Are you curious about how to use Payhippo? Well, this is a fresh and innovative online service oriented toward making financial services as effortless as possible for Small and Medium Enterprises in Nigeria.

You’re a newcomer, and everything that comes your way is a bit overwhelming. Fear not! Payhippo is user-friendly and designed to empower the business owner in you.

Whether it is funds to expand your operations or tools that streamline your finances, learning how to use Payhippo opens new doors for your business.

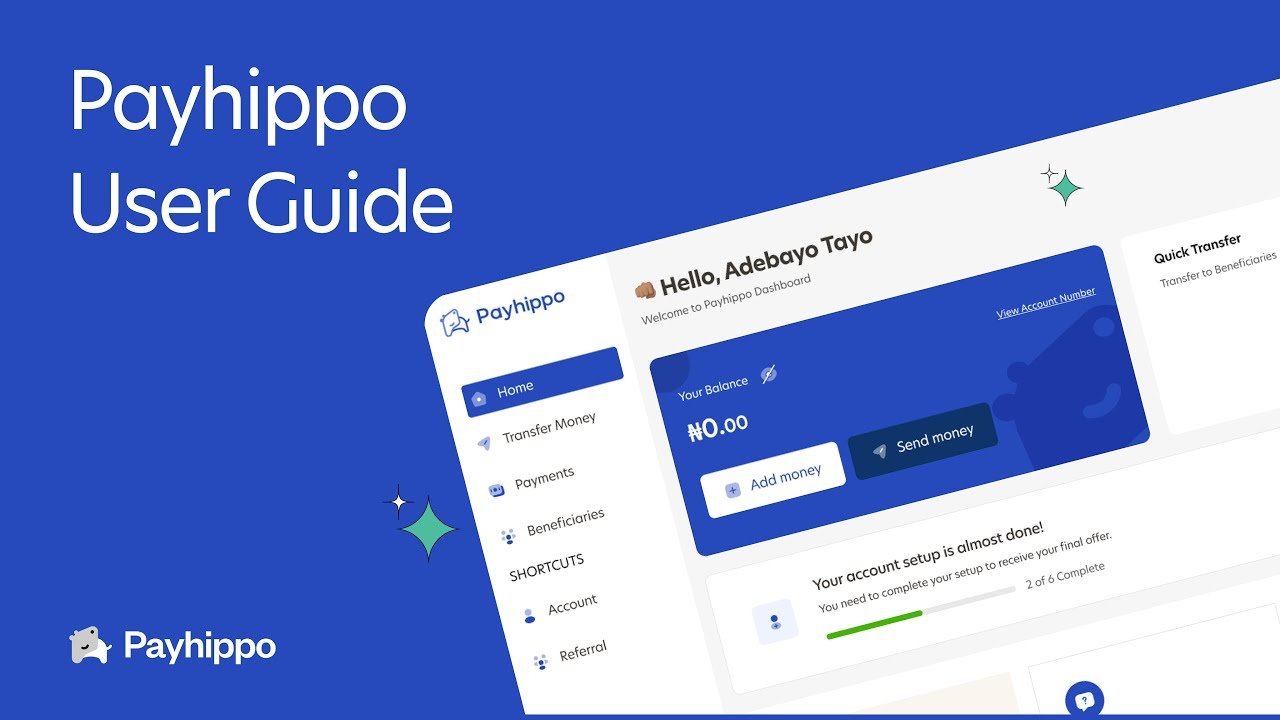

This Payhippo user guide will detail the necessary steps to get started with it, even for a beginner. From accessing quick loans to managing business banking, Payhippo has many features especially designed for SMEs.

So, let’s dive in and explore how you can leverage Payhippo for your business growth!

Table of Contents

What is Payhippo?

Payhippo is a Nigerian fintech startup that grants loans and other financial services to SMEs.

Founded in 2019, it was founded by Chioma Okotcha, Uche Nnadi, and Zach Bijesse. Payhippo is on a mission to make financial services seamless for African SMEs.

Payhippo offers a range of financial products and services to SMEs, including:

- Loans: Payhippo offers loans to SMEs in under three hours without collateral. To ascertain the creditworthiness of a business, it takes into consideration various data points, which include bank statements and even social media activity.

- Banking services: Payhippo extends other banking services to SMEs such as business accounts, debit cards, and international money transfers.

- Insurance: Payhippo also offers insurance products to SMEs, including asset protection and business interruption insurance.

Briefly, Payhippo is a very reliable partner for Nigerian SMEs to find fast, flexible, and relatively inexpensive access to finance.

Related – A User’s Guide on How to Use Social Lender to Request and Repay Loans

Features of Payhippo

Payhippo offers the following set of features answering the needs of SMEs in Nigeria:

- Quick Loans: Payhippo offers loans to the SMEs in less than three hours, collateral-free.

- Flexible Repayment Options: The repayment terms will be tailored to suit and fit the needs and cash flows of the borrower.

- Technology-driven Platform: The technology will be at the heart of the company’s platform in making the lending process seamless and quicker for SMEs.

- Other Financial Services: Payhippo also offers other financial services to SMEs, inclusive of business accounts, debit cards, and international money transfers.

These features enable SMEs to have quick access to finance, manage their books of account, and expand their businesses.

