Paystack is a platform that enables businesses to accept payments online and offline via multiple channels, offering tools to enhance efficiency, security, and user experience.

From startups to large corporations, Paystack has become a go-to solution for businesses looking to streamline transactions and scale their operations.

By focusing on user-friendly design, localized solutions, and a developer-first approach, Paystack has redefined how payments are handled across Africa and beyond.

This analysis delves into Paystack’s features, benefits, and user experience, shedding light on why it has become a cornerstone for digital payments in Africa.

Whether you’re a business owner exploring payment solutions or a tech enthusiast interested in fintech innovations, Paystack’s story is one of growth, impact, and the power of technology to reshape industries

An Overview of Paystack

Paystack is a trailblazing payment gateway that has transformed the digital payment landscape in Africa.

Launched in 2015 by Nigerian entrepreneurs Shola Akinlade and Ezra Olubi, Paystack emerged as a solution to the fragmented and challenging payment systems that previously hindered businesses on the continent.

With its mission to power growth for African businesses by simplifying payments, Paystack quickly gained traction among small and large enterprises alike, establishing itself as a reliable and innovative platform.

The company’s success caught the attention of global fintech giant Stripe, which acquired Paystack in 2020 for over $200 million—a deal that marked one of the largest acquisitions in Africa’s tech history.

This milestone not only highlighted the potential of African fintech but also cemented Paystack’s position as a leader in the industry.

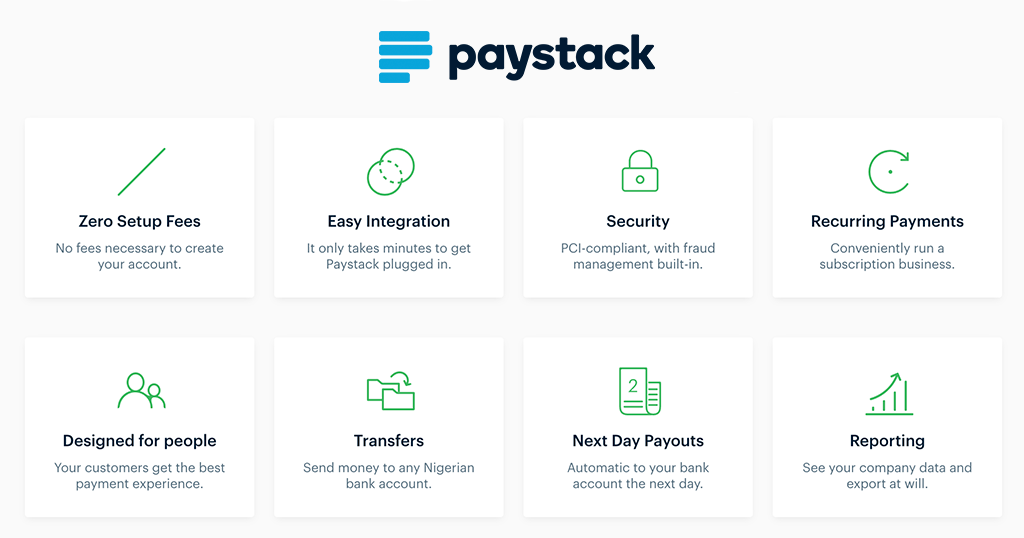

Key Features of Paystack

Paystack’s robust feature set is designed to cater to the needs of businesses across various sectors, making payment processing seamless, secure, and efficient. Below is an in-depth exploration of its core features:

1. Multiple Payment Channels

Paystack supports an extensive range of payment methods, enabling businesses to accept payments in ways that are most convenient for their customers. These include:

- Card Payments: Accept Visa, MasterCard, and Verve card payments globally.

- Bank Transfers: Customers can pay by transferring funds directly from their bank accounts.

- USSD Payments: Popular in regions with limited internet access, USSD offers a low-tech but efficient payment method.

- Mobile Money: Particularly valuable in Africa, where mobile money services like MTN Mobile Money dominate the financial ecosystem.

- QR Code Payments: Contactless payment through QR codes adds convenience and safety.

2. Developer-Friendly API

Paystack’s API is one of its standout features, enabling developers to integrate payment solutions seamlessly into their platforms. The API is:

- Well-Documented: Comprehensive guides and resources make it easy to use, even for developers new to payment integration.

- Customizable: Businesses can tailor the payment process to match their branding and operational workflows.

- Compatible: The API integrates smoothly with various programming languages and platforms, making it versatile and scalable.

