Palmpay has made life easier; it has made transactions way easier. Learning how to use Palmpay will be your key to unlock seamless payments and a hassle-free financial life.

Thanks to Palmpay, you will enjoy convenient, fast, and secure payments within the comfort of your space.

As our lives are becoming digital day by day, managing finances and making transactions have become really overwhelming. That’s where Palmpay comes in: a mobile payment platform built to make your financial life much easier.

By mastering how to use Palmpay for transactions, you’ll save time, reduce stress, and gain control over your finances.

More than a payment means, Palmpay is something like your personal finance manager, budgeting tool, and financial safety net in one. Learning how to use Palmpay to its fullest extent can really make quite a difference in your financial life.

This user’s guide will lead you through the basic use of Palmpay, from setting up your account, making payments, managing your finances, to getting the most out of the various features on Palmpay. Let’s dive in!

Table of Contents

What is Palmpay and How Does It Work?

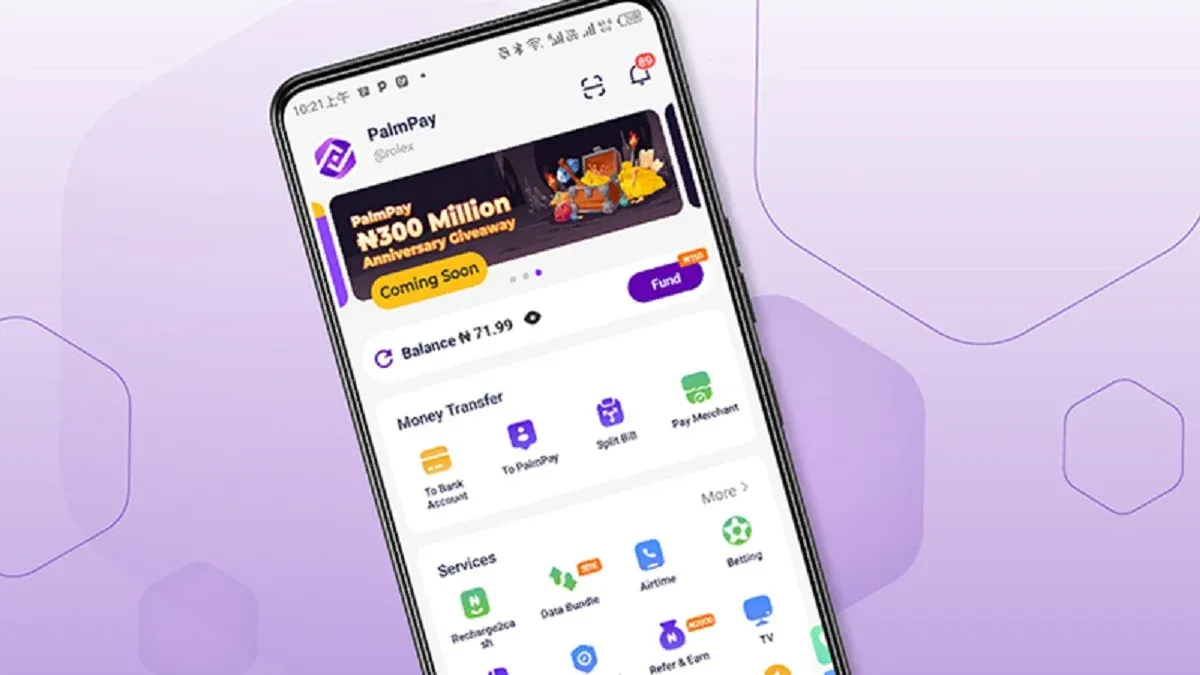

PalmPay is a secure, convenient fintech payment platform that allows users to pay and withdraw money with ease and at the fastest speed in Nigeria. It has been designed for those who want an easy and convenient way to manage their finances.

With the cash scarcity caused by the Naira redesign policy of the central bank of Nigeria, knowing how to use PalmPay can easily make users pay bills, shop online, or send money to friends and family from any location.

