Let’s be honest, managing money these days can feel like a full-time job. Between keeping track of bills, sending money to friends and family, and making sure you have enough airtime, it can all get a bit overwhelming.

That’s where mobile banking apps come in, offering a much simpler way to handle our finances.

And among these, the Moniepoint app has become a real game-changer for many. It offers a ton of useful features, all accessible right from your phone.

This isn’t just about sending money; we’re talking bill payments, topping up your phone, and even services for businesses.

This comprehensive guide is designed to walk you through everything you need to know about how to use Moniepoint app effectively.

We’ll cover everything from downloading and setting up the app to performing everyday transactions like paying bills and buying airtime.

For those times when you don’t have internet access, we’ll also explore how to use Moniepoint USSD codes, which are incredibly handy for quick transactions.

Whether you’re already familiar with mobile banking or just getting started, this article will give you a clear understanding of how to make the most of the Moniepoint app and Moniepoint USSD codes, making your financial life a whole lot easier.

So, if you’re looking for a straightforward way to manage your money, read on to discover how to use Moniepoint app and its USSD functionality.

What is the Moniepoint App?

The Moniepoint app is a mobile banking application that makes it easy for users to manage their finances. Its main goal is to provide a simple way for people to access banking services without needing to visit a physical bank.

Here are some key features of the Moniepoint app:

- Money Transfers: You can quickly send and receive money to other Moniepoint users or bank accounts.

- Bill Payments: Pay your bills, like utilities and school fees, directly through the app.

- Airtime Purchases: Buy airtime for yourself or others in just a few taps.

- Merchant Services: Businesses can use the app to manage their transactions efficiently.

Read Next: How to Use OPay on Your Mobile Device: A Beginner’s Guide to Mobile Finance

Why Choose Moniepoint?

When looking for a mobile banking solution, it’s important to find one that fits your needs. Here are some reasons why the Moniepoint app is a great choice:

- User-Friendly Interface: The app is designed to be easy to use, so anyone can navigate it without trouble.

- Enhanced Security Measures: Moniepoint takes security seriously, using advanced measures to protect your financial information.

- Wide Range of Services: Whether you need personal banking or business solutions, Moniepoint has you covered.

- Accessibility Through Both App and USSD Codes: You can perform transactions online or offline, making it convenient in any situation.

How to Use the Moniepoint App

Getting started with the Moniepoint app is simple. Here’s how you can begin:

1. Downloading the Moniepoint App

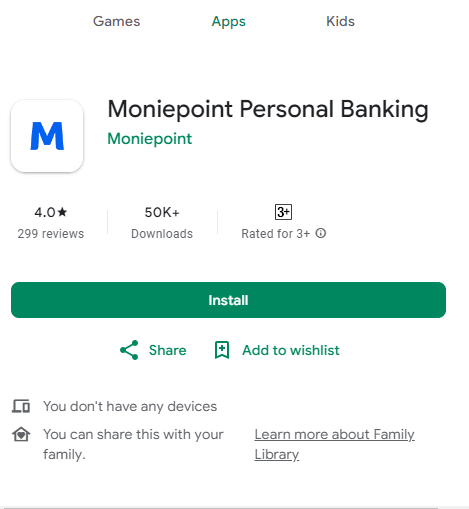

To use the Moniepoint app, first download it on your smartphone.

For Android Users:

- Open the Google Play Store on your phone.

- Type “Moniepoint” into the search bar.

- Tap “Install” and wait for it to download.

For iOS Users:

- Go to the Apple App Store on your device.

- Search for “Moniepoint.”Tap “Get” and follow any prompts to complete the installation.

2. Setting Up Your Account

After installing the app, you’ll need to set up your account:

- Open the app and select “Sign Up.” Enter your personal information, including your phone number and email address.

- Complete the verification process by entering the code sent to your phone via SMS.

3. Logging into the Moniepoint App

Once your account is set up, logging in is easy:

- Open the Moniepoint app. Enter your username and password.

- If you forget your password, click on “Forgot Password” to reset it.

Daily Transactions Using Moniepoint

Now that you’re all set up, let’s look at how you can perform daily transactions using the Moniepoint app.

1. Sending Money

To send money:

- Open the app and select “Send Money.”

- Enter the recipient’s details (either another Moniepoint user or a bank account).

- Input how much money you want to send.

- Review everything and confirm the transaction.

- Keep in mind that there might be limits on how much money you can send and possible fees involved.

2. Paying Bills

You can easily pay bills through the app:

- Go to “Pay Bills.”

- Choose from categories like utilities or school fees.

- Fill in any required details and confirm your payment.

This feature saves time since you can pay multiple bills all in one place without needing to visit different service providers.

3. Purchasing Airtime

Buying airtime is quick and straightforward:

- Navigate to “Buy Airtime” in the app.

- Decide if it’s for yourself or someone else.

- Enter how much airtime you want to buy.

- Confirm your transaction.

Be aware that there may be daily limits on how much airtime you can purchase.