3. Subscription and Recurring Billing

Paystack offers a built-in subscription management system, making it easy for businesses to handle recurring payments. Key benefits include:

- Automatic billing cycles for subscription services.

- Notifications and reminders for renewals to keep customers informed.

- Flexible billing intervals (weekly, monthly, annually, etc.).

4. Real-Time Settlements and Reporting

Paystack provides next-business-day settlements, allowing businesses to access their funds quickly. The reporting features include:

- Real-time insights into transaction statuses.

- Detailed analytics on revenue trends and customer behavior.

- Customizable reports for better financial planning.

5. Fraud Prevention and Security

Paystack prioritizes the security of its users through advanced fraud detection mechanisms. Key measures include:

- PCI DSS Compliance: Ensures high standards of payment security.

- Intelligent Fraud Detection: Algorithms analyze transaction patterns to flag suspicious activities.

- Tokenization: Sensitive payment data is encrypted, adding an extra layer of protection.

Benefits of Using Paystack

Paystack’s comprehensive suite of features not only provides businesses with the tools they need to streamline their payment processes but also delivers a range of benefits that contribute to business growth, operational efficiency, and customer satisfaction.

Here’s a deeper look into the key benefits of using Paystack:

1. Ease of Integration

One of the standout advantages of Paystack is its simplicity in integration. Whether you’re a small startup or a large enterprise, Paystack’s integration process is straightforward and adaptable. Key benefits include:

- Developer-Friendly API: Paystack offers an intuitive, well-documented API that simplifies the integration of payments into websites, mobile apps, or other platforms.

- Pre-built Plugins: For those using e-commerce platforms like WooCommerce, Shopify, or Magento, Paystack offers ready-made plugins that significantly reduce setup time.

- Customization Options: Developers can easily customize the checkout experience to match their branding and design, ensuring a seamless user experience.

2. Scalability

Paystack is designed to grow with businesses. As companies expand, Paystack’s infrastructure can handle increased transaction volumes and new requirements. This scalability offers several advantages:

- Support for All Business Sizes: Whether you’re a small business just starting out or a large enterprise with global operations, Paystack caters to businesses of all sizes.

- Global Reach: Paystack’s ability to accept payments from customers worldwide enables businesses to scale internationally without worrying about payment infrastructure.

- Flexible Solutions: Paystack provides solutions for both online and offline payments, which is especially useful for businesses with both digital and physical presences, ensuring smooth growth across channels.

3. Improved Customer Experience

The customer experience is a critical factor for businesses, and Paystack prioritizes making payments as simple and seamless as possible. Some of the key ways Paystack enhances customer experience include:

- Multiple Payment Options: With a wide range of payment methods—cards, bank transfers, mobile money, and USSD—customers can pay via their preferred method, increasing conversion rates.

- Streamlined Checkout: Paystack’s checkout process is quick, intuitive, and mobile-friendly, helping reduce cart abandonment.

- Recurring Billing: For subscription-based businesses, Paystack’s recurring billing feature ensures customers are automatically billed on time, improving customer retention and satisfaction.

- Local Payment Methods: In Africa, where mobile money is prevalent, Paystack’s integration with mobile money systems like MTN Mobile Money ensures businesses can serve customers in regions where traditional banking might be less accessible.

4. Comprehensive Reporting and Analytics

Effective data management is crucial for business operations, and Paystack offers a powerful reporting and analytics suite that helps businesses make informed decisions. Key benefits include:

- Real-Time Insights: Business owners can monitor transactions in real-time, gaining immediate insights into sales activity and cash flow.

- Customizable Reports: Paystack offers the flexibility to generate detailed, customized reports that help businesses track performance, sales trends, and other critical metrics.

- Customer Insights: By analyzing customer purchasing behavior, businesses can tailor their offerings and marketing strategies, improving customer engagement and targeting.

User Experience with Paystack

Paystack is designed to provide an intuitive and frictionless experience for both businesses and their customers.

The platform’s focus on usability, simplicity, and seamless interaction makes it a preferred choice for businesses of all sizes. Here’s a detailed look at the key aspects of the user experience with Paystack:

1. Onboarding and Account Setup

Getting started with Paystack is a smooth and straightforward process, designed to ensure businesses can quickly begin accepting payments. Key aspects of the onboarding experience include:

- Quick Sign-Up: Businesses can sign up and create an account in minutes. The registration process is simple, requiring basic information about the business and its operations.

