Risevest is a Nigeria-based fintech platform that offers investment opportunities in U.S. assets, aiming to democratize access to wealth-building options for Africans.

With a mission to enable users to grow and preserve their wealth through diversified portfolios, Risevest has become a popular choice for retail investors.

This review explores Risevest’s services, features, benefits, and user experience, presenting an in-depth analysis of its impact on financial growth and investment in Africa.

Read also – Renmoney review: Analyzing Its Services, Features & User experience

About Risevest

Founded by Ekechi Nwokah in 2019, Risevest was established to address the challenges African investors face in accessing global investment markets.

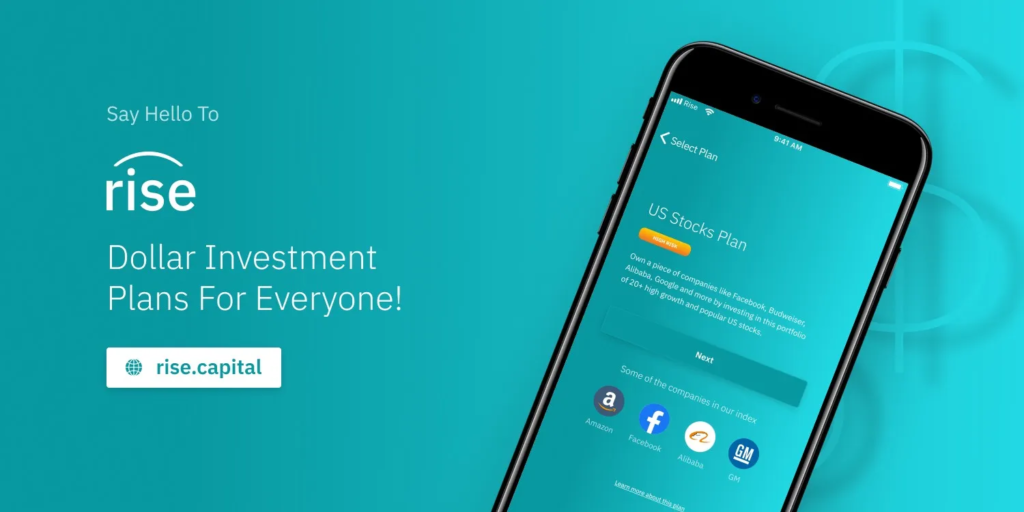

The platform provides opportunities for Nigerians to invest in dollar-denominated assets, such as U.S. stocks, real estate, and fixed-income securities, which help protect users’ wealth against local currency devaluation.

Risevest seeks to empower Africans by offering tools and guidance to build sustainable wealth through secure and well-researched investment options.

The platform partners with U.S.-regulated brokers to handle investments and adheres to global best practices for compliance and security.

How Risevest Works

1. Account Setup

- Download the App: Risevest is available on both Android and iOS platforms.

- Sign Up: Create an account using your email address or phone number.

- Verification: Complete KYC (Know Your Customer) processes by providing government-issued ID and other necessary documentation.

2. Funding Your Account

- Fund your Risevest wallet in Naira or U.S. Dollars via bank transfers, debit cards, or other payment methods.

3. Choosing Investment Plans

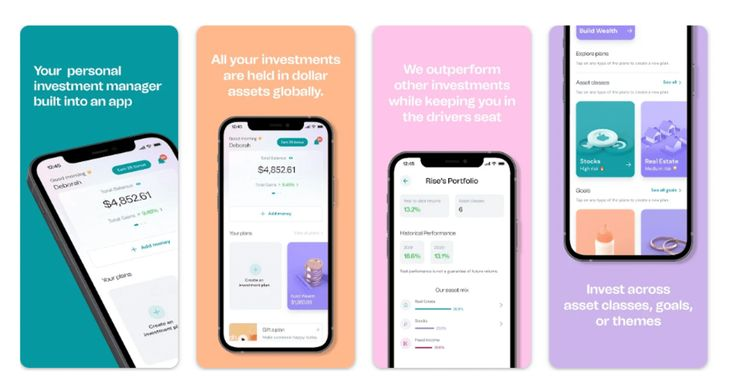

Users can invest in three primary asset classes:

- Stocks: Invest in U.S. stocks with long-term growth potential, including technology, healthcare, and consumer goods companies.

- Real Estate: Earn stable returns through managed U.S. rental properties.

- Fixed Income: Low-risk investments in dollar-denominated bonds and other fixed-income instruments.

