Remember when paying bills or sending money was a hassle? Long queues, endless paperwork, and uncertain wait times? Well, those days are long gone, thanks to innovative solutions like eTranzact.

eTranzact, and its handy eTranzact mobile app (Xcel), have completely changed the game for how we handle our finances in Africa. It’s like having a personal financial assistant right in your pocket.

As a leading payment solution provider, eTranzact has significantly impacted the African fintech landscape, offering a wide range of innovative services that cater to both individuals and businesses.

Let’s discuss what makes eTranzact so special and how it’s shaping the future of fintech in Africa.

From its humble beginnings to its current status as a leading payment solution provider, we’ll explore its journey, its services, and why it’s become a go-to choice for millions of people.

Company Profile

Let’s talk about the company in general:

Company History

eTranzact was founded in September 2003 by Valentine Obi and his team, initially operating as an interbank payment network in Nigeria.

The company’s early focus was on facilitating electronic transactions between banks, which laid the groundwork for its future expansion into a broader range of payment services.

Over the years, eTranzact has formed strategic partnerships with various stakeholders, including banks and telecommunication companies, enabling it to enhance its service offerings.

The company evolved from its initial model as PayOutlet to become a comprehensive electronic transaction platform that supports various payment methods and services.

This evolution reflects eTranzact’s commitment to innovation and responsiveness to market demands.

Business Operations

eTranzact operates across several African countries including Nigeria, Ghana, Tanzania, Zimbabwe, Côte d’Ivoire, and even the UK. This regional presence allows the company to tap into diverse markets and cater to varying customer needs.

The services offered by eTranzact span multiple sectors:

- Telecommunications: Providing mobile payment solutions that facilitate transactions for telecom operators.

- Banking: Offering integrated payment solutions that enhance banking operations.

- E-commerce: Enabling secure online transactions for merchants through various platforms.

- Public Sector: Assisting government agencies with efficient payment processing systems.

This diverse operational framework positions eTranzact as a key player in fostering economic growth through seamless financial transactions.

Corporate Structure

eTranzact International Plc operates as a subsidiary of eTranzact Global Limited. The company became publicly listed on the Nigerian Stock Exchange in 2019, marking a significant milestone in its corporate journey.

The leadership team is composed of experienced professionals who bring extensive knowledge from various sectors of finance and technology.

Key figures within the management team include:

- Valentine Obi: Founder and CEO, who has been instrumental in driving the company’s vision.

- Adeyemi Adeyemo: Group Head of Business Development, focusing on expanding market reach and enhancing service delivery.

This strong leadership structure supports eTranzact’s strategic initiatives and operational efficiency.

Achievements and Recognition

Over the years, eTranzact has garnered numerous awards and accolades within the fintech industry. These recognitions highlight its commitment to innovation and excellence in service delivery.

Notable milestones include:

- Being recognized as one of Nigeria’s leading payment solution providers.

- Winning awards for outstanding contributions to financial inclusion efforts across Africa.

- Expanding its customer base significantly through innovative products like PocketMoni and CorporatePay.

These achievements underscore eTranzact’s role as a catalyst for change within the African fintech landscape.

Read Next: Yoco Review: What it Means, how it Works, Transfer Fees & Comparison with Alternatives

How Does eTranzact Work?

Understanding how eTranzact operates is essential for users looking to leverage its services effectively. The platform employs advanced technologies to facilitate secure electronic transactions.

Here’s how it works:

1. Core Technologies

At the heart of eTranzact’s operations is its electronic transaction switching technology. This technology enables seamless communication between various financial institutions and facilitates real-time processing of transactions.

Secure payment processing methods include:

- Mobile Payments: Allowing users to make payments via their mobile devices.

- Web Payments: Enabling online purchases through secure gateways.

- Point of Sale (POS): Providing merchants with terminals for card payments.

These technologies ensure that users can transact safely and efficiently across multiple platforms.

2. Product Offerings

eTranzact offers a range of products designed to meet diverse customer needs:

- BankIT: A mobile banking application that allows users to manage their bank accounts conveniently from their smartphones.

- CorporatePay: An automated payment solution tailored for organizations looking to streamline their payment processes.

- PocketMoni: A mobile wallet service that enables users to store funds securely and make payments easily.

- eRemit: An international money transfer service designed for users needing to send money abroad securely.

- WebConnect: A merchant payment processing solution that facilitates online transactions for businesses.

These products collectively enhance user experience by providing flexible options for managing finances.

3. User Experience

The user interface across eTranzact’s platforms is designed with accessibility in mind.

Features such as intuitive navigation, real-time notifications, and personalized dashboards enhance user engagement and satisfaction.

Furthermore, continuous updates ensure that users benefit from the latest technological advancements.