- Account Verification: Paystack’s verification process is efficient, allowing businesses to upload necessary documentation to verify their identity and complete the setup. The process is streamlined for different business types, making it accessible for both small businesses and large enterprises.

- Comprehensive Guides: During onboarding, Paystack provides easy-to-follow guides and tutorials, making it simple for businesses with little technical experience to understand how to integrate the system into their websites or apps.

2. Payment Experience for Customers

The customer-facing side of Paystack is designed with ease of use and simplicity in mind. Paystack offers a range of features that make the payment process smooth and enjoyable for customers:

- Seamless Checkout Flow: Paystack’s checkout interface is fast and intuitive, ensuring a smooth transaction experience. The design is optimized for mobile and desktop devices, making it easy for customers to complete payments no matter what device they use.

- Multiple Payment Methods: Customers can choose from a variety of payment options, including cards, mobile money, bank transfers, and USSD. This flexibility helps businesses reach customers who prefer different payment methods, increasing conversion rates.

- Guest Checkout: Paystack allows customers to complete their purchase without creating an account. This convenience reduces friction during the payment process and minimizes cart abandonment.

- Saved Cards and One-Click Payments: Returning customers can save their payment details securely with Paystack’s tokenization system, allowing for faster, one-click payments during future transactions. This feature enhances the user experience, especially for businesses with repeat customers.

3. Transaction Management for Businesses

For businesses, managing payments efficiently is crucial. Paystack offers a suite of tools and features to help businesses keep track of their transactions with ease:

- Real-Time Transaction Tracking: Paystack’s dashboard provides businesses with real-time updates on every payment that is processed. Business owners can monitor their cash flow and track the status of each transaction as it happens.

- Transaction History: Businesses can view a complete history of all transactions, including details about each payment, customer, and transaction status. This helps businesses track performance and reconcile their accounts more effectively.

- Refund and Dispute Management: The platform allows businesses to easily manage refunds and disputes. In case of issues with a transaction, businesses can initiate a refund directly from the dashboard, making it easy to handle customer inquiries and resolve issues promptly.

- Exportable Reports: Paystack offers the ability to export transaction reports in various formats, including CSV and Excel. This feature is particularly useful for businesses that need to share data with accounting teams or external stakeholders. The reports are highly customizable, allowing businesses to filter by date range, transaction type, or payment method.

4. Customization Options

Paystack offers extensive customization options to ensure businesses can tailor the payment experience to their brand and operational needs. Key customization features include:

- Custom Payment Pages: Businesses can design their own payment pages, ensuring the payment experience aligns with their brand identity. This includes custom logos, colors, and text, allowing businesses to maintain a consistent look and feel across all customer touchpoints.

- Invoice Customization: Paystack enables businesses to customize the invoices they send to customers. This includes adding logos, business details, and payment terms, ensuring a professional and consistent appearance.

- Customized Checkout Flow: Developers can adjust the payment flow using Paystack’s API to match the unique needs of their website or app, whether it’s integrating additional steps, adding discount codes, or implementing custom fields.

FAQs

What is Paystack?

Paystack is a payment platform that enables businesses to accept online and offline payments. It also accepts various mobile money, card types, and bank transfers.

Is Paystack secure?

Yes, Paystack deploys state-of-the-art security such as PCI DSS compliance, fraud monitoring, and encryption to protect your transactions.

What are the fees for Paystack?

Paystack takes 1.5% + ₦100 for local and 3.9% + ₦100 for international transactions. The ₦100 charge is waived for transactions less than ₦2,500.

Are there User Reviews?

Users call Paystack user-friendly, easy to integrate, and quick with customer support, although some complain about the infrequent delays in payout disbursements.

Can I integrate Paystack with my website or app?

Yes, Paystack offers developer-friendly APIs and plugins that make integration to websites, e-commerce platforms, and mobile apps pretty straightforward.

Conclusion

Paystack is thus dependable, easy to use, and trusted by businesses across Africa-from small to large.

From its secure platform, multi-channel support for various payment methods was ensured to be seamlessly transacted by customers and merchants alike.

It continues to make online and offline payments easier with its competitive fees, ease of integration, and responsive customer support.

Recommendations

PalmPay Review: Getting Started, Features, Pros & Cons

A Comprehensive Overview of Flutterwave : Analyzing Its Services, and Features

A Comprehensive Review of PiggyVest: Analyzing Its Features and Benefits