How to Use the Yoco App. If you’re running a business, big or small, you know how important it is to make transactions smooth and easy for your customers.

Nobody wants to fumble with cash or deal with complicated payment systems. A smooth checkout experience means happier customers, quicker sales, and ultimately, a healthier business. And that’s where the Yoco App comes into play.

Think of the Yoco App as your pocket-sized point-of-sale system. It’s designed to make taking payments incredibly simple, whether you’re at a market stall, in a bustling shop, or even sending invoices online.

It’s a game-changer, especially for small and medium-sized businesses that might not have the resources for expensive traditional payment setups.

This app isn’t just about taking money; it’s about making your entire business run more efficiently.

Now, you might be thinking, “Another app to learn? I don’t have time for that!” But trust me, the Yoco App is designed with simplicity in mind. It’s built to be intuitive and user-friendly, so even if you’re not a tech whiz, you can get the hang of it quickly.

This article is here to walk you through everything you need to know about how to use the Yoco app. We’re going to break down every feature, from the very basics of downloading and setting up the app, to more advanced features that can really boost your business.

We’ll cover everything from how to use Yoco to accept various payment types, whether it’s a quick tap of a card, a mobile wallet transaction, or sending a secure payment link.

We’ll talk about how to use the Yoco app to manage your sales, track your money, and even access funding opportunities. This isn’t just a technical manual; it’s a practical guide to help you use Yoco to its full potential.

Table of Contents

Understanding the Yoco App

The Yoco App is more than just a payment processing tool; it is a comprehensive solution designed to meet the needs of small business owners.

As a payment solution provider, Yoco enables businesses to accept card payments effortlessly while offering a suite of features that enhance operational efficiency.

Payment Processing Capabilities: The Yoco App supports various payment methods, including card swipes, mobile wallets like Apple Pay, and online payment links. This versatility ensures that businesses can cater to their customers’ preferences.

User-Friendly Interface: The app is designed with entrepreneurs in mind, featuring an intuitive layout that simplifies navigation and makes it easy to access essential tools.

Integration with Various Devices: Yoco offers a range of hardware options such as Yoco Pro, Go, Lite, and Khumo, allowing users to choose the best setup for their business needs.

Related: A User’s Guide on How to Use Social Lender to Request and Repay Loans

How to Download and Install the Yoco App

To begin your journey with the Yoco App:

Availability on iOS and Android Platforms:

The app is compatible with both iOS and Android devices. You can find it on the Apple App Store or Google Play Store.

Step-by-Step Installation Process:

1. Open your device’s app store.

2. Search for “Yoco” in the search bar.

3. Click on “Install” or “Get” to download the app.

4. Once installed, open the app and follow the prompts to set up your account.

Creating Your Yoco Account

Setting up your Yoco account is straightforward:

Required Information for Registration: You will need to provide your email address, mobile number, and create a password.

Verification Process and Setting Up Your Business Profile: After entering your details, you will receive a verification code via SMS or email. Enter this code in the app to verify your account. Next, complete your business profile by providing additional information such as your business name and address.

Navigating the Yoco App

Main Interface Overview

The main interface of the Yoco App consists of several key tabs:

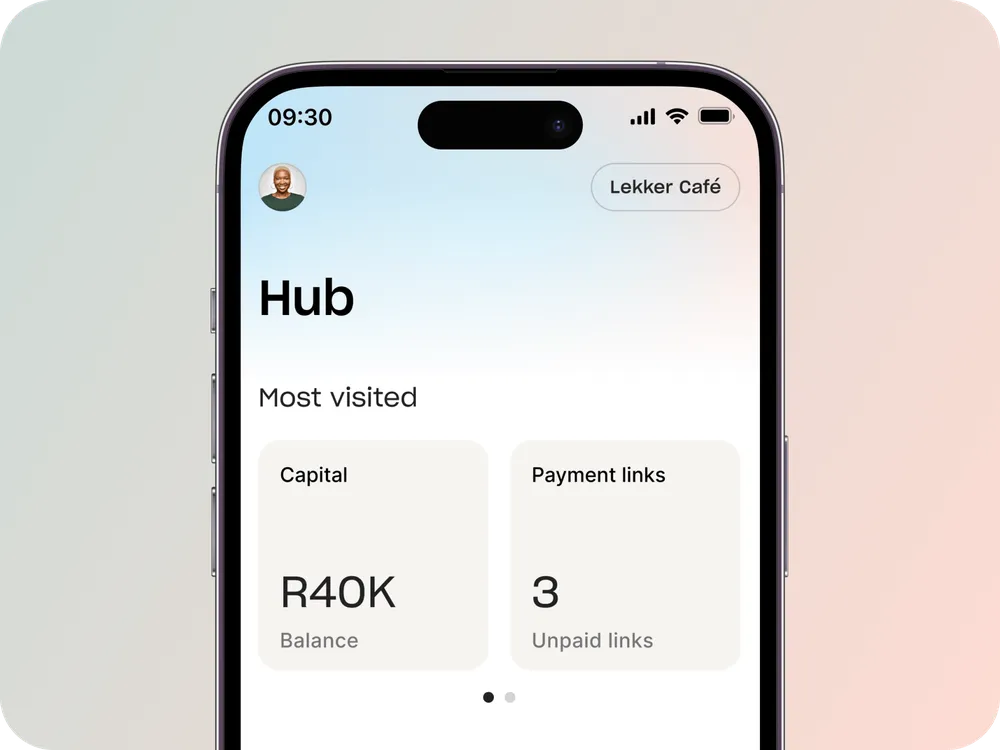

- Hub: This is your dashboard where you can access quick insights into sales performance and frequently used tools.