4. Portfolio Management

- Risevest automatically manages your portfolio using professional strategies.

- The platform also provides periodic updates on performance and rebalances investments as needed.

5. Withdrawals

- Users can withdraw their funds at any time, converted to their preferred currency at the prevailing exchange rate.

Key Features of Risevest

1. Diversified Investment Options

Risevest allows users to invest across three asset classes: stocks, real estate, and fixed income. This diversification minimizes risk and maximizes returns.

2. Dollar-Denominated Investments

All investments are made in U.S. dollars, protecting users’ portfolios from the depreciation of local currencies like the Nigerian Naira.

3. Managed Portfolios

Risevest handles all aspects of investment management, from asset selection to rebalancing, making it ideal for novice investors.

4. Low Entry Barrier

Investors can start with as little as $10, making it accessible for a wide range of users.

5. Transparency

Risevest provides detailed insights into investment performance, fees, and portfolio updates.

6. Mobile Accessibility

The platform is fully mobile, offering an intuitive app for seamless investment management on the go.

7. Educational Content

Risevest offers financial literacy resources, including articles, videos, and webinars, to help users make informed investment decisions.

Benefits of Using Risevest

1. Wealth Preservation

By investing in dollar-based assets, users protect their wealth from currency devaluation and inflation in local economies.

2. Professional Management

The platform employs experienced fund managers and advanced algorithms to optimize portfolios for growth and stability.

3. Accessibility

With a user-friendly app and low minimum investment requirements, Risevest is accessible to beginners and experienced investors alike.

4. Convenience

The fully digital process allows users to manage their investments anytime and anywhere, without needing to visit physical offices.

5. Secure Transactions

Risevest uses bank-grade encryption and partners with regulated financial institutions, ensuring the safety of funds and data.

6. Competitive Returns

By investing in high-performing U.S. assets, users can achieve returns significantly higher than those offered by traditional savings or investment accounts in Nigeria.

User Experience of Risevest

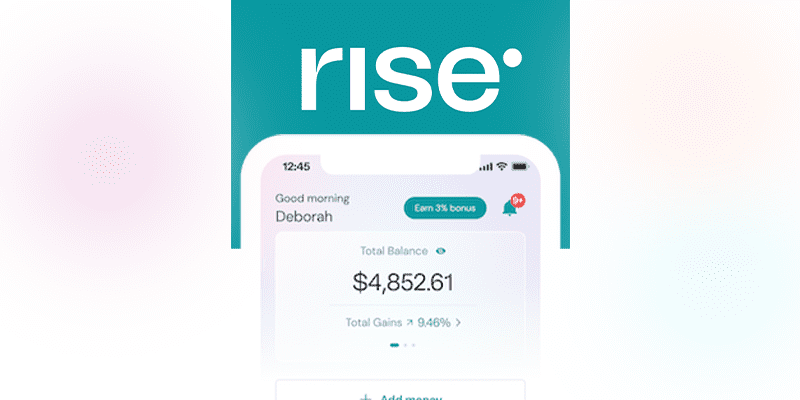

1. Mobile App Design

Risevest’s mobile app has a sleek, intuitive interface that caters to both new and experienced investors.

- Navigation: Simple menus and clearly labeled features make it easy to use.

- Performance Dashboard: Users can monitor their portfolio growth in real-time, view historical data, and track investment returns.

2. Account Setup

The sign-up process is straightforward, with minimal delays during KYC verification.

3. Investment Process

Investors appreciate the simplicity of funding accounts, selecting plans, and tracking performance without requiring advanced financial knowledge.

4. Customer Support

Risevest offers responsive support through email, live chat, and social media. However, some users report delays in responses during high-traffic periods.

5. Challenges

- Limited Asset Classes: Compared to global platforms like Robinhood or eToro, Risevest offers fewer investment options.

- Withdrawal Delays: A small percentage of users have reported delays in withdrawals, often attributed to bank processing times.

Comparison with Alternatives

1. Risevest vs. Bamboo

- Asset Classes: Bamboo focuses on U.S. stocks and ETFs, while Risevest includes real estate and fixed income in addition to stocks.

- Management Style: Risevest provides managed portfolios, while Bamboo allows users to self-manage their investments.

2. Risevest vs. Trove

- Accessibility: Both platforms are beginner-friendly, but Trove offers access to Nigerian and Chinese stocks in addition to U.S. assets.

