Have you ever found yourself in a tight financial spot, needing a quick loan to tide you over until your next payday? Or perhaps you’re looking for a convenient way to manage your finances, save money, and pay bills all in one place?

Nowadays, mobile technology has revolutionized how we access financial services, and FairMoney App is a prime example. This article will walk you through everything you need to know about how to use the FairMoney app, from downloading it to managing your loans and exploring its additional features.

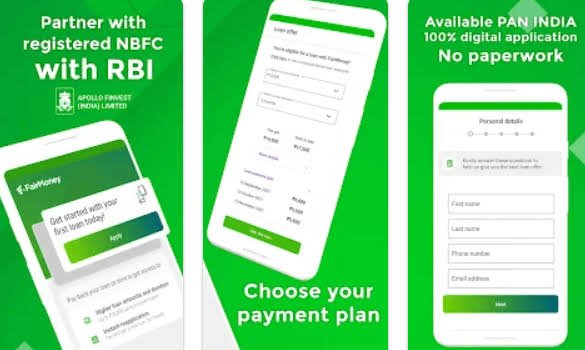

FairMoney has emerged as a leading digital lending platform in Nigeria, offering quick and accessible loans to millions of users. In a country where access to traditional banking services can be challenging, FairMoney App provides a vital lifeline, empowering individuals to access credit when they need it most.

The app’s user-friendly interface and streamlined loan application process have contributed to its widespread popularity. FairMoney boasts a substantial user base and offers a range of features beyond just lending, including savings options and bill payments. This guide will provide detailed instructions on how to use the FairMoney app, ensuring you can leverage its full potential.

We’ll cover everything from downloading the app and creating an account to applying for and repaying loans, managing your finances, and even exploring additional features like savings and bill payments. Learning how to use the FairMoney app can significantly improve your access to financial tools.

Table of Contents

Getting Started with FairMoney App

Before you can enjoy the benefits of the FairMoney app, you need to get it set up on your device. Here’s how to do it:

Downloading the FairMoney App

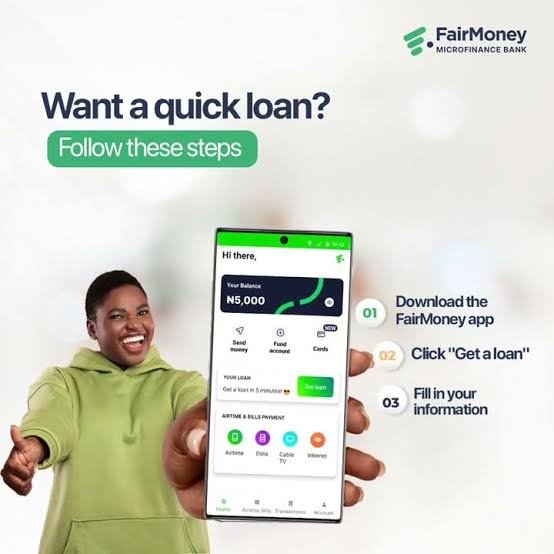

To start using the FairMoney app, you first need to download it. Here’s how:

- For Android Users: Open the Google Play Store on your device. In the search bar, type “FairMoney” and look for the app developed by FairMoney Ltd. Tap on “Install” to download it.

- For iOS Users: Go to the Apple App Store and search for “FairMoney.” Ensure that you select the app by FairMoney Ltd before tapping “Get” to download.

Once downloaded, open the app to begin the registration process.

Creating an Account

Creating an account on the FairMoney app is straightforward. Follow these steps:

1. Input Personal Details: Enter your name, phone number, and email address. Make sure that your phone number is linked to your Bank Verification Number (BVN) for a smoother registration process.

2. Link Your BVN: Providing your BVN is crucial as it helps verify your identity and creditworthiness.

3. Set a Strong Password: Choose a password that is secure and memorable. You will also need to agree to the terms and conditions of using the app.

4. Complete Registration: After filling in all required fields, submit your registration form. You may receive a confirmation message via SMS or email.

Setting Up Your Profile

Once you have created an account, it’s important to complete your profile for a better experience:

Completing Your Profile

- Add Residential Address: Input your current residential address accurately.

- Employment Information: Provide details about your employment status and monthly income. This information helps in assessing your loan eligibility.

- Link a Bank Account: For seamless loan disbursement, link a bank account where funds can be transferred when approved for a loan.

Related: A Step-by-Step Guide on How to Use the KiaKia Loan App for Beginners

How to Use the FairMoney App for Borrowing

Now that you have set up your account, let’s dive into how you can borrow money using the FairMoney app.

