In Uganda, Numida is making waves as a fintech startup that aims to help small businesses thrive.

Launched in 2017, Numida’s mission is clear: to empower micro and small enterprises by providing unsecured loans through an easy-to-use mobile application.

The Numida App is designed to make financial services accessible to those who often struggle to get funding from traditional banks.

With mobile technology becoming increasingly important in our lives, knowing how to use Numida can open up new opportunities for business owners.

Many entrepreneurs face challenges when it comes to getting credit. Traditional banks usually require collateral, which many small business owners do not have.

Moreover, many operate in cash-based environments without formal financial records.

Numida changes this by allowing users to apply for loans quickly and conveniently using their smartphones.

This article will explore the key features of the Numida app, provide a step-by-step guide on how to use it for business loans, and discuss both the benefits and challenges of this innovative solution.

Key Features of the Numida App

The Numida App is built with small business owners in mind, offering several features that simplify applying for loans and managing finances.

1. User-Friendly Interface

The app has a simple design that makes it easy for anyone to navigate. Even if you’re not very tech-savvy, you can quickly learn how to apply for and manage your loans. Plus, it works well on mobile devices, so you can access it whenever you need.

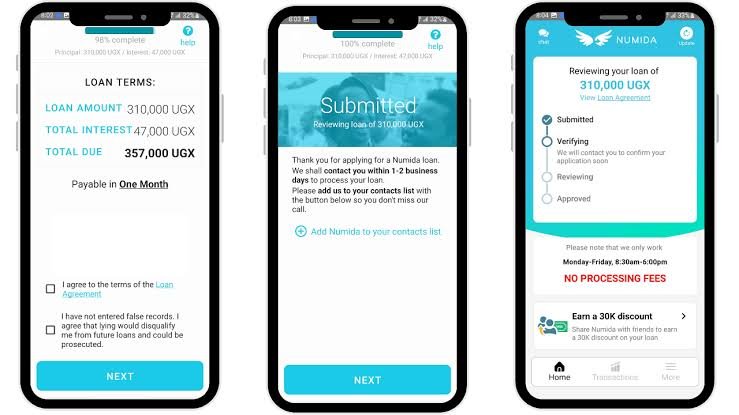

2. Loan Application Process

Applying for a loan with Numida is straightforward. Here’s how to use Numida app for loan applications:

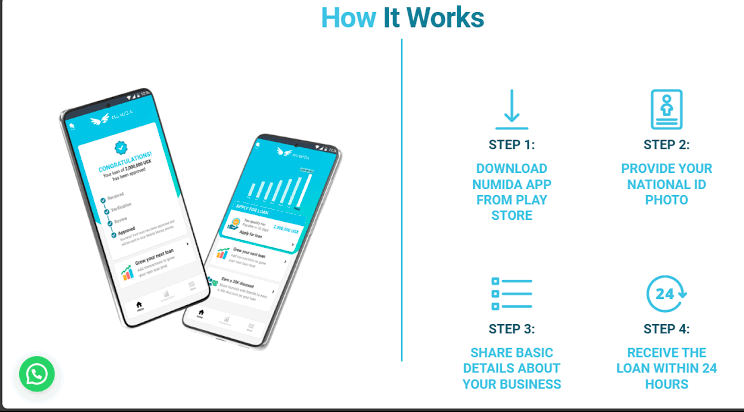

- Downloading the App: Start by downloading the Numida app from the Google Play Store.

- Inputting Personal and Business Information: Open the app and enter your personal details along with your business information.

- Uploading Required Documents: You’ll need to upload important documents like your National ID and photos of your business.

3. Loan Amounts and Terms

Initially, you can borrow between UGX 200,000 and UGX 1,500,000 (about $53 to $400). If you repay your loans on time and use the app regularly, you may qualify for higher amounts later on. The interest rates are competitive, usually ranging from 10% to 16% for a one-month term.

Related: A Step-by-Step Guide to Using Moniepoint App for Daily Transactions

Understanding the Numida Business Loan

To make the most of Numida, it’s helpful to understand who can get these loans and how users can build their creditworthiness.

Types of Businesses Eligible for Loans

Numida focuses on helping micro and small businesses in various sectors like retail, services, agriculture, and more.

This inclusive approach ensures that many entrepreneurs can benefit from their financial services.

Building Creditworthiness with Numida

Keeping accurate sales records in the app is essential for building your credit profile. By regularly logging transactions and using the platform effectively, you can improve your chances of getting higher loan limits over time.

How to Use Numida for Business Loans

Using Numida to get a business loan is quick and easy if you follow these steps:

1. Download and Install the App: Find the Numida app on the Google Play Store and install it on your phone.

2. Creating an Account: Open the app and create an account using your mobile number.

3. Providing Necessary Business Details: Fill in all required information about your business, including recent sales figures.

4. Completing the Loan Application Process: Follow the prompts in the app to finish your application by submitting any necessary documents.

5. Receiving Funds: After your application is approved, you can expect to receive funds through mobile money within 24 to 72 hours.

This quick turnaround means you can access capital when you need it most.

Managing Your Loan with the Numida App

Once you’ve secured a loan through Numida, managing it well is key to maintaining good financial health.

Loan Repayment Options

The app offers flexible repayment schedules that let users choose between making installments or paying back in one lump sum at the end of the loan term.

You can easily track your repayment status through the app’s dashboard.

Customer Support and Resources

If you have questions or concerns about your loan or account management, customer support is available directly through the app.

There’s also an FAQ section that addresses common user inquiries.

Related: How to Use OPay on Your Mobile Device: A Beginner’s Guide to Mobile Finance

Benefits of Using Numida

Using Numida comes with several advantages that can significantly boost a small business’s financial capabilities.

1. Access to Unsecured Loans: One of the best features of Numida is that it offers unsecured loans that don’t require collateral. This is especially helpful for small businesses that may not have assets to secure loans against.

2. Financial Insights and Management Tools: The app includes tools that help users track their income and expenses effectively. By analyzing this data, entrepreneurs can gain insights into improving their business performance over time.

Conclusion

Numida serves as a valuable tool for small businesses in Uganda by providing quick access to unsecured financing through its innovative mobile app.

By focusing on empowering entrepreneurs who lack traditional collateral options, Numida plays an essential role in fostering economic growth within local communities.

As more small business owners explore this fintech solution, they are encouraged to take full advantage of its features for their financial needs.

Frequently Asked Questions

1. What types of businesses can apply for loans through Numida?

Micro and small businesses across various sectors such as retail, services, agriculture, etc., are eligible for loans through Numida.

2. How quickly can I receive funds after applying?

Funds are typically disbursed via mobile money within 24 to 72 hours after loan approval.

3. Do I need collateral to secure a loan from Numida?

No, Numida provides unsecured loans that do not require collateral.

4. How can I increase my loan limit over time?

By consistently using the app to log sales transactions accurately and maintaining good repayment practices, users can increase their loan limits over time.

For further assistance or inquiries regarding using the Numida app:

Visit official FAQs on their website.

Contact customer support through in-app channels for personalized help.

Recommendations

How to Use Kuda for Daily Banking: A Beginner’s Guide

Numida Review: What it Means, How it Works, Requirements & Alternatives