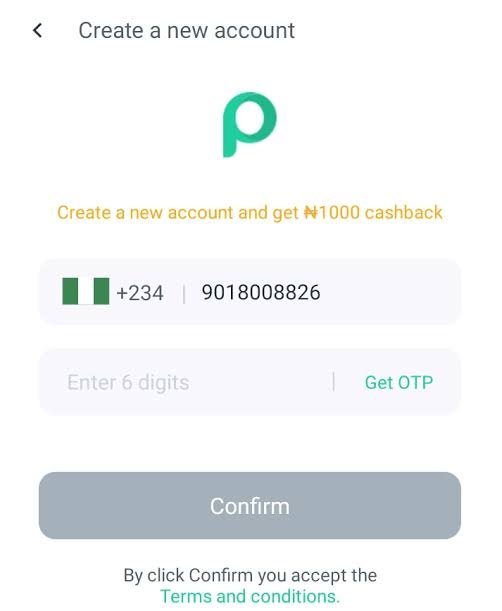

Creating an OPay Account

To create an account on OPay, you’ll need a few things:

- A valid phone number

- Identification (like a national ID or driver’s license)

Here’s how you can set up your account:

1. Launch the app and select your preferred language.

2. Enter your personal information including your name, phone number, and email address.

3. Verify your phone number by entering the code sent via SMS.

4. Set up a secure password and PIN for your account.

This process ensures that your account is secure and ready for transactions.

How to Use OPay App on My Phone?

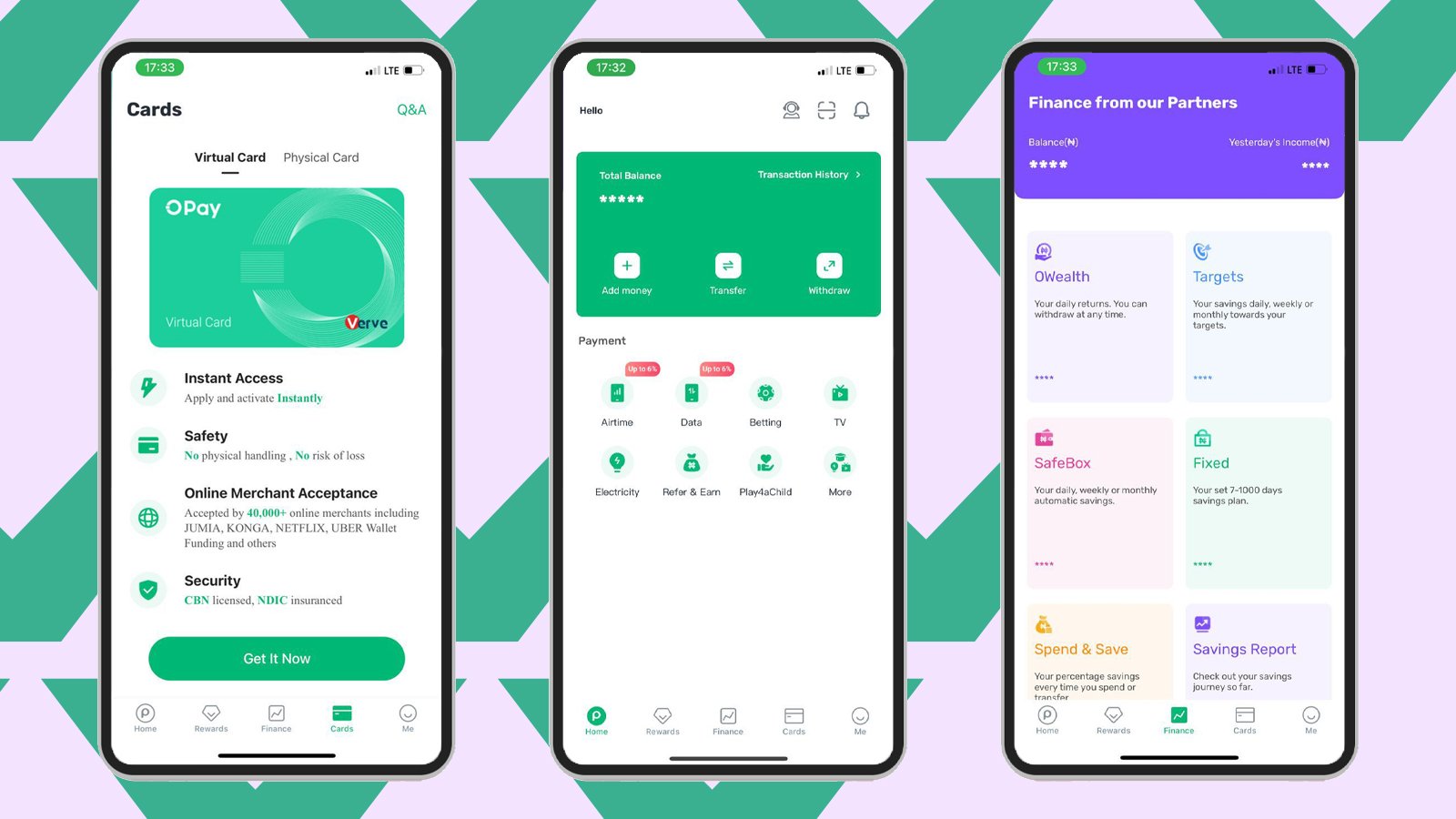

Once you’ve set up your account, familiarizing yourself with the app’s interface is essential. The main dashboard displays various options such as:

- Home: Overview of your wallet balance and recent transactions.