They can also withdraw cash from ATMs and other financial institutions in Nigeria. PalmPay is a great avenue for making payments and having access to your funds whenever you need them.

With the app, users can easily pay and withdraw money from anywhere and at any time. The user experience is fast and secure, so you can trust your money with PalmPay.

Related – A Comprehensive Guide on How to Use Carbon App For Beginners

Features of Palmpay You Should Know

PalmPay has a number of features that make life easier and offer financial benefits to the user. Some of the features of Palmpay are as follows:

Payment Features

- Bill Payments: Pay your bills for electricity, water, internet, and many more.

- Airtime and Data Purchases: Buy airtime and data for yourself or someone else.

- Fund Transfers: Transfer money to your friends, family, or business partners.

- Merchant Payments: Pay for goods and services at participating merchants.

Financial Management Features

- Account Management: The ability to view account balances, transaction history, and payment schedules.

- Budgeting: The ability to set budgets and track expenses in order to stay on top of your finances.

- Savings: Save money and earn interest on your savings.

- Investments: Invest in a host of investment options such as mutual funds and stocks.

Security Features

- Two-Factor Authentication: Adding an extra layer of security to your account with two-factor authentication.

- Transaction PIN: Set a transaction PIN to authorize transactions.

- Account Freezing: Freeze your account if you suspect unauthorized activity.

- Transaction History: Your transaction history is available to you in order to detect suspicious activity.

Rewards and Benefits

- Cashback Rewards: Cashback rewards on certain transactions.

- Discounts: Enjoy discounts at participating merchants.

- Referral Rewards: Get rewarded for referring friends to Palmpay.

- Loyalty Program: Be part of the Palmpay loyalty program and get points and rewards.

Customer Support

- 24/7 Customer Support: Palmpay’s customer support team is always ready to help users around the clock.

- In-app support: Customer support can be accessed directly from the Palmpay app.

- Email Support: Reach out to Palmpay’s customer support through email.

- Social Media Support: Reach Palmpay’s customer support team through their social media handles.

How to Set Up Your Palmpay Account

PalmPay is a popular mobile payment platform in Nigeria offering services that range from money transfers and bill payments to loan access. The process of setting up a PalmPay account is pretty straightforward and simple. Here is how to set it up:

1. Download the app

Download and install the PalmPay mobile application on your device. It is available on the Google Play Store and also on the iOS Store.

2. Open an app, sign up

Open the application and click on the Sign-up button. Select your country code and enter your phone number. Here, the phone number will be used for receiving the verification code.

3. Verify your phone number

Click to submit and wait for a verification code. Put in the verification code sent to your phone number and allow the page to load back.

4. Set up your pin

You will be required to set up a 4-digit pin. You will enter your preferred code and also confirm it.

Read Also – How to Use MFS Africa as a First Time User

How to Use Palmpay to Make Payments

Making payments with Palmpay is a breeze. To get started, follow these simple steps:

- Log In to Your Palmpay Account: First, open the Palmpay app on your device and log in to your account using your phone number and password.

- Choosing Your Payment Option: Upon opening the application and clicking the “Pay” button at the bottom, choose what kind of payment you will be paying for: “Bill Payment,” “Airtime/ Data,” or “Send Money.”

- Details of Payment: Enter information relevant to your type of payment option: biller’s name, your account number, or payee’s mobile phone number.

- Confirm Payment: Check your payment details carefully and tap “Confirm” to complete your transaction.

- Get Payment Confirmation: Upon successful payment, a message will be sent to Palmpay, confirming this, and the recipient is notified.

That’s it! Paying bills with Palmpay is easy, quick, and secure. You can make as many payments, from bill payments to airtime, money transfers, and lots more, by following these steps with Palmpay.

How to Use Palmpay to Transfer Money

Transferring money with Palmpay is pretty straightforward. To get started, follow these simple steps:

- Choose Transfer Option: Upon login, tap the “Send Money” at the bottom of the screen.