- Minimum Investment: Risevest’s $10 entry point is lower than Trove’s $50 minimum for some investments.

3. Risevest vs. Chaka

- Local Market Access: Chaka provides access to both Nigerian and global stocks, while Risevest focuses solely on U.S. markets.

- Investment Management: Risevest offers automated portfolio management, whereas Chaka requires users to select and manage their investments.

Pros and Cons of Risevest

Pros

- Ease of Use: Intuitive app for seamless investing.

- Low Barrier to Entry: Start investing with just $10.

- Wealth Protection: Dollar-based assets shield against local currency devaluation.

- Professional Management: Expert-managed portfolios ensure optimal growth.

- Transparency: Regular updates and clear fee structures build trust.

Cons

- Limited Investment Options: Focuses only on U.S. markets and three asset classes.

- Withdrawal Delays: Occasional delays due to bank processing.

- No Self-Directed Investing: Advanced investors may prefer platforms offering more control over asset selection.

Customer Reviews of Risevest

Positive Reviews

- Ease of Investing: Many users appreciate the simplicity of Risevest’s app and the clarity of its investment plans.

- Portfolio Growth: Users report significant growth in their dollar-based portfolios compared to local savings.

- Educational Content: The platform’s focus on financial literacy is praised by beginners.

Negative Reviews

- Withdrawal Times: Some users have experienced delays when withdrawing funds, though these are usually resolved quickly.

- Limited Asset Range: Advanced investors seek more asset classes beyond stocks, real estate, and fixed income.

How to make money on Risevest

Making money on Risevest involves leveraging its investment plans to grow your wealth. Here’s how:

1. Choose the Right Investment Plan

Risevest offers three investment options tailored to different goals:

- U.S. Stocks: Invest in high-growth companies like Apple, Amazon, and Tesla. This plan focuses on long-term appreciation, making it ideal for building wealth over time.

- Real Estate: Earn stable, consistent returns from managed U.S. rental properties. This plan suits those seeking reliable passive income.

- Fixed Income: Invest in dollar-denominated bonds for low-risk, steady returns. Perfect for risk-averse investors.

2. Start with a Small Amount

You can begin investing with as little as $10, allowing you to build your portfolio gradually.

3. Benefit from Dollar Investments

All investments are dollar-based, protecting your funds from currency depreciation and inflation.

4. Compound Returns

Reinvest your earnings to maximize growth through the power of compounding.

5. Withdraw Anytime

Withdraw your earnings or reinvest to grow your portfolio further.

With Risevest’s professional management, you can earn competitive returns without needing extensive investment knowledge. Consistently contribute to your portfolio and let your money work for you over time.

How to withdraw from Risevest wallet

To withdraw funds from your Risevest wallet, follow these steps:

- Launch the Risevest app on your phone (available on iOS and Android).

- Log in with your credentials (email or phone number and password).

- Navigate to the “Wallet” section from the dashboard or the main menu.

- Click on the “Withdraw” button, usually located within the wallet section.

- You can choose to withdraw funds in Naira or U.S. Dollars, depending on your preference.

- Enter the amount you wish to withdraw.

- For Naira withdrawals, you’ll need to provide your local bank account details (account number, bank name, etc.).

- For U.S. Dollar withdrawals, the system will ask for your preferred withdrawal method, such as a dollar-denominated account.

- Review the withdrawal details and confirm. Risevest will process the request within a specified timeframe.

- Typically, it takes 1-3 business days for the funds to reach your bank account, depending on the processing time of your bank.

FAQs

What investment options does Risevest offer?

Risevest provides access to U.S. stocks, real estate, and fixed-income investments.

How much do I need to start investing?

You can start investing on Risevest with as little as $10.

Is Risevest safe to use?

Yes, Risevest partners with regulated brokers and uses bank-grade encryption to ensure the safety of your funds and data.

Can I withdraw my funds anytime?

Yes, funds can be withdrawn at any time, converted at the prevailing exchange rate.

Does Risevest manage investments for users?

Yes, Risevest provides professionally managed portfolios, ideal for users with limited investment experience.

Conclusion

Risevest is a game-changer in Africa’s fintech space, providing easy access to U.S. investments for Nigerians.

With a user-friendly app, low entry requirements, and professional portfolio management, it empowers users to build and preserve wealth in a stable currency.

While the platform could expand its investment options and address occasional withdrawal delays, it remains a top choice for retail investors in Nigeria.

Recommendations

Renmoney review: Analyzing Its Services, Features & User experience