Accessing quick loans in Nigeria has become significantly easier thanks to mobile loan apps like KiaKia.

This comprehensive guide provides a step-by-step walkthrough on how to use the KiaKia loan app and its USSD service, empowering you to navigate the application process smoothly.

Whether you’re a first-time user or simply looking for a refresher, this article will equip you with the knowledge you need to successfully secure a loan.Unexpected expenses can arise at any moment.

Whether it’s a medical emergency, a pressing bill, or a business opportunity, having access to quick funds can make all the difference.

In Nigeria, where traditional banking processes can sometimes be slow and cumbersome, mobile loan apps have emerged as a game-changer.

Among these, the KiaKia loan app stands out as a popular choice, offering a streamlined and convenient way to access short-term loans.

This article serves as a comprehensive guide on how to use the KiaKia loan app and its USSD service.

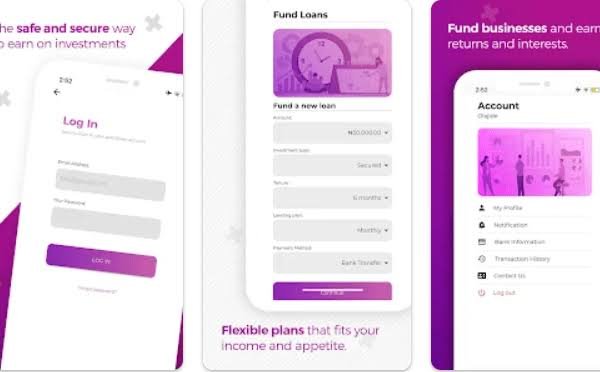

The KiaKia loan app is a mobile lending platform designed to provide quick and accessible loans to individuals and businesses in Nigeria.

The app simplifies the loan application process, eliminating the need for lengthy paperwork and physical visits to banks.

Its purpose is to bridge the financial gap by offering short-term loans to those who need them, empowering individuals to manage their finances effectively. Learning how to use the KiaKia loan app opens doors to quick financial solutions.

This article details everything from downloading the KiaKia loan app to managing your loan repayments.

So, if you’re looking for a convenient way to access funds, read on to discover how the KiaKia loan app can help.

Table of Contents

Getting Started with the KiaKia Loan App

Before diving into the loan application process, it’s essential to understand how to get started with the KiaKia loan app.

Downloading the App

To begin your journey with the KiaKia loan app, you first need to download it:

For Android Users:

- Visit the Google Play Store and search for “KiaKia Loan App.”

- Click on the download button and wait for the installation to complete.

For iOS Users:

Currently, the KiaKia loan app is primarily available on Android; however, you can access their services via their official website.

Creating an Account

Once you have downloaded the app, follow these steps to create your account:

- Open the app and select “Sign Up.”

- Enter your email address and phone number.

- Provide your Bank Verification Number (BVN), which is mandatory for identification purposes.

- Verify your email through a confirmation link sent to your inbox.

Creating an account is crucial as it allows you to access all features of the KiaKia loan app.

Related: How to Use Flutterwave: Everything You Should Know

Understanding the Loan Application Process

Now that your account is set up, it’s time to understand how to apply for a loan through the KiaKia loan app.

Initiating a Loan Application

To start your application:

- Open the KiaKia loan app.

- Click on “Apply for a Loan” or start a chat with “Mr. K,” KiaKia’s virtual assistant who will guide you through the process.

Required Documentation

Before applying, ensure you have the following documents ready:

- A valid means of identification (such as a government-issued ID or work ID).

- Proof of income, which could be your last three months’ salary slips or business income statements.

Having these documents prepared will streamline your application process.

Filling Out the Loan Application

Filling out your application accurately is critical for approval. In this section:

- Specify how much money you want to borrow (between N10,000 and N200,000).

- Choose a repayment duration ranging from 7 days to 30 days.

Make sure that your requested amount aligns with your repayment capabilities.

Accepting Terms and Conditions

Before finalizing your application:

- Review all terms and conditions carefully.

- Accept them only if you fully understand what you’re agreeing to.

This step is vital as it ensures you are aware of interest rates and repayment obligations.

Submitting Your Application

Once you have filled out all necessary information, it’s time to submit your application.

Before hitting submit:

- Upload any required documents (ID and proof of income).

- Double-check that all entered details are correct.

What Happens After Submission?

After submission:

- You can expect a notification regarding your application status within minutes.

- If approved, funds will typically be disbursed directly into your bank account almost immediately.

Managing Your Loan

Once you’ve received your loan, managing it effectively is crucial for maintaining good credit health.

Repayment Process

Understanding how repayment works is essential:

- The interest rates range from 5.6% to 24%, depending on various factors including your creditworthiness.

- Repayment can be made via bank transfer or through options provided in the KiaKia app.

Make sure to adhere strictly to repayment schedules to avoid penalties.

Early Repayment Benefits

If you’re able to repay your loan early:

- You may benefit from reduced interest payments.

Early repayment can also improve your credit rating, making future borrowing easier and potentially cheaper.

Related: How to Use PiggyVest: A Guide to Investing and Saving

Using the KiaKia Loan USSD Code

For those who prefer not using an app or internet connection, KiaKia offers a USSD code option.

Overview of USSD Services

USSD technology allows users without smartphones or internet access to apply for loans quickly and efficiently through their mobile phones.

How to Apply Using USSD Code (*448#)

To use this service:

- Dial *448# on your mobile phone.

- Follow the prompts provided in the menu.

- Enter personal data and specify loan details as requested.

This method provides an alternative way for users in areas with limited internet connectivity to access loans conveniently.

Troubleshooting Common Issues

Even with a user-friendly platform like KiaKia, issues may arise during the application process.

What to Do If Your Application Is Declined?

If your application gets rejected:

- Review common reasons such as insufficient income proof or poor credit history.

- Improve these areas before reapplying in the future.

Understanding why applications are declined can help increase your chances of success next time.

Customer Support Options

Should you encounter problems or have questions:

- Reach out to KiaKia’s customer support via their website or through contact options provided in the app.

- They offer assistance through various channels including email and phone support(02019125176) for quick resolution of issues.

Conclusion

The KiaKia loan app offers an innovative solution for individuals seeking quick access to financial assistance in Nigeria.

By following this step-by-step guide on how to use the KiaKia loan app, beginners can navigate through downloading, applying for loans, managing repayments, and utilizing USSD services effectively.

As with any financial product, responsible borrowing practices are essential; ensure that you only borrow what you can repay comfortably while maintaining good financial health.

Frequently Asked Questions

1. What are the eligibility requirements for a KiaKia loan?

To qualify for a KiaKia loan, you must be at least 21 years old, reside in Nigeria, possess a valid BVN, and have verifiable income sources.

2. How long does it take for my loan application to be approved?

Typically, applications are processed within minutes; however, some may take up to 24 hours depending on various factors such as documentation verification.

3. Can I apply for a loan without using the app?

Yes! You can apply using their USSD code (*448#) if you prefer not using an internet-connected device or smartphone.

4. What happens if I miss my repayment date?

Missing a repayment date may incur additional fees and negatively impact your credit score; it’s advisable to communicate with customer support if you’re facing difficulties in making payments on time.

Recommendations

Step-by-Step Process on How to Use eTranzact to Make Payments

A Comprehensive Guide on How to Use the Yoco App for Seamless Transactions

A User’s Guide on How to Use Social Lender to Request and Repay Loans