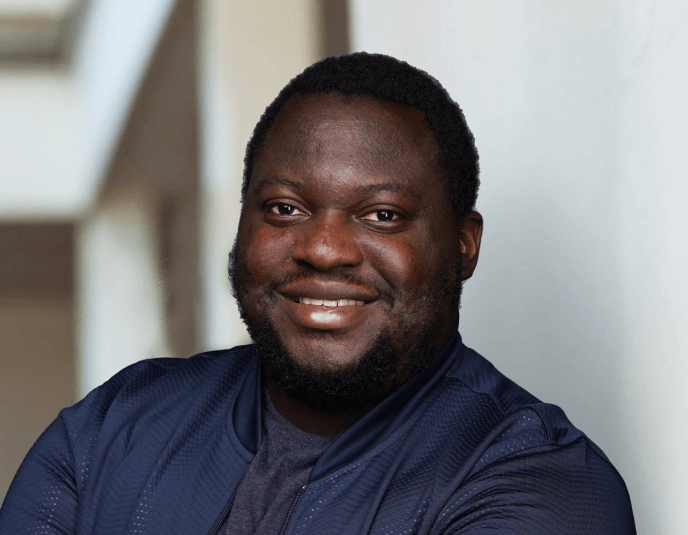

With Eke Urum as the latest CEO, Chaka, a fintech platform based in Nigeria, has emerged as a significant player in the realm of cross-border stock trading, enabling investors to access both local and international markets.

The company’s mission is to democratize investing for Africans, providing them with the tools to invest in global financial assets.

This initiative is particularly vital in today’s interconnected global economy, where access to diverse investment opportunities can significantly enhance financial inclusion and wealth creation.

Eke Urum’s Background

Eke Urum’s journey into the fintech landscape is marked by a commitment to financial inclusion and innovation. He grew up in Nigeria, where he developed an early interest in technology and finance.

Urum pursued higher education at prestigious institutions, including the University of Pennsylvania and Dartmouth College, where he honed his skills in business and technology.

Before taking the helm at Chaka, Urum amassed extensive experience in various sectors, including investment banking and technology. His professional background includes roles at notable firms where he focused on leveraging technology to solve complex financial challenges.

This experience fueled his passion for fintech, particularly the potential it holds for enhancing financial access for underserved populations.

Read Next: Tshepo Moloi – Founder of StokFella, Supporting Communal Savings

Founding Chaka

Chaka was initially founded by Tosin Osibodu and Olaolu Ajose in 2019. The platform quickly gained traction as it addressed a critical gap in the African investment landscape, access to cross-border stock trading.

In a significant turn of events, Chaka was acquired by RiseVest, a fintech company focused on enabling dollar investments, which led to Urum stepping into the role of CEO after Osibodu’s exit.

The need for cross-border stock trading in Africa became increasingly apparent as many investors sought opportunities beyond their local markets.

However, the startup faced numerous challenges during its early stages, including regulatory hurdles that initially hindered its operations.

Despite these obstacles, Urum’s leadership has been pivotal in navigating these complexities and steering Chaka towards success.

Chaka’s Platform and Services

Chaka operates as a digital investment platform that allows users to trade stocks listed on both the Nigerian Stock Exchange (NSE) and major international exchanges like NASDAQ and the New York Stock Exchange (NYSE).

Key features of Chaka include:

- Investment Passport: This unique offering enables users to invest in over 4,000 global assets from their mobile devices.

- Fractional Shares: Investors can start trading with as little as $10, making it accessible for a broader audience.

- Diverse Asset Classes: Chaka supports various markets and asset classes, including equities, mutual funds, and fixed-income products.

By integrating technology with traditional brokerage services through partnerships with firms like DriveWealth and Citi Investment Capital, Chaka facilitates seamless transactions for its users.

Eke Urum’s Role as CEO of Chaka

As CEO of Chaka, Eke Urum has set a clear vision for the company that emphasizes innovation and customer-centricity. Under his leadership:

- Strategic Direction: Urum has focused on expanding Chaka’s offerings and market reach while ensuring compliance with regulatory requirements across different jurisdictions.

- Culture of Innovation: He fosters an environment that encourages creativity and responsiveness to customer needs, positioning Chaka as a leader in the fintech space.

- Regulatory Navigation: Urum has adeptly managed relationships with regulatory bodies to ensure that Chaka operates within legal frameworks while advocating for policies that support fintech growth.

Read Next: Michael Oluwole: Providing Cashless Transit Solutions as Co-founder of Touch and Pay (TAP)

Chaka’s Impact and Growth

Since its inception, Chaka has achieved several milestones that underscore its impact on the African fintech ecosystem:

- Market Expansion: Initially focused on Nigeria, Chaka is now expanding its services to other African countries, thereby increasing accessibility to cross-border trading.

- User Adoption: The platform has seen significant growth in user adoption rates due to its user-friendly interface and comprehensive educational resources aimed at promoting financial literacy.

- Partnerships: Collaborations with established financial institutions have enhanced Chaka’s credibility and operational capacity.

Challenges and Future Outlook

Despite its successes, Chaka faces ongoing challenges typical of the African fintech landscape:

- Infrastructure Issues: Connectivity and technological infrastructure remain significant barriers that can impede growth.

- Investor Education: There is a pressing need for initiatives aimed at educating potential investors about financial markets to promote greater participation.

- Growth Potential: The future looks promising for Chaka as it continues to innovate and expand its services across Africa. The demand for diverse investment opportunities is likely to grow as more individuals seek ways to diversify their portfolios.

Conclusion

Eke Urum’s leadership has been instrumental in driving Chaka’s success as a facilitator of cross-border stock trading in Africa.

By addressing critical barriers to investment access, Chaka not only empowers individual investors but also contributes significantly to the broader economic landscape.

As Africa continues to evolve into a hub for fintech innovation, platforms like Chaka will play an essential role in shaping a more inclusive financial future.

Read Also: Ashraf Sabry -Founder of Fawry, Egypt’s Leading Electronic Payment Platform

FAQs Section

1. What is Eke Urum’s main contribution to fintech?

Eke Urum has significantly advanced financial inclusion by leading Chaka in providing accessible cross-border stock trading options for African investors.

2. How did Chaka gain international recognition?

Through strategic partnerships with global firms like DriveWealth and its innovative approach to democratizing investments, Chaka has garnered attention both locally and internationally.

3. What impact has Chaka had on the African fintech ecosystem?

Chaka has paved the way for increased investment opportunities within Africa by enabling access to global markets, thus fostering economic growth and financial literacy.

4. What is Eke Urum’s leadership style?

Urum exhibits a collaborative leadership style that prioritizes innovation, customer feedback, and regulatory compliance while fostering an inclusive workplace culture.

In celebrating industry giants like Eke Urum, Dratech International highlighted his role as a catalyst for change within Africa’s tech landscape, recognizing his contributions as pivotal in shaping a more inclusive financial future.