- Enter Recipient Details: Enter the recipient’s phone number or Palmpay ID. You can also select a contact from your phonebook.

- Enter Transfer Amount: Enter the amount you want to transfer, and select the currency if applicable.

- Review and Confirm Transfer: Review the transfer to be made, including recipient information and the amount to be transferred. Tap “Confirm” if correct.

- Receive Transfer Confirmation: A confirmation message from Palmpay will pop up on your screen, and also a notification for the receiving party.

Following these steps, you can transfer money through Palmpay quickly, easily, and securely.

Read Also – A Beginner’s Guide on How to Use the M-Pesa App: What You Need to Know

How to Use Palmpay to Withdraw Cash

Actually, withdrawing money from your Palmpay account isn’t an issue. To accomplish it, follow these steps:

- Tap the “Withdraw” button at the bottom after logging in.

- Choose Your Preferred Withdrawal Method. It might include anything like an ATM withdrawal, bank transfer, or an agent withdrawal.

- Enter the amount of money you want to withdraw and specify the currency, where necessary.

- Make sure to review carefully the amount and means of withdrawal. If everything goes well, tap “Confirm” to proceed with the withdrawal.

- You will receive a message from Palmpay about the confirmation of your withdrawal in case everything went well.

By following these steps, you will be able to withdraw cash using Palmpay in the fastest, most convenient, and safest way possible.

How to Use Palmpay to Borrow Money

The loaning of money is very smooth and easy with Palmpay. Here is how to get a loan:

- Loan Option: After opening an account and logging in, tap the “Loan” button at the bottom of the screen.

- Check Your Eligibility: It checks whether you are eligible or not for a loan by looking at your credit score among other factors.

- Select Loan Amount: If eligible, select your desired loan amount and repayment period.

- Review and Accept the Loan Terms: Carefully review the loan offer, including interest rate, repayment schedule, and associated fees. Tap “Accept” if you are satisfied with the loan offer to confirm the loan.

- Loan Disbursement: Upon accepting the loan offer, a disbursement of the loan amount will be made into your Palmpay account.

With these steps, one can borrow cash quickly, easily, and securely from Palmpay.

Also Read – How to Use the Remita App for Local and International Transactions

Benefits of Making Transactions with Palmpay

There are several advantages one is likely to enjoy while transacting with PalmPay. These have been identified to make the platform more user-friendly to the advantage of the subscribers. Below are some of the key benefits:

- Convenience: With a couple of touches on your phone, one can pay bills, transfer funds, and purchase airtime and data.

- Security: Advanced security technology shields your transactions and personal information.

- Cost-Effective: Low transaction fees help you save up for longer.

- Rewards: Cashback rewards on select transactions, plus offers from partner merchants.

- Easy Transaction Tracking: Keep track of transaction history to detect any suspicious activity.

- Fast Transaction Processing: Transactions are processed fast, saving your precious time.

- Wide Acceptance: Palmpay is widely accepted across merchants, making it rather convenient to use.

- Easy to Use: The Palmpay app has a user-friendly interface that makes using it very easy.

Also Read – How to Use the JumiaPay App on Mobile: A Complete Guide for Users

How to Troubleshoot Common Palmpay Issues

There might be some challenges that may arise while using Palmpay. How to resolve all common PalmPay problems effortlessly.

- Check Your Internet Connection: Make sure you have a stable internet connection, either Wi-Fi or mobile data.

- Restart Your Device: Sometimes, the mere restarting of your device solves most minor issues.

- Clear App Data and Cache: Go into your device settings, find the Palmpay app, and clear its data and cache.

- Contact Customer Support: If the problem persists, you can contact them via email, support@palmpay.com, phone number 018886888, or through social media.

- File a Complaint: If the issue persists, file a formal complaint through the Central Bank of Nigeria’s procedures.

Is Palmpay safe to save money?