- Transfer: For sending money to other users.

- Payments: To pay bills or purchase airtime.

- More: Access additional features like savings or loans.

Funding Your OPay Wallet

To use OPay effectively, you’ll need to fund your wallet. Here are some methods available:

- Bank Transfer: Link your bank account for easy transfers.

- Debit Card: Add funds using your debit card directly through the app.

To add money:

1. Tap on “Add Money” from the homepage.

2. Choose your funding method (bank transfer or debit card).

3. Follow prompts to complete the transaction.

Using OPay for Transactions

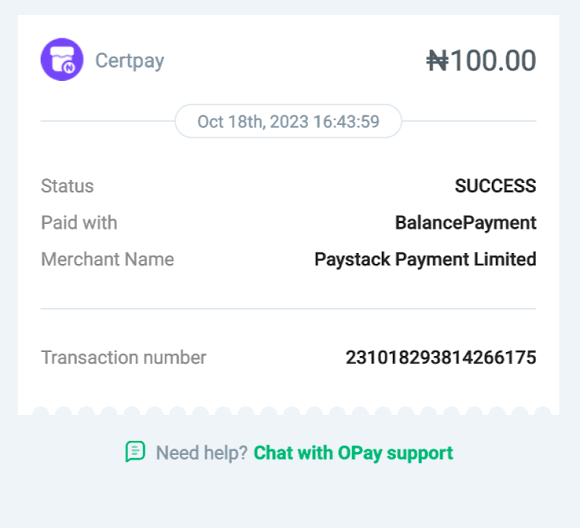

Making Payments

Making payments through OPay is straightforward. Here’s how you can pay bills or purchase airtime:

1. Select “Payments” from the main menu.

2. Choose the type of bill (e.g., electricity or cable).

3. Enter the necessary details such as account number and amount.

4. Confirm the payment and wait for a notification of success.

For purchasing airtime:

1. Go to “Airtime” on the dashboard.

2. Enter your phone number and select an amount.

3. Confirm your purchase.

Money Transfers

Sending money is one of the core features of OPay:

1. Tap “Transfer” on the dashboard.

2. Enter the recipient’s phone number or select from contacts.

3. Specify the amount and add a note if desired.

4. Confirm your transaction—be aware of any limits or fees associated with transfers.

Using USSD Codes with OPay

For those who may not have internet access, USSD codes offer a convenient alternative:

Dial *955# on your phone to access basic functions like checking balance or transferring funds without needing to open the app.

This feature is particularly useful in areas with poor internet connectivity.

Additional Features of OPay

Here are some additional features of Opay:

Savings and Investment Options

OPay offers savings features that allow users to earn interest on their deposits over time. This can be an excellent way for users to grow their funds while keeping them accessible.

Explore investment opportunities through OWealth, a platform that offers access to various investment options.

Loan Services via OKash

Through OKash, users can apply for loans directly within the app:

1. Navigate to “Loans” in the menu.

2. Fill out necessary information regarding loan amount and repayment terms.

3. Submit your application for approval.

Repayment options are flexible, allowing users to manage their finances effectively.

Read Also: How to Use Kuda for Daily Banking: A Beginner’s Guide

Benefits of Using OPay

Using OPay comes with several advantages over traditional banking methods:

1. Convenience: Perform transactions anytime and anywhere from your mobile device.

2. Security: The app employs robust security measures including encryption and two-factor authentication.

3. Promotions: Users often benefit from discounts, cashback offers, and other promotional deals that enhance their experience.

Additionally, customer support is readily available through various channels if assistance is needed.

Common Issues and Troubleshooting

Like any digital service, users may encounter issues while using OPay:

Verification Problems: Ensure that all provided information matches official documents during registration.

Transaction Failures: Check wallet balance before attempting transactions; insufficient funds will lead to failures. If problems persist, consider reaching out to customer support via chat or email for resolution.

Conclusion

Using OPay can significantly simplify how you manage finances on-the-go. With its wide array of services, from bill payments to money transfers, OPay stands out as a leading mobile finance solution in Nigeria.

Beginners are encouraged to explore all features available within the app as they adapt to this digital finance landscape.

Embracing digital finance solutions like OPay not only enhances convenience but also promotes efficient financial management in everyday life.

Frequently Asked Questions

1. How do I reset my password on OPay?

To reset your password, open the app and click on “Forgot Password?” Follow the prompts sent via email or SMS for recovery instructions.

2. Can I use OPay without an internet connection?

Yes! You can use USSD codes (*955#) for basic transactions without needing internet access.

3. Are there fees associated with using OPay?

While many services are free (like transfers between users), some transactions may incur fees depending on service type, check within the app for specifics.

4. What should I do if my transaction fails?

If a transaction fails, check your wallet balance first; if sufficient funds are available but it still fails, contact customer support for assistance immediately.

For further assistance or inquiries regarding using the Opay app:

Visit official FAQs on their website.

Contact customer support through in-app channels for personalized help.

Recommendations

Bankly Review: A Comprehensive Guide to it Features, Mobile App, Functionality, and Alternatives

Cellulant Review: All You Should About the Payment Solution Provider