Honestly, sometimes we need a little extra cash, and getting a loan from a traditional bank can be a real hassle.

They often have tons of paperwork and strict requirements, leaving many of us, especially those without a long credit history or access to regular banking, out in the cold. That’s where something like Social Lender comes in.

It’s a pretty interesting idea – instead of just looking at your bank statements, they also consider your online presence and social connections to determine if you’re a good candidate for a loan.

This is especially helpful in places like Nigeria and South Africa, where a large number of people don’t use traditional banks.

This article is all about helping you understand how to use Social Lender to both borrow and pay back money. We’ll break down everything from how to sign up, to how the loan process works, to what your repayment options are.

Knowing how the system works is super important if you want to borrow responsibly and have a good experience with Social Lender.

So, whether you’re brand new to the platform or just want to brush up on the details, stick with me, and we’ll get you up to speed on everything you need to know about Social Lender.

Table of Contents

What is Social Lender?

Social Lender is a digital financial service platform that provides loans based on users’ social reputation rather than traditional credit scores.

Its primary purpose is to offer financial services to individuals who may not have access to conventional banking, particularly in Nigeria and South Africa.

By using social connections and online behavior, Social Lender creates opportunities for users to obtain credit, savings, and insurance services.

The platform targets individuals who often face barriers in accessing financial services due to a lack of collateral or poor credit history.

By utilizing a unique social audit process, Social Lender assesses the creditworthiness of its users based on their social media activity and community ties.

Related: How to Use GTPay to Send and Receive Payments

How Social Lender Works

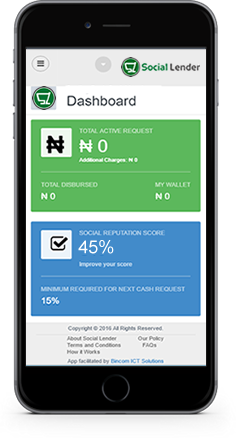

At the core of Social Lender’s operations is its proprietary Social Reputation Score(SRS). This score is calculated through a social audit that evaluates various factors including:

Social Media Activity: The frequency and nature of interactions on platforms like Facebook and Twitter.

Community Connections: The strength of relationships within the user’s social network.

User Behavior: Patterns in mobile phone usage and online transactions.The SRS helps determine the amount of loan a user can request. A higher score indicates greater trustworthiness, enabling users to access larger amounts of credit.

Getting Started with Social Lender

Registration Process

To begin using Social Lender, users must complete a registration process that requires the following information:

- Personal Details: Name, address, phone number, and bank account information.

- Social Media Profiles: Links or access permissions for platforms like Facebook or Twitter.

Once the information is submitted, users undergo verification steps which include confirming their phone number and validating their bank account.

Understanding the Social Reputation Score

The Social Reputation Score is crucial for determining loan eligibility. It is calculated based on:

- The accuracy of the information provided during registration.

- The user’s online presence and engagement levels.

- Input from social guarantors, friends or family members who can vouch for the user’s reliability.

Providing accurate information is essential as it directly influences the score and consequently the loan amounts available.

How to Use Social Lender to Request a Loan

1. Application Process

Knowing how to use Social Lender to request a loan is straightforward. Follow these steps:

- Accessing the Platform: Users can log in via web browsers, SMS, USSD codes, or the mobile app.

- Selecting Loan Amount: Based on their SRS, users choose an appropriate loan amount within their limits.

- Submitting the Application: After filling out necessary details, users submit their application for review.

2. Loan Amounts and Limits

Social Lender offers flexible loan amounts ranging from N1,000 to N100,000. However, first-time users without social guarantors may face lower limits, typically starting at N3,000.

As users build their reputation through timely repayments, they can request higher amounts in subsequent applications.

3. Approval and Disbursement

Once an application is submitted, it undergoes review by Social Credit Officers who assess the SRS and other relevant factors.

Approval can be quick, often within minutes, and funds are disbursed directly into verified bank accounts.

Related: How to Use Paga for Seamless Transactions

How to Use Social Lender to Repay Loans

1. Repayment Options

Knowing how to use Social Lender to repay loans is essential, and it can be done via various methods including:

- Mobile money transfers

- Bank transfers

- Physical payments at partner banks

Users must ensure that they indicate their full name or verified mobile number during repayment for automatic reconciliation.

2. Understanding Loan Terms

Loans typically have a duration of up to 30 days with transaction charges ranging from 5% to 20% of the loan amount.

It’s crucial for borrowers to understand these terms fully before committing to a loan.

3. Consequences of Non-repayment

Failure to repay loans on time can lead to significant consequences:

Loans become classified as ‘unserviced,’ triggering retrieval processes by Social Lender.

Users may incur additional transaction charges if repayments are overdue.

Non-repayment negatively impacts future borrowing abilities and can lower the user’s SRS.

Benefits of Using Social Lender

1. Quick Access to Funds: One of the standout features of Social Lender is its speed compared to traditional lending processes that often require lengthy approval times and extensive documentation.

2. Financial Inclusion: Social Lender plays a crucial role in promoting financial inclusion by providing access to credit for unbanked populations who may not qualify for conventional loans due to strict requirements.

3. Building Credit History: Timely repayments on loans contribute positively towards building a user’s credit history, making it easier for them to access larger loans in the future.

Conclusion

Understanding how to use Social Lender for requesting and repaying loans is essential for anyone looking to improve their financial situation without relying on traditional banking systems.

By making use of social reputation scores and ensuring responsible borrowing practices, users can take advantage of quick access to funds while also building a positive credit history that opens doors for future opportunities.

Frequently Asked Questions

1. What happens if I miss my repayment date?

If you miss your repayment date, your loan will be classified as ‘unserviced,’ leading to additional charges and potential retrieval processes initiated by Social Lender.

2. Can I increase my loan limit?

Yes! By consistently repaying your loans on time and improving your Social Reputation Score through positive engagement in your community, you can qualify for higher loan amounts over time.

3. Are there any hidden fees associated with loans?

No, all fees are transparent upfront during the application process; however, be mindful of transaction charges which range between 5% to 20% of the loan amount.

4. How does my social media activity impact my loan eligibility?

Your social media activity contributes significantly to your Social Reputation Score; higher engagement levels with positive interactions improve your chances of securing larger loans while demonstrating reliability as a borrower.

Recommendations

How to use Chipper cash app to send and receive payment