When considering digital financial platforms, many users ask: is PalmPay safe to save money? The answer is yes—PalmPay is regulated by the Central Bank of Nigeria (CBN) and insured by the Nigeria Deposit Insurance Corporation (NDIC), which means your funds are protected up to the insured limit.

The PalmPay app uses advanced security measures such as encryption, two-factor authentication, and real-time transaction monitoring to keep your account safe.

The services offered by PalmPay go beyond just payments. Through the app, users can pay bills, buy airtime, send and receive money, access savings options, and sometimes even apply for loans. These features make PalmPay one of the leading fintech platforms in Nigeria.

That said, while PalmPay is generally secure, there are some disadvantages of PalmPay to consider. These include occasional transaction delays, limited customer support response times during peak periods, and possible restrictions on certain features depending on your verification level.

Overall, PalmPay provides a convenient and safe platform to save and manage money, as long as users follow best practices like enabling security settings, avoiding sharing login details, and keeping their app updated.

How to use finance icon on Palmpay

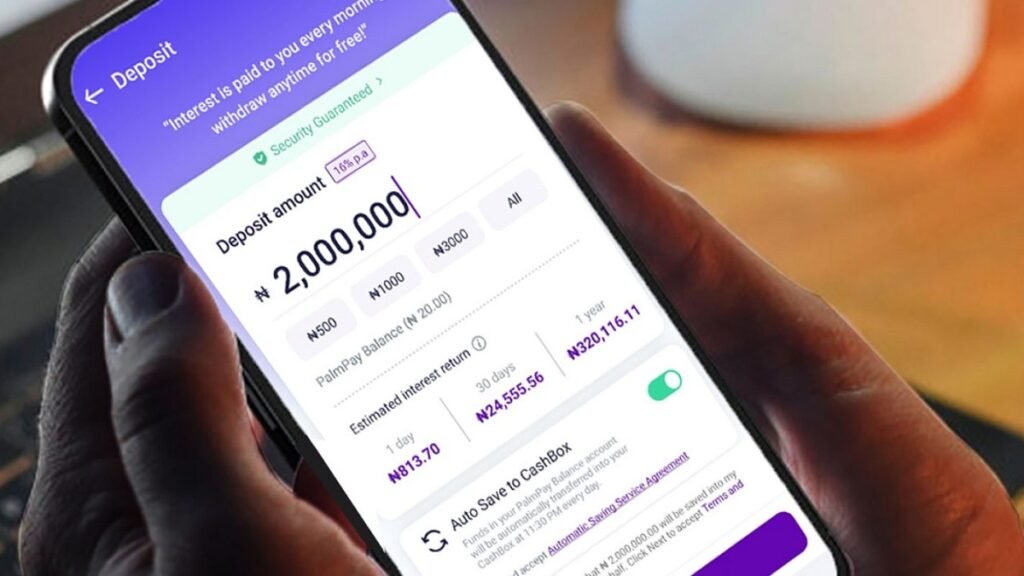

On PalmPay, the Finance icon is where you access savings, investment, and related financial features inside the app. Here’s how to use finance icon on palmpay step by step:

- Open the PalmPay App

Make sure you’re logged in to your PalmPay account. - Locate the Finance Icon

On the home screen, look for the Finance tab or icon (usually displayed at the bottom navigation bar or in the main dashboard). - Explore Available Finance Options

Under the Finance section, you’ll find features like:- Savings (PalmPay FlexiSave or fixed plans): Save money securely and earn interest.

- Investments (if available): Put money into financial products to grow returns.

- Loans (PalmCredit integration or PalmPay loan offers): Apply for quick loans when eligible.

- Financial Tools: Track transactions, monitor balances, or set targets.

- Select a Service

Tap the specific option you’re interested in (e.g., Savings). Follow the on-screen prompts to set up a savings plan, check interest rates, or invest. - Fund Your Finance Activity

You may need to deposit or transfer money from your PalmPay wallet or linked bank card to use savings or investment services. - Track and Manage

Once set up, you can return to the Finance icon anytime to view balances, returns, or adjust your financial plans.

