Knowing how to use Renmoney allows users to unlock the full potential of the app, ensuring they can borrow, save, and invest securely.

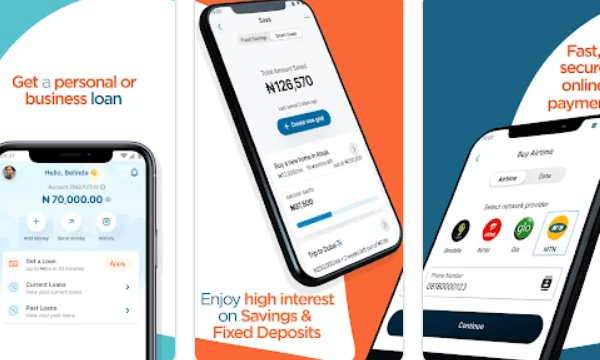

Renmoney is a leading fintech platform in Nigeria that offers quick loans, savings plans, and investment opportunities to users through its user-friendly mobile app.

Whether you need personal loans, flexible repayment options, or high-yield savings accounts, Renmoney has you covered.

The platform is designed to provide seamless financial solutions, making it ideal for individuals looking to manage their money effectively.

With Renmoney, you can apply for loans without collateral, track repayment schedules, and monitor your savings all in one place. It caters to diverse financial needs, empowering users to achieve their goals with ease.

The app’s intuitive interface and advanced features simplify financial management, even for those with limited technical expertise.

Whether you’re an entrepreneur seeking business capital, a salary earner in need of emergency funds, or someone looking to grow savings, Renmoney provides tailored solutions.

This guide explores how to use Renmoney effectively, including setting up an account, applying for loans, and troubleshooting common issues.

By the end, you’ll have the confidence to navigate the app and make the most of its services.

You might also like – How To Use Zeepay to Send and Receive Money in Ghana

Table of Contents

What is Renmoney?

Renmoney is a digital lending and financial services platform that provides access to loans, savings, and investment opportunities.

Knowing how to use Renmoney allows users to easily apply for loans, track payments, and grow their savings securely.

The app is designed for simplicity, making it accessible to both tech-savvy and less-experienced users. With Renmoney, individuals can enjoy financial freedom through instant loans, flexible repayment plans, and competitive savings options.

Renmoney’s user-friendly interface and advanced features make it an ideal solution for anyone seeking quick and secure financial services. U

nderstanding how to use Renmoney empowers users to leverage its tools effectively—whether applying for a loan, building a savings plan, or investing for the future.

Renmoney is built for modern financial needs, offering transparency, accessibility, and convenience to help users meet their goals.

Why Choose Renmoney?

Understanding how to use Renmoney reveals its advantages over traditional banking options. Some of the key benefits include:

- Quick Loans: Access personal and business loans without collateral.

- Flexible Repayment Plans: Customize repayment schedules based on your income.

- High-Interest Savings Plans: Earn competitive interest rates on savings and investments.

- User-Friendly Interface: The app is simple and easy to navigate.

- Security: All transactions are encrypted to ensure data protection.

- 24/7 Access: Manage finances anytime, anywhere through the mobile app.

Features of the Renmoney App

Renmoney’s app is packed with features that make it a convenient and efficient financial tool. Key features include:

- Quick Loan Applications: Apply for personal or business loans with flexible repayment options.

- Savings and Investment Plans: Create savings goals or invest funds to earn competitive interest rates.