Also Read – A User’s Guide on How to Use Palmpay For Seamless Transactions

How to Use Payhippo: Step-by-Step Guide

To effectively use Payhippo, follow these extensive steps designed for beginners:

Step 1: Go to the Website or Download the Application

First, log into the website or download the mobile application of Payhippo from your device’s app store.

Step 2: Account Creation

When on the platform, tap “Sign Up” and provide personal information like your full name, email address, and telephone number.

Step 3: Account Activation

Check your email for a confirmation link from Payhippo. Click on this link to activate your account.

Step 4: Log In

Go back to the Payhippo app or website and log in using your newly created credentials.

Step 5: Complete Your Profile

After logging in, complete your profile by adding any additional required information, such as your business details and bank account information.

Step 6: Apply for Loans or Services

Next, click to apply for a loan. You will have access to collateral-free loans and other facilities organized by Payhippo. You apply by filling in your application and submitting it for their approval.

Step 7: Upload Necessary Documents

You may be asked to upload some documents, such as a three-month bank statement of your account to prove the validity of your status. All the uploaded documents should be clear.

Step 8: Assess Proposed Loan Opportunities

After your application has been processed, read the loan offers presented to you. Check the interest rates and the terms of the repayments.

Step 9: Accept the Loan Offer

If you find an ideal loan offer, then accept it. You may be required to sign an agreement online.

Step 10: Receive Funds

Once you have accepted, the funds will be deposited into your bank account, which takes about 24 hours.

Step 11: Manage Your Finances

You can use the dashboard to track your finances daily and monthly. You are also able to repay your loan directly through the dashboard.

By following these steps, you should be able to go through Payhippo with ease and success!

Read Also – A Comprehensive Guide on How to Use Carbon App For Beginners

What Are the Main Advantages of Using Payhippo for SMEs?

Payhippo offers a lot of advantages to SMEs, including:

- Speedy Access to Loans: The SMEs will have access to collateral-free loans in less than three hours, hence solving urgent financial needs faster.

- No Collateral Requirement: Payhippo, unlike conventional banks, does not ask for collateral against its loan disbursement, making the process of getting funded for SMEs easier without losing their assets.

- Competitive Interest Rates: It provides interest rates as low as 6.5% per month to help SMEs manage their borrowing costs.

- All-inclusive Financial Services: Payhippo offers business banking solutions like accounts and debit cards for easier financial operations.

- Insurance Products: The platform will have insurance products such as asset protection and business interruption coverage that will help the SMEs to protect their businesses.

- Use of Alternative Data: Using alternative data to determine credit scores, Payhippo opens up access to financing for businesses otherwise overlooked by other financial institutions.

- Support for Growth and Stability: Equipped with integrated financial services, Payhippo will be able to enable SMEs to enhance cash flow management while investing in initiatives for growth.

These benefits culminate in increasing the financial capability of SMEs for their growth and sustainability within the competitive market.

Read Also – A Beginner’s Guide on How to Use the M-Pesa App: What You Need to Know

Tips for Optimizing Your Payhippo Experience

Enhance your experience with Payhippo; be a better user. Sign up via their website or mobile app.

After signing up, take some time to familiarize yourself with your dashboard, which comprises loan applications and banking services.

For Payhippo for beginners, Payhippo offers a user guide that gives step-by-step instructions on how to apply for loans and manage one’s finances.

Take advantage of customer support; they provide quick responses via chat or calls. Lastly, regularly check on updates and new features in order to maximize your benefit from the platform.

Also Read – How to Use MFS Africa as a First Time User

How Can I Troubleshoot Issues on Payhippo?

If you are used to using Payhippo, you may definitely feel frustrated when there’s an issue, especially the ones you rely on heavily for important financial transactions and business operations.

Here are how to troubleshoot issues on Payhippo:

- Check your internet connection to ensure it is stable.

- Ensure you update your Payhippo app to the latest version.

- Muster the courage to clear the cache from your settings, as this often solves issues in performance for the app.

- You may contact Payhippo on +2349088434841, or email hello@payhippo.ng if you need further assistance.

Frequently Asked Questions

What kind of loans does Payhippo offer?

Payhippo offers collateral-free loans, fast and quick, in about three hours, using alternative data to assess credit.

Are there any charges on the transactions made by Payhippo?

Payhippo charges 5% on sales when the account is free; this can be brought down to 2% if one upgrades to a paid plan.

Am I able to manage my transactions on Payhippo?

Yes, transaction history, statements, and management of beneficiaries can be done directly through the app.

How does Payhippo determine creditworthiness?

Payhippo makes use of alternate data, like bank statements and social media usage, to determine a customer’s creditworthiness.

Conclusion

Learning how to use Payhippo is crucial in giving you that financial management as a beginner. The Payhippo user guide has successfully taken you through crucial steps; from sign-up, loan access to banking among others.

These are straightforward ways to be up and running on this platform in full use.

Remember, Payhippo for beginners is all about making financial services accessible and straightforward.

Recommendations

- Beginners Guide on How to Use Interswitch For Transactions

- How to Use Flutterwave: Everything You Should Know

- How to Use PiggyVest: A Guide to Investing and Saving

- Step-by-Step Process on How to Use eTranzact to Make Payments

- A Comprehensive Guide on How to Use the Yoco App for Seamless Transactions