Numida is a fintech company that’s making waves in Africa, particularly in Uganda. It’s a platform designed to empower small and medium-sized enterprises (SMEs) by providing them with much-needed financial services.

While the name “Numida” might be unfamiliar to many, it’s quickly becoming synonymous with financial inclusion and technological innovation. It’s more than just a name; it’s a promise of a brighter future for African entrepreneurs.

Moreover, the term “Numida” also refers to Numida meleagris, commonly known as the guinea fowl, which holds importance in sustainable agriculture and food security.

Numida’s mission is to empower African entrepreneurs by providing them with the tools and resources they need to succeed.

One of the biggest challenges facing African SMEs is access to finance. Traditional banks often require extensive documentation and collateral, which can be difficult for small businesses to obtain.

Numida addresses this challenge by offering a streamlined application process and flexible repayment terms.

By leveraging technology, Numida is able to assess creditworthiness quickly and efficiently. This allows the company to make faster decisions and disburse loans more quickly than traditional banks.

What is Numida?

At its core, Numida operates at the intersection of technology and finance, aiming to streamline financial management for small businesses while offering them access to credit.

Numida exists in two primary forms:

1. Numida Technologies

Numida Technologies is a fintech company dedicated to enhancing financial inclusion for MSMEs in Uganda.

The mission of Numida is straightforward: to equip entrepreneurs with tools that simplify financial management and facilitate access to unsecured loans.

This mission is particularly significant given that Uganda’s MSMEs make up about 90% of the private sector production and generate roughly 80% of new jobs in the country.

The importance of financial inclusion cannot be overstated. Many small businesses encounter barriers such as poor record-keeping practices and lack of collateral, which hinder their ability to secure loans from traditional banks.

By leveraging mobile technology, Numida enables entrepreneurs to efficiently track their income, expenses, and debts.

As users demonstrate their creditworthiness through consistent app usage, they can unlock access to small loans tailored to their business performance.

2. Numida meleagris (Guinea Fowl)

On the agricultural side, Numida meleagris, or guinea fowl, is an indigenous bird native to Africa. Scientifically classified within the family Numididae, guinea fowl are known for their distinctive appearance and social behavior.

Guinea fowl are not only valued for their meat and eggs but also play a crucial role in sustainable agriculture. Their meat is leaner than chicken and rich in protein, making it a healthy dietary choice.

Furthermore, guinea fowl farming can significantly contribute to food security by providing a source of income for rural communities.

They are hardy birds that require less intensive management compared to other poultry species, making them an ideal choice for smallholder farmers looking to diversify their agricultural practices.

What are the Features of Numida Technologies?

The features offered by Numida Technologies are tailored specifically to meet the needs of MSMEs, providing them with tools that enhance their financial management capabilities.

1. Financial Management Tools

The Numida mobile app comes packed with functionalities that allow users to keep detailed records of their financial activities.

Users can log daily sales, expenses, and debts directly through the app, which integrates cash flow data essential for assessing loan eligibility.

This systematic approach helps entrepreneurs maintain accurate financial records without needing extensive accounting knowledge.

2. Access to Unsecured Credit

One of the standout features of Numida is its provision of unsecured credit directly through the mobile app.

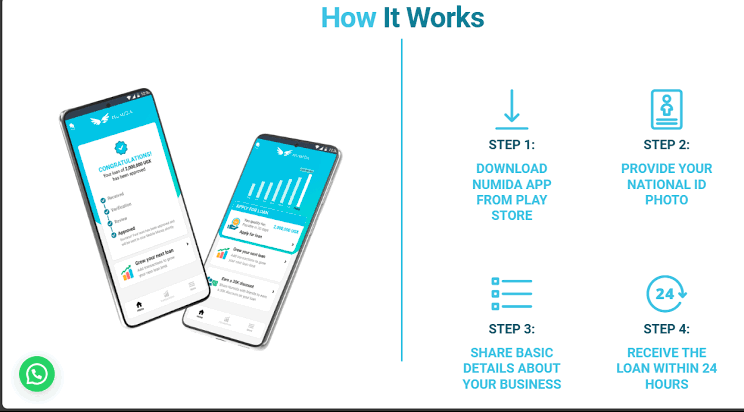

After just seven days of using the app, users can apply for loans based on their recorded cash flow data. The application process is straightforward:

- Download the app

- Provide necessary business details

- Submit sales figures from previous weeks

Loans are typically disbursed within 24 hours via mobile money services, allowing entrepreneurs quick access to funds when they need them most.

The loan terms are competitive, with interest rates around 13% per month and flexible repayment options.

3. Gamification and User Engagement

To encourage good financial practices among users, Numida incorporates gamification elements into its app.

As users engage consistently with the platform, logging transactions and maintaining records, they can improve their credit terms over time.

This approach not only motivates users but also fosters better financial habits that can lead to long-term business success.