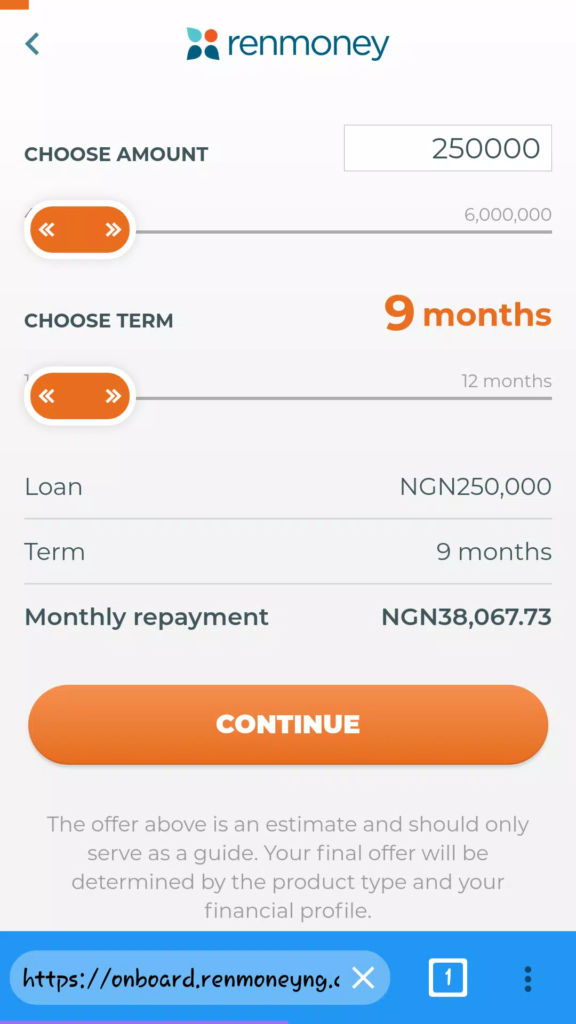

- Loan Calculator: Estimate repayment amounts and interest rates before applying.

- Easy Account Management: View account balances, loan details, and transaction history.

- Automated Repayments: Schedule automatic deductions to avoid late payments.

- Secure Transactions: Advanced encryption ensures your data and transactions are safe.

- 24/7 Customer Support: Access assistance through in-app chat or email anytime.

- Credit Score Tracking: Monitor your creditworthiness directly within the app.

- Instant Notifications: Receive updates on loan approvals, payment reminders, and promotions

You might also like – How to use Chipper cash app to send and receive payment

How to Use Renmoney: A Step-by-Step Guide

A step-by-step guide on how to use renmoney is listed below:

