In fintech, Kuda Bank stands out as a revolutionary force in Nigeria’s banking sector.

Kuda Bank, founded in 2018 by Musty Mustapha and Babs Ogundeyi, has transformed the way Nigerians approach banking with its mobile-first design and commitment to zero fees.

This digital-only bank, originally known as Kudimoney, has quickly gained traction among users seeking a more accessible and user-friendly banking experience.

Kuda’s Features are designed to meet the needs of a tech-savvy generation, while Kuda’s Mobile App offers seamless navigation and innovative tools for managing personal finances.

This article looks into Kuda’s unique offerings, its competitive edge over traditional banks, and its promising future in the fintech space.

An Overview of Kuda Bank

Kuda Bank is not just another digital payment platform; it is a fully licensed bank that operates entirely online, catering to the needs of millions of Nigerians who are frustrated with traditional banking practices.

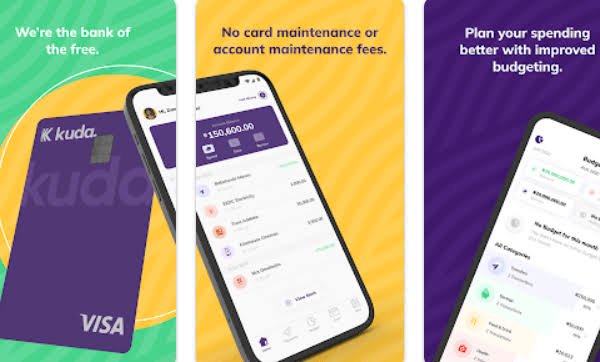

With its slogan “the bank of the free,” Kuda has positioned itself as a champion of financial inclusivity, aiming to eliminate hidden fees and cumbersome processes that have long plagued conventional banks.

The journey of Kuda began when it was launched as Kudimoney in 2016, primarily focusing on savings and lending services.

However, it wasn’t until 2019 that Kuda received its full banking license from the Central Bank of Nigeria, allowing it to expand its services significantly.

Since then, Kuda has attracted substantial investment, raising over $111 million and growing its user base to over 1.4 million within just a few years.

This explosive growth reflects a broader trend towards digital banking in Africa, where traditional banks often fail to meet the needs of younger consumers.

Read Next: A Comprehensive Overview of Opay: Analyzing Its Services, Features, and User Experience

What are the Key Features of Kuda?

Kuda’s unique features make it an attractive option for users looking for a modern banking experience. Below are some of the unique features that define Kuda:

1. Mobile-first Banking Experience

Kuda offers a fully mobile-based banking app that allows users to manage their finances directly from their smartphones.

The app is designed with a seamless user interface, making navigation intuitive even for those who may not be tech-savvy.

Users can perform transactions, check balances, and access various banking services without stepping into a physical branch.

Accessibility is at the core of Kuda’s mission; users can open an account in minutes without lengthy paperwork or credit history checks.

This convenience has made banking more accessible to many Nigerians who previously struggled with traditional banks.

2. No Monthly Fees or Minimum Balance

One of Kuda’s most compelling features is its commitment to affordable banking.

Unlike traditional banks that impose monthly maintenance fees and require minimum balances, Kuda eliminates these costs entirely.

This approach not only saves users money but also encourages them to save more effectively without worrying about hidden charges.

The absence of traditional banking fees positions Kuda as a disruptive force in the financial sector, appealing especially to younger customers who prioritize value and transparency in their financial dealings.

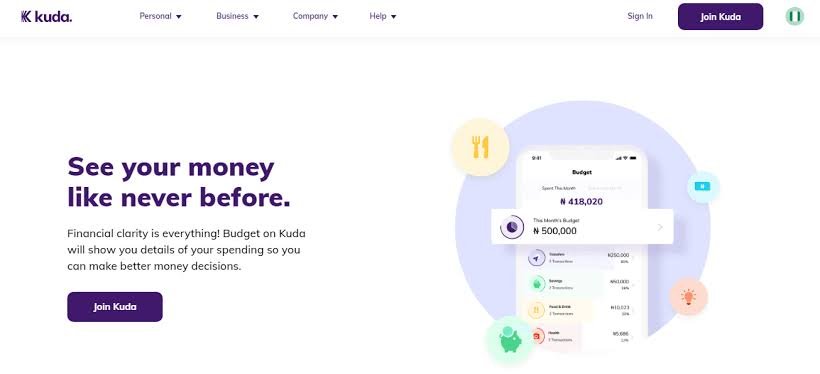

3. Budgeting and Money Management Tools

Kuda integrates powerful budgeting features directly into its app, enabling users to track their spending effortlessly.