Palmpay Pro: How It Works & Benefits Attached

The PalmPay app has become one of Nigeria’s most trusted fintech platforms, offering users a wide range of financial tools. A new feature many people are curious about is PalmPay Pro, an upgraded package that gives users access to more advanced services, higher rewards, and better savings options.

To understand PalmPay Pro, it’s important to first ask: how does PalmPay work? Simply put, PalmPay functions as a mobile wallet. Users can download the app, register, and fund their accounts via bank transfer, debit card, or agents. Once funded, they can pay bills, buy airtime, send and receive money, and access other financial tools.

What is PalmPay Pro?

PalmPay Pro is an enhanced version of the platform designed to give users more value. Think of it as a premium account tier within the PalmPay app. It comes with added benefits like higher transaction limits, exclusive rewards, and access to better savings and cashback offers.

If you’re wondering how PalmPay works in its Pro version, the process is similar to the standard PalmPay account but with additional privileges.

Users can upgrade within the app, often after meeting certain verification requirements. Once upgraded, PalmPay Pro users can enjoy higher daily limits, more cashback opportunities, and priority access to customer support.

Services Offered by PalmPay

The services offered by PalmPay include:

- Money transfers (to banks and PalmPay users)

- Airtime and data purchases with cashback

- Bill payments (electricity, cable TV, water, etc.)

- Savings plans with competitive interest rates

- Access to loans and credit services (depending on eligibility)

- Merchant and business payment solutions

PalmPay Pro enhances many of these services by increasing transaction allowances and offering better rewards.

PalmPay Review: Is PalmPay Pro Worth It?

A quick PalmPay review highlights that the platform is safe and reliable, being fully regulated by the Central Bank of Nigeria (CBN) and insured by the Nigeria Deposit Insurance Corporation (NDIC).

This ensures that users’ funds are protected while using the PalmPay app. When asking how does PalmPay work, the answer lies in its simple, user-friendly setup: users can send and receive money, pay bills, buy airtime and data, and access other convenient digital financial tools.

The launch of PalmPay Pro adds even more value to the platform. How PalmPay works with this upgrade is by giving users better cashback rates, higher transaction limits, and access to priority customer service.

Looking at the services offered by PalmPay, it is clear that the Pro version is designed for frequent users who want to maximize benefits while enjoying seamless transactions. Overall, PalmPay Pro is worth it for heavy users seeking more perks.

Benefits of PalmPay Pro

- Increased transaction and withdrawal limits

- Exclusive cashback rewards

- Access to premium financial tools

- Faster customer support

- Enhanced savings and investment opportunities

Frequently Asked Questions

How do I fund my Palmpay account?

You can fund your Palmpay account by linking your bank card or account to the app. Go to the “Add Money” section, select your bank, and follow through until it’s complete.

How Do I Make Payments on Palmpay?

To make a payment through Palmpay, tap the “Pay” icon and select the kind of payment you want to make. It could be bill payments or the purchase of airtime. After putting in the details needed for that transaction, confirm the payment.

Is Palmpay secure?

Yes, Palmpay is very secure. Advanced security technology used by the app protects your transactions and personal information with encryption and two-factor authentication.

Can I use Palmpay to transfer funds to others?

Yes, you can transfer money to people using Palmpay. Just go to the “Send Money” section, enter the recipient’s phone number or Palmpay ID, and follow the on-screen instructions to complete the transaction.

Conclusion

Mastering how to use Palmpay is the surefire way to seamless transactions. By following this user’s guide on how to use Palmpay for transactions, you’ll be able to navigate the app with ease.

Effective use of Palmpay means one can pay, transfer, and purchase airtime and data in record time securely.

Why wait? Download the Palmpay app today and start enjoying hassle-free transactions with Palmpay.