- Sales: Here, you can view your sales history and manage payments.

- Money: This tab provides information on payouts and transaction fees.

- Manage: Use this section to handle inventory, staff management, and other operational tasks.

How to Use Yoco: Detailed Feature Breakdown

Hub Tab

To use the Hub tab in the Yoco app:

- Log in to access a centralized dashboard for your business. Here, you can view key metrics, including sales history and account balance over the past week.

- The Hub features quick actions for processing card sales, creating invoices, and generating payment links.

- Additionally, it provides widgets for insights into sales performance, unpaid invoices, and payment configurations, allowing you to manage your business effectively and make informed decisions.

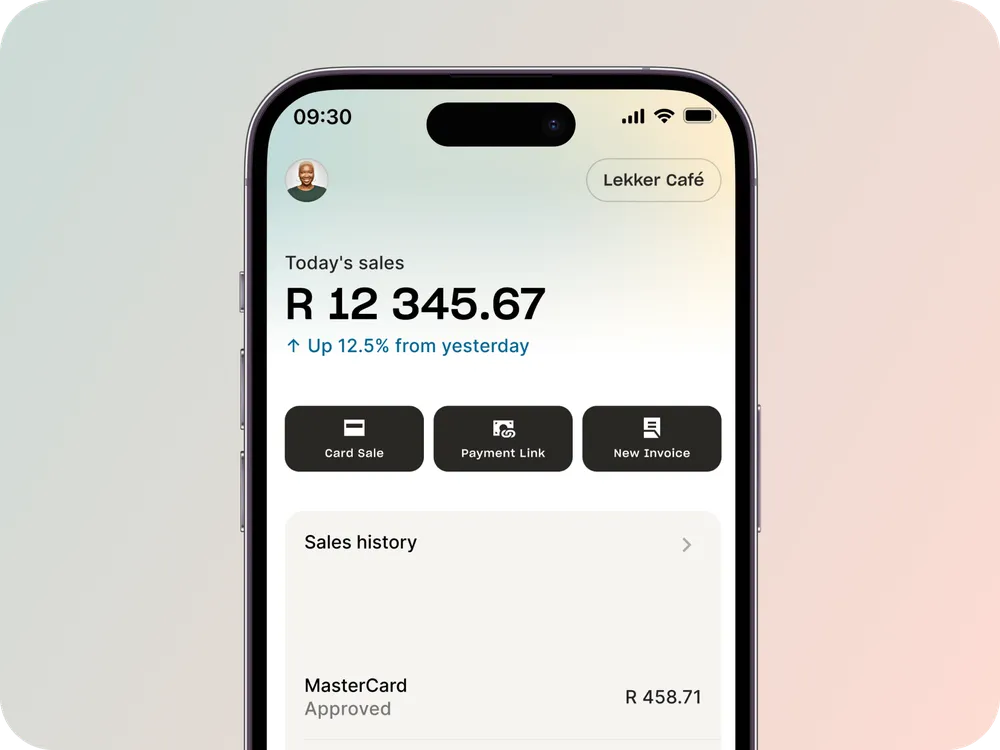

Sales Tab

The Sales tab allows you to:

- View sales history and analytics.

- Process card payments directly from the app by entering the amount and selecting the payment method.

Money Tab

In this section:

- Access payout information to see when funds will be available.

- Understand fees associated with transactions so you can plan accordingly.