Users can categorize expenses, set savings goals, and monitor their progress, all within the app.

The built-in expense tracking tools help users make informed financial decisions by providing insights into their spending habits.

Additionally, Kuda offers an automatic savings feature that allows users to save a percentage of each transaction automatically, promoting healthier financial habits.

4. Instant Money Transfers and Payments

With Kuda, users enjoy real-time fund transfers without incurring fees on up to 25 transactions per month.

The app supports various payment options, including split bill features for group payments,a significant advantage for social gatherings or shared expenses.

Kuda also integrates with popular payment platforms, making it easy for users to send money across different services seamlessly.

5. Personalized Debit Card and Design

Kuda offers users the ability to customize their debit cards, allowing them to choose from various designs and themes that reflect their personal style.

This feature enhances user engagement while providing flexibility in card management.

Users can easily manage their cards through the app by freezing or unfreezing them as needed, an essential feature for security-conscious consumers.

6. Cryptocurrency and Investment Features

In response to the growing interest in digital currencies, Kuda has introduced features that allow users to buy, sell, and hold cryptocurrencies directly within the app.

This integration simplifies accessing digital assets for those looking to diversify their investment portfolios.

Moreover, Kuda provides educational resources about cryptocurrencies, helping users navigate this complex market confidently.

7. Customer Support and Security

Kuda prioritizes customer satisfaction with 24/7 customer service available through the app.

Users can quickly resolve issues or seek assistance without long wait times typically associated with traditional banks.

Security is also paramount; Kuda employs multi-factor authentication and biometric security measures to protect user accounts from unauthorized access.

Additionally, robust fraud protection mechanisms ensure that users’ funds are safeguarded against potential threats.

Kuda’s Comparison to Traditional Banks and Other Fintech Offerings

As Kuda continues to gain popularity, it’s essential to compare its offerings against traditional banks and other fintech competitors:

1. Advantages of Kuda Over Traditional Banking

- Lower Fees: Kuda’s no-fee structure significantly reduces costs compared to traditional banks that charge maintenance fees.

- Improved User Experience: The mobile app provides a feature-rich experience tailored for convenience, something many traditional banks struggle with.

- Innovative Tools: With integrated budgeting tools and cryptocurrency options, Kuda offers services beyond what most conventional banks provide.

2. Differentiation from Other Fintech Competitors

Kuda distinguishes itself from other fintech companies through:

- Unique Product Offerings: Unlike many competitors focused solely on payments or loans, Kuda combines comprehensive banking services with innovative financial management tools.

- Geographical Focus: While many fintechs target global markets, Kuda’s primary focus remains on Nigeria, allowing it to tailor its services specifically for local needs.

- Customer Satisfaction: User reviews highlight both positive experiences with customer support and frustrations related to app bugs, indicating areas where Kuda can improve while still maintaining high overall satisfaction ratings.

Here is a tabular presentation of kuda’s offerings against traditional banks and other fintech competitors

| Features | Kuda | Traditional Banks | Other Fintech Competitors |

| Account Opening | Fully digital, fast and convenient | In-person, lengthy process | Mostly digital, fast and convenient |

| Banking Services | Basic banking services (current account, debit card, etc.) | Full suite of banking services | Mostly focused on specific services (e.g., payments, lending, investments) |

| Free Transfers | 25 free transfers/month | Charges apply (e.g., N25 per transfer) | Varies; some offer free transfers |

| Interest Rates | Competitive interest rates on deposits | Lower interest rates on deposits | Varying interest rates, sometimes higher than traditional banks |