An Overview of the Numida App

Numida focuses on providing unsecured working capital loans to micro and small businesses through its mobile application. Here is an overview of the app:

1. Financial Management: The Numida app allows users to track their financial records easily, enhancing their financial literacy and management skills. This record-keeping feature is crucial as many small businesses struggle with inadequate financial documentation.

2. Access to Credit: Users can apply for unsecured loans directly through the app. After just seven days of using the app, entrepreneurs can unlock access to credit. The amount and terms of the loans improve with consistent usage of the app, incentivizing good financial practices.

3. Quick Loan Disbursement: Loans are typically disbursed within 24 hours via mobile money, providing a level of convenience that is often lacking in traditional lending processes.

4. Risk-Based Pricing: Numida employs a proprietary credit scoring system based on cash flow and behavioral data collected from users. This allows them to offer tailored loan products while maintaining a high repayment rate, which has been reported at around 99%.

How Does Numida Work?

Understanding how Numida operates provides insight into its effectiveness as a tool for MSMEs.

1. User Experience

Using the Numida app involves several key steps:

- Initial Setup: Users download the app and create an account by entering basic personal and business information.

- Record-Keeping: Entrepreneurs log daily sales and expenses directly into the app.

- Loan Application: After establishing a track record within the app (usually after one week), users can apply for loans based on their cash flow data.

This streamlined process minimizes barriers that often deter small business owners from seeking financing.

2. Data Utilization

Numida leverages user data to tailor loan offerings effectively.

By analyzing behavioral data, such as transaction history and cash flow patterns, Numida can assess risk more accurately than traditional lenders who rely heavily on collateral or credit scores alone.

This innovative approach allows them to offer unsecured loans at competitive rates.

3. Impact on Small Businesses

The impact of Numida on small businesses has been great:

- Success Stories: Numerous entrepreneurs have reported significant improvements in their business operations after using Numida.

- Economic Contribution: By facilitating easier access to credit, Numida contributes to local economies by enabling MSMEs to expand operations and create jobs.

Statistics indicate that businesses using Numida’s services have experienced increased revenue growth compared to those relying solely on traditional banking methods.

Requirements to Use Numida Technologies

For MSMEs interested in leveraging Numida’s services, there are specific requirements that must be met. They include:

1. Eligibility Criteria

To qualify for services provided by Numida Technologies:

- Businesses must be registered as Micro Small or Medium Enterprises.

- Basic documentation is required during loan applications, including proof of identity (such as a national ID) and evidence of business operations (like sales receipts).

2. App Usage Guidelines

Maintaining accurate financial records through the app is crucial for maximizing benefits:

- Users should log all transactions daily.

- Regularly reviewing cash flow reports can help identify trends that inform better business decisions.

By adhering to these guidelines, entrepreneurs can enhance their chances of securing larger loans with favorable terms in future applications.

Alternatives to Numida Technologies

While Numida offers unique advantages for MSMEs in Uganda, several alternatives exist within the fintech landscape.

Here is a brief overview of some of the alternatives:

1. Other Financial Platforms for MSMEs

Several platforms provide similar services across Uganda and Africa. For example:

- Kiva: A global lending platform that connects lenders with borrowers in need of microloans.

- Tala: Offers personal loans based on mobile data analytics.

- Branch: Provides quick loans through a mobile app with flexible repayment terms.

Each platform varies in terms of loan amounts, interest rates, and eligibility criteria; hence businesses should evaluate options based on their specific needs.

2. Traditional Banking Options

Conventional banks also offer financing solutions for small businesses:

- While they may provide larger loan amounts over extended periods, traditional banks often require collateral and extensive documentation.

- Interest rates may be lower compared to fintech options; however, processing times can be significantly longer.

This comparison highlights the trade-offs between speed and accessibility offered by fintech solutions like Numida versus traditional banking methods.

Conclusion

Numida plays a critical role in empowering small businesses in Uganda by providing essential financial management tools and access to credit without the barriers typically associated with traditional banking systems.

As fintech continues to evolve, its potential impact on economic development becomes increasingly significant, enabling entrepreneurs not only to thrive but also contribute positively to local economies.

Looking ahead, there is immense potential for further integration between technology and agriculture; initiatives like guinea fowl farming could serve as viable alternative agricultural ventures alongside technological advancements in finance.

Frequently Asked Questions

1. What is Numida?

Numida is a fintech platform designed specifically for Micro Small and Medium Enterprises (MSMEs) in Uganda, offering tools for financial management and access to unsecured credit through a mobile application.

2. How does Numida help small businesses?

Numida assists small businesses by providing an easy-to-use app for tracking finances which enables them to apply for quick loans based on their cash flow data without requiring collateral.

3. What are the requirements for using Numida?

To use Numida’s services, businesses must be registered as MSMEs in Uganda and provide basic documentation such as proof of identity and evidence of business operations during loan applications.

4. Are there alternatives to Numida?

Yes! Alternatives include platforms like Kiva, Tala, and Branch which offer similar services tailored for MSMEs across Uganda and Africa; however, each has different terms regarding loans and eligibility criteria.