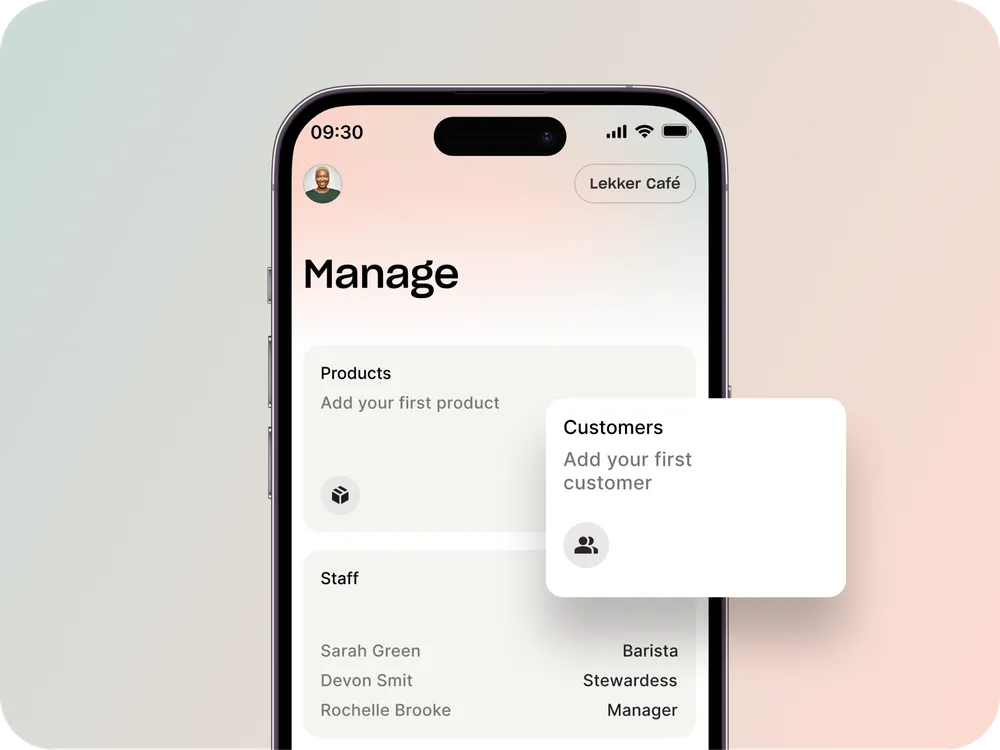

Manage Tab

This tab enables you to:

- Manage products by adding new items or adjusting existing ones.

- Add staff members and set permissions based on their roles within your business.

Making Transactions with the Yoco App

Here’s how to make transactions using the Yoco app:

Accepting Payments

To accept payments using the Yoco App:

- Process payments via card by selecting “Card Payment” in the Sales tab.

- Use mobile wallets like Apple Pay by enabling this option during setup.

- Create secure payment links that customers can use for online transactions by navigating to “Payment Links” in the app.

Instant Payouts

Accessing instant payouts is simple:

- Go to the Money tab.

- Select “Instant Payouts.”

- Follow the prompts to transfer funds directly to your bank account.

This feature helps businesses manage cash flow efficiently by providing quick access to funds after transactions are completed.

Related: How to Use GTPay to Send and Receive Payments

Advanced Features of the Yoco App

Yoco Capital

Yoco offers cash advance options through its platform:

- Overview of Cash Advance Options: Businesses can apply for cash advances based on their sales history with Yoco.

- Eligibility Criteria and Repayment Process: Eligibility is typically based on transaction volume through Yoco. Repayment is automatically deducted from future sales until fully paid off.

Invoicing and Payment Links

Creating invoices is straightforward:

- Navigate to the Invoicing section in the app.

- Fill out customer details and itemize services or products provided.

- Send invoices directly through email or generate payment links for online payments.

Analytics and Reporting

Using analytics tools within the Yoco App allows businesses to track performance over time:

- Monitor sales trends by filtering data based on time frames or product categories.

- Gain insights into customer behavior through detailed reports that help inform business decisions.

Troubleshooting Common Issues

While using the Yoco App, users may encounter some common issues:

- Payment Failures: If a payment fails, check if there are connectivity issues or if incorrect card details were entered. Encourage customers to retry or use another payment method if necessary.

- Account Access Problems: If you’re unable to log in, ensure that you’re using correct credentials or reset your password through the app’s recovery options.

Customer Support and Resources

Yoco provides several support channels for users needing assistance:

Available Support Channels:

- Phone support for immediate inquiries( WhatsApp or call 0875509626).

- Live chat within the app for real-time assistance.

- Email support for detailed queries or issues requiring documentation( support@yoco.com).

Accessing Help Articles and Video Tutorials:

The app includes a help section where users can find articles addressing common questions and video tutorials demonstrating various features of the app.

Related: How to Use Paga for Seamless Transactions

Conclusion

Mastering how to use the Yoco App can significantly enhance your business operations by streamlining transactions and providing valuable insights into sales performance.

By following this comprehensive guide, you are now equipped with all necessary tools and knowledge required for seamless transactions through Yoco.

Embrace all features offered by this powerful app to maximize efficiency in managing your small business today!

Frequently Asked Questions (FAQs)

1. Is there a fee associated with using Yoco?

Yes, there are transaction fees associated with each sale processed through Yoco. These fees vary based on transaction volume but are generally competitive within the industry.

2. Can I access my sales reports from previous months?

Absolutely! The Sales tab allows you to view historical sales data filtered by date range or specific criteria for detailed analysis.

3. What if I have trouble connecting my Yoco card reader?

Ensure your device’s Bluetooth is enabled and that the card reader is charged. Try restarting your device and the Yoco App. If the problem persists, contact Yoco support.

4. Is Yoco Capital available to all Yoco users?

Yoco Capital is subject to eligibility criteria based on your business’s sales history and other factors. Check the app for more information on eligibility and application process.

Recommendations

How to Use Cellulant for Seamless Online Payments

A Step-by-Step Guide to Using Moniepoint App for Daily Transactions

How to Use OPay on Your Mobile Device: A Beginner’s Guide to Mobile Finance