| Mobile App | Intuitive, feature-rich mobile app | Basic mobile app functionalities | Innovative, user-friendly mobile apps |

| Customer Service | Digital-first, chat-based support | Branch-based, phone support | Varying levels of digital and phone support |

| Financial Management Tools | Advanced budgeting, savings, and spending tracking features | Limited financial management tools | Varying levels of financial management tools |

| Credit/Lending Products | Limited credit/lending products | Wide range of credit/lending products | Specialized credit/lending products (e.g., personal loans, buy-now-pay-later) |

| Global Reach | Primarily focused on the Nigerian market | International presence and operations | Varying levels of global reach and availability |

Read Also: An In-Depth Analysis of Cowrywise: Features, Benefits, and User Experience

Kuda’s Growth and Future Prospects

As one of Nigeria’s leading fintech companies, Kuda is poised for continued growth in several key areas:

1. Expansion Plans and Regional Coverage

Kuda Bank is expanding its operations to the UK, Ghana, and Uganda, aiming to enhance banking services for Africans globally.

The UK will be the first market outside Nigeria, focusing on remittance services for Nigerians abroad, with a flat fee structure for transfers.

Kuda has also secured payment licenses in Tanzania and Canada, allowing it to offer multi-currency wallet services.

With over 4.6 million customers in Nigeria, Kuda plans to leverage technology to build a pan-African banking presence.

2. Partnerships and Integrations with Other Services

Kuda has formed several strategic partnerships to enhance its financial services.

For example, Kuda collaborates with SeerBit to offer seamless online payments, allowing customers to transact without entering card details.

They partnered with Vendy to enable secure WhatsApp payments using Kuda Pay ID.

Additionally, they also partnered with MetaMap to improve user onboarding and expand its services internationally through enhanced identity verification processes.

Subsequently, Kuda is actively pursuing future partnerships and integrations to expand its services:

- Global Expansion: Kuda plans to launch a multi-currency digital wallet in Canada by Q3 2024, targeting the African diaspora to facilitate remittances and financial services.

- Payment Solutions: Collaborations with companies like SeerBit and Vendy aim to enhance online payment options and secure transactions, allowing users to make payments without exposing card details.

- Further African Markets: Kuda has secured a payment license in Tanzania, indicating potential growth into additional African countries.

3. Potential for Further Innovation and Feature Development

Kuda is poised for further innovation and feature development, focusing on enhancing customer experience and expanding service offerings.

Recent updates include investment opportunities, improved savings plans, and a self-help portal for account management.

Kuda’s introduction of SoftPoS technology allows users to accept payments via mobile devices, enhancing accessibility for businesses.

Future innovations may include social banking features and partnerships to improve customer service.

Additionally, Kuda’s growth strategy emphasizes the importance of a diverse fintech ecosystem to build trust and foster competition in Nigeria’s financial sector.

Conclusion

Kuda Bank has carved out a unique niche in Nigeria’s fintech landscape through its innovative features and commitment to customer-centric banking solutions.

By eliminating fees associated with traditional banking while offering robust budgeting tools and cryptocurrency options, Kuda stands out as a leader in digital finance.

As the company continues to grow and evolve within the competitive fintech space, it remains crucial for potential users to explore what Kuda has to offer fully, whether they are looking for basic banking services or advanced financial management tools.

Frequently Asked Questions

1. What is Kuda Bank?

Kuda Bank is a digital-only bank based in Nigeria that offers mobile-first banking services without monthly fees or minimum balance requirements.

2. How does Kuda differ from traditional banks?

Unlike traditional banks that charge maintenance fees and require physical branches for transactions, Kuda operates entirely online with no hidden fees and offers innovative budgeting tools.

3. Can I use cryptocurrencies with my Kuda account?

Yes! Kuda allows users to buy, sell, and hold cryptocurrencies directly within its mobile app while providing educational resources about digital assets.

4. What customer support options does Kuda provide?

Kuda offers 24/7 customer support through its app, ensuring users can quickly resolve issues or seek assistance whenever needed.