Applying for a Loan

1. Navigate the Dashboard: Open the app and log in. On the dashboard, look for options related to loans.

2. Select Loan Amount: Choose how much money you wish to borrow. FairMoney offers loans ranging from small amounts up to ₦3,000,000 depending on your credit profile.

3. Choose Repayment Period: Decide on a repayment period that suits your financial situation, options typically range from 30 days to 180 days.

4. Submit Loan Application: Review all details carefully before submitting your application. Once submitted, you will need to wait for approval.

Loan Approval Process

- Processing Time: Loan applications are processed quickly, often within minutes or hours.

- Notification of Status: You will receive notifications regarding your loan status via SMS or within the app itself. If approved, you will be presented with loan offers that include terms and repayment schedules.

How to Use the FairMoney App to Repay Loans

After borrowing money, it’s crucial to understand how repayments work:

Steps to Repay Your Loan

1. Access Loan Details: From the home screen of the app, navigate to your loan section where all details about outstanding loans are listed.

2. Choose Repayment Option: You can opt for full repayment or make partial payments. Available methods include:

- Bank Transfer

- USSD Transfer

- Debit Card payment

3. Confirm Payment: Follow prompts based on your chosen payment method and confirm once completed.

Managing Your Loans

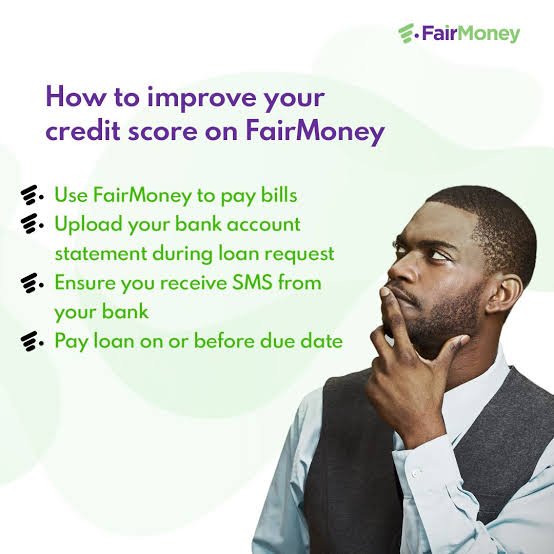

Managing loans effectively is key to maintaining good financial health:

Understanding Loan Management Features

- Use the app’s dashboard to track loan statuses and repayment schedules easily.

- Set reminders for upcoming payments to avoid defaults.

- Consider tips like budgeting monthly expenses and ensuring timely repayments to build a positive credit history with FairMoney.

Related: Beginners Guide on How to Use Interswitch For Transactions

Troubleshooting Common Issues

Even with user-friendly apps like FairMoney, issues may arise:

Common Problems and Solutions

- If you encounter problems logging in or accessing your account:

- Ensure you are using the correct credentials.

- Reset your password if necessary through the “Forgot Password” option.

If you’ve lost access due to losing your phone, contact customer support immediately for assistance in recovering your account.

For any other issues, reach out via customer support channels provided in-app or through their official website.

Additional Features of FairMoney App

Beyond just borrowing money, FairMoney offers several other valuable services:

- Savings Options: Users can save money with attractive interest rates through features like FairLock (fixed term deposits) and FairSave (high-yield savings accounts).

- Bill Payment Services: The app facilitates easy bill payments with discounts on transactions.

- Referral Programs: Users can earn rewards by referring friends who sign up for the app.

How to Use the FairMoney Savings Features

Saving money is just as important as borrowing:

1. Explore various savings options available within the app.

2. Set specific savings goals and amounts based on personal financial plans.

3. Monitor progress regularly through tracking features that show interest earned over time.

Conclusion

Using the FairMoney app can significantly ease financial burdens by providing quick access to loans and facilitating effective money management strategies.

By following this guide on how to use the FairMoney app effectively, from downloading it, creating an account, borrowing funds, repaying loans, managing finances, troubleshooting issues, and exploring additional features, you can take full advantage of what this innovative platform has to offer. Embrace these tools today for better financial health!

Frequently Asked Questions

1. What types of loans can I get through FairMoney?

You can access personal loans ranging from small amounts up to ₦3,000,000 without needing collateral.

2. How quickly can I receive my loan?

Loans are typically processed within minutes after application approval; funds are transferred directly into your linked bank account.

3. Can I repay my loan early?

Yes! You can repay your loan early without incurring any penalties; just follow standard repayment procedures within the app.

4. What should I do if I forget my password?

Use the “Forgot Password” feature in the app to reset it securely via email or SMS verification methods provided during registration.

Recommendations

How to Use Flutterwave: Everything You Should Know

How to Use PiggyVest: A Guide to Investing and Saving

Step-by-Step Process on How to Use eTranzact to Make Payments