Wondering how to use GTpay?. Think about how much we use the internet these days. From shopping for groceries to paying bills, so much of our lives happens online. And that means moving money around digitally is more important than ever.

Whether you’re a business owner trying to expand your reach to online customers, a freelancer getting paid for your work, or simply someone who appreciates the convenience of managing your finances digitally, understanding online payment systems is absolutely essential. That’s where GTpay comes into the picture.

It’s become a really popular and trusted way to handle online transactions, especially here in Africa.

This article is designed to be your friendly guide to everything GTpay. We’re going to break down what it is, explore all the different things it can do, and most importantly, show you step-by-step how to use GTpay to send and receive payments.

We’ll cover all the basics and even some of the more detailed stuff, so by the end, you’ll feel completely confident using it.

We’ll walk you through how it works for both businesses and individuals, so whether you’re looking to accept payments on your website or just want a simpler way to pay for things online, you’ll find what you need here.

We know that online payments can sometimes seem a bit complicated, but we’re going to keep things simple and easy to understand.

Our goal is to empower you with the knowledge you need to confidently navigate the digital marketplace and take full advantage of the convenience and security that GTpay offers.

So, if you’re ready to learn how to make your online transactions smoother and more efficient, let’s get started and explore the world of GTpay together!

Table of Contents

Understanding GTpay

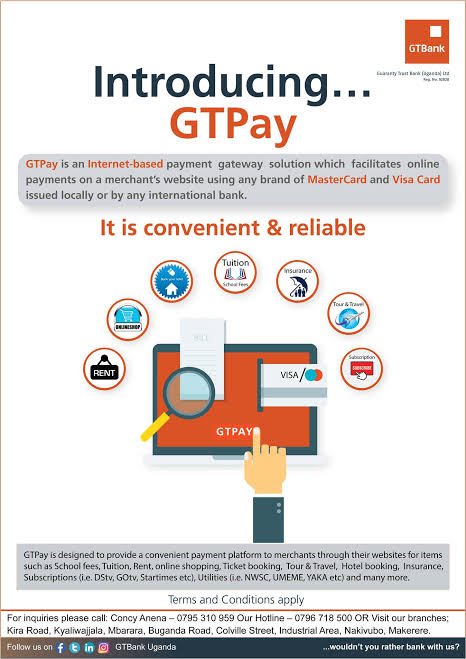

GTpay is an internet-based payment gateway that facilitates online transactions using debit and credit cards.

It serves as a bridge between merchants’ websites and financial institutions, allowing businesses to accept payments from customers globally.

Historically, GTpay was developed in response to the growing demand for digital payment solutions in Nigeria and beyond.

Since its inception, it has evolved to incorporate advanced features that enhance user experience and security.

When compared to other payment gateways like Remita or PayU, GTpay stands out due to its strong backing from GTBank, which provides a level of trust and reliability.

While some competitors may offer lower setup fees or different features, GTpay’s focus on local market needs and robust security measures make it a compelling choice for many users.

Related: How to Use Paga for Seamless Transactions

How GTpay Works

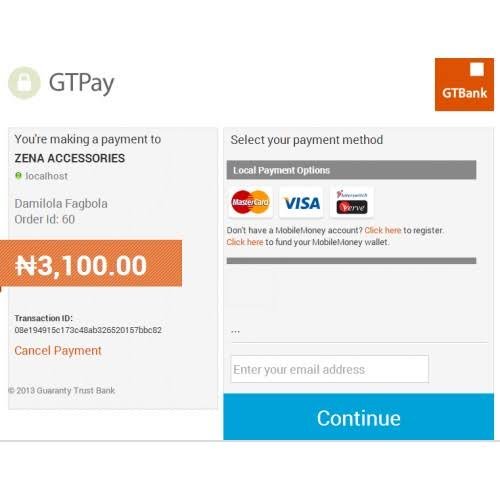