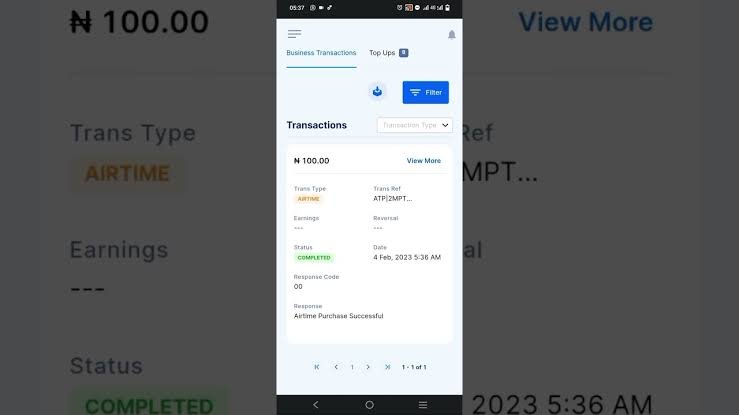

4. Accessing Transaction History

To keep track of what you’ve done financially:

- Go to “Transaction History” in the app.

- Here, you can see all past transactions.

Keeping an eye on your financial activities helps you stay organized and aware of your spending habits.

Read Next: How to Use Payday App

Using Moniepoint USSD Codes

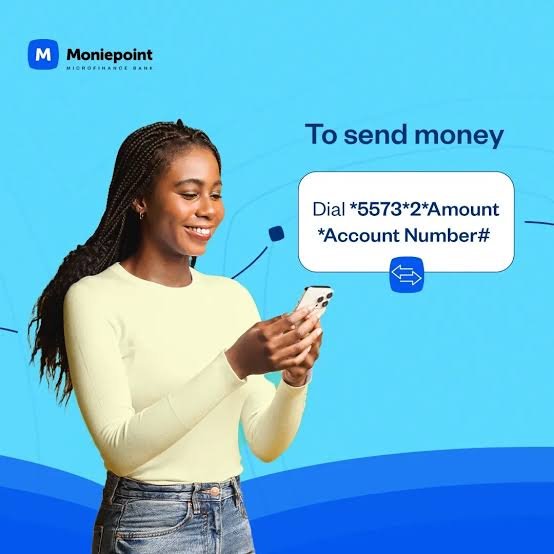

For those who prefer offline options or have limited internet access, Moniepoint offers USSD codes that allow you to perform banking transactions without needing a smartphone or internet connection.

1. Overview of USSD Functionality

USSD codes are short numbers that let users carry out various banking operations directly from their mobile phones.

They are especially useful when internet connectivity is poor.

2. Key USSD Codes for Moniepoint Users

Here are some important USSD codes every Moniepoint user should know:

*5573# : Access main menu

*5573*5# : Check balance

*5573*1*Amount*Account# : Transfer funds

*5573*911# : Block/unblock accounts

These codes make it easy to manage finances even when you’re offline.

3. Enabling USSD Banking

To enable USSD functionality:

- Open the Moniepoint app.

- Go into settings and select “Enable USSD Banking.”

- You’ll need to authorize this action with your user PIN.

Tips for Effective Use of Moniepoint

To make sure you’re getting the most out of your experience with the Moniepoint app:

- Regularly update the app for new features and security improvements.

- Use strong passwords and enable two-factor authentication whenever possible.

- Familiarize yourself with all features available in the app.

- If you have any issues or questions, reach out to customer support through the app.

Common Challenges and Solutions

While using any mobile banking application, users may face challenges. Here are some common issues along with solutions:

Internet Connectivity Problems: Make sure you’re connected to a stable network before trying transactions. If problems continue, switch between Wi-Fi and mobile data.

Error Messages During Transactions: If you see error messages while transacting, take note of what they say and consult customer support for help.

Moniepoint provides customer support options through their website and within the app itself, ensuring assistance is always available when needed.

Conclusion

The Moniepoint app offers an easy way to manage daily financial transactions without hassle.

With its user-friendly design, strong security features, and wide range of services, including USSD capabilities, it’s an excellent choice for anyone looking to simplify their banking experience.

Whether you’re sending money, paying bills, or buying airtime, downloading and exploring everything that Moniepoint has to offer can greatly enhance how you handle your finances every day.

Frequently Asked Questions

1. What is Moniepoint?

The Moniepoint app is a mobile banking application that allows users to conduct various financial transactions such as sending money, paying bills, and purchasing airtime easily from their smartphones or via USSD codes.

2. How do I download the Moniepoint app?

You can download it from either Google Play Store (for Android) or Apple App Store (for iOS) by searching for “Moniepoint” and following installation prompts.

3. Are there transaction fees associated with using Moniepoint?

Yes, there may be transaction limits and fees depending on what services you use within the app. It’s advisable to check these details within your account settings or during transaction confirmations.

4. Can I use Moniepoint without an internet connection?

Yes! You can use USSD codes like *5573# to perform various transactions without needing an internet connection, making it accessible even in areas with poor connectivity.

Recommendations

How to Use Kuda for Daily Banking: A Beginner’s Guide

MyBucks Review: A Comprehensive Guide to its Features, Mobile App, Functionality, and Alternatives

Yoco Review: What it Means, how it Works, Transfer Fees & Comparison with Alternatives