Overview of eTranzact Mobile App (Xcel)

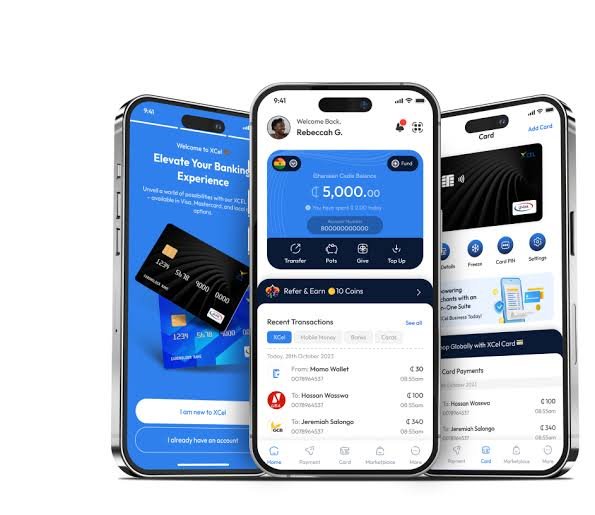

The introduction of the eTranzact mobile app, branded as Xcel App, marks a significant advancement in mobile banking solutions offered by the company.

The Xcel App incorporates various features aimed at improving user experience:

- User-Friendly Interface: Designed for ease of navigation.

- Comprehensive Financial Management Tools: Allowing users to track spending, manage budgets, and make payments effortlessly.

Compared to previous applications offered by eTranzact, the Xcel App introduces enhanced functionalities tailored to meet modern banking needs.

The app provides numerous benefits for both individuals and businesses:

- Integration with Various Payment Methods: Such as GH-Link prepaid cards, facilitating diverse transaction options.

- Enhanced Financial Management Tools: Helping users monitor their finances effectively.

These features empower users by providing them with greater control over their financial activities.

Moving on, security is paramount in digital transactions; thus, eTranzact has implemented robust security protocols within its mobile app, such as:

- Encryption Technologies: Protecting user data during transactions.

- Multi-Factor Authentication: Ensuring that only authorized users can access their accounts.

These measures create a secure environment for users engaging in mobile banking activities.

Read Also: MyBucks Review: A Comprehensive Guide to its Features, Mobile App, Functionality, and Alternatives

eTranzact Transfer Fees

Understanding transfer fees associated with using eTranzact services is crucial for potential users looking to manage costs effectively.

eTranzact employs a transparent fee structure that varies depending on the type of transaction:

- Mobile Transfers: Generally attract lower fees compared to traditional bank transfers.

- International Remittances: Fees are competitive relative to other service providers in the market.

This clarity helps users make informed decisions regarding their financial transactions.

Also, when compared with competitors like Paystack or Flutterwave, eTranzact’s fees are often seen as competitive:

| Payment Gateway | Local Transactions | International Transactions |

| eTranzact | 1% + NGN 50 | 3% + NGN 100 |

| Paystack | 1.5% + NGN 100 | 4% |

| Flutterwave | 1.4% | 3.8% |

This comparative analysis highlights how eTranzact positions itself within the competitive landscape while maintaining affordability for users.

Comparison with Alternatives

When evaluating alternatives to eTranzact, it’s essential to consider factors such as service offerings, fees, user experience, and security measures.

Here is a tabular comparison:

| Feature/Service | eTranzact | Interswitch | Remita | Unified Payments |

| Market Presence | Nigeria & Other African Countries | Nigeria & West Africa | Nigeria | Nigeria |

| Service Type | Multi-channel payments | Integrated digital payments | Payment gateway | Shared infrastructure |

| Fee Structure | Competitive rates | Varies by transaction type | Varies by organization | Varies by bank partnership |

| User Interface | User-friendly app | Comprehensive web platform | Business-focused interface | Banking community-centric |

Conclusion

eTranzact has made significant strides in transforming the payment processing landscape across Africa. Its innovative solutions not only enhance user experience but also promote financial inclusion among underserved populations.

As digital payments continue to grow globally, eTranzact is well-positioned for future growth through ongoing innovation and expansion into new markets.

The company’s commitment to using technology will likely drive further advancements in fintech across Africa.

Frequently Asked Questions

1. What is eTranzact?

eTranzact is a Nigerian fintech company providing electronic payment solutions including mobile banking, online payments, and money transfers across Africa.

2. How does the eTranzact mobile app work?

The app allows users to manage their finances through features like money transfers, bill payments, and account management all from their smartphones securely.

3. What are the transfer fees associated with using eTranzact?

Transfer fees vary based on transaction type; typically around 1% for local transactions and competitive rates for international remittances compared to other providers.

4. How does eTranzact compare with other payment gateways?

While there are several competitors like Paystack and Flutterwave, eTranzact offers unique features tailored for African markets along with competitive pricing structures making it an attractive option for users seeking reliable payment solutions.