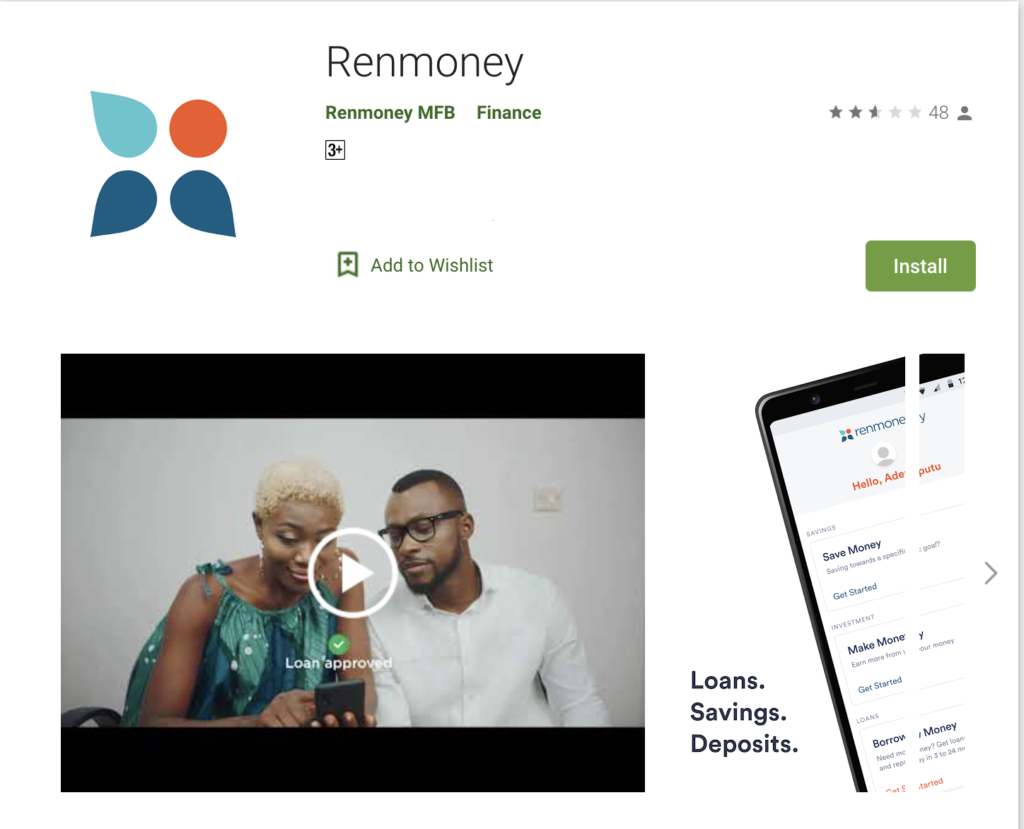

Step 1: Download and Install the Renmoney App

- Visit the Google Play Store (Android) or Apple App Store (iOS).

- Search for Renmoney App and download it.

- Install the app and open it.

Step 2: Sign Up and Create an Account

- Click on Sign Up to create a new account.

- Enter your personal details, including name, email, and phone number.

- Create a secure password.

- Verify your phone number through the OTP sent to your device.

Step 3: Apply for a Loan

- Log in to the app and go to the Loans section.

- Select Apply for Loan and fill in the required details.

- Choose the loan amount and repayment period.

- Upload the necessary documents, such as ID and proof of income.

- Submit your application and wait for approval.

- Once approved, the loan amount is disbursed to your bank account.

Read also – How to use Bamboo: A beginner’s comprehensive guide

Step 4: Save and Invest

- Navigate to the Savings or Investments tab.

- Choose a savings plan or investment option that suits your goals.

- Set the amount and duration.

- Confirm the transaction, and your funds will be saved or invested.

Step 5: Track and Manage Payments

- Use the Dashboard to view your outstanding loans and repayment schedules.

- Set reminders for payments to avoid late fees.

- Withdraw funds easily from your savings or investments whenever needed.

Other Things You Can Do on the Renmoney App

Beyond borrowing, saving, and investing, there are several other things you can do on the Renmoney app:

- Bill Payments: Pay utility bills, subscriptions, and services directly through the app.

- Airtime and Data Top-Ups: Recharge your phone or buy data bundles seamlessly.

- Budget Tracking: Set financial goals and track your expenses to stay on budget.

- Financial Insights: Access spending reports and trends to improve money management.

- Referral Program: Invite friends and earn rewards when they sign up and use the app.

- Document Uploads: Easily upload and manage financial documents required for loan approvals.

- Account Updates: Modify personal details, passwords, and preferences securely.

Tips for Using Renmoney Effectively

- Borrow Responsibly: Ensure you borrow only what you can repay comfortably.

- Automate Savings: Set automatic transfers to grow your savings consistently.

- Monitor Credit Score: Regularly review your credit score through the app.

- Use Customer Support: Reach out to support for any issues or clarifications.

Read also – The Comprehensive guide on How to use Credpal

Common Issues and Troubleshooting

Login Problems

- Forgot Password: Use the “Forgot Password” option to reset credentials.

- Verification Issues: Ensure you enter the correct OTP sent to your phone.

Loan Application Delays

- Document Errors: Double-check uploaded documents for accuracy.

- Approval Delays: Contact customer support if approval takes longer than 24 hours.

App Performance

- Slow Loading: Update the app to the latest version or clear cache.

- Crashes: Reinstall the app to resolve persistent issues.

FAQs

What is Renmoney?

Renmoney is a fintech platform that offers loans, savings, and investments through a mobile app.

How do I apply for a loan?

Open the Renmoney app, navigate to the Loans section, and submit your application.

Is Renmoney secure?

Yes, Renmoney uses encryption and other security features to protect user data.

Can I save and earn interest on the app?

Yes, Renmoney offers high-interest savings and investment options.

How do I contact support?

Use the in-app chat feature or email support through the app.

Conclusion

Learning how to use Renmoney empowers you to manage your finances effectively, whether you need quick loans or want to save and invest.

With its user-friendly design, flexible repayment options, and secure platform, Renmoney simplifies financial management for everyone.

By following this guide, you can confidently navigate the app and take full advantage of its features to meet your financial goals.

Recommendations

How To Use Zeepay to Send and Receive Money in Ghana

How to use Chipper cash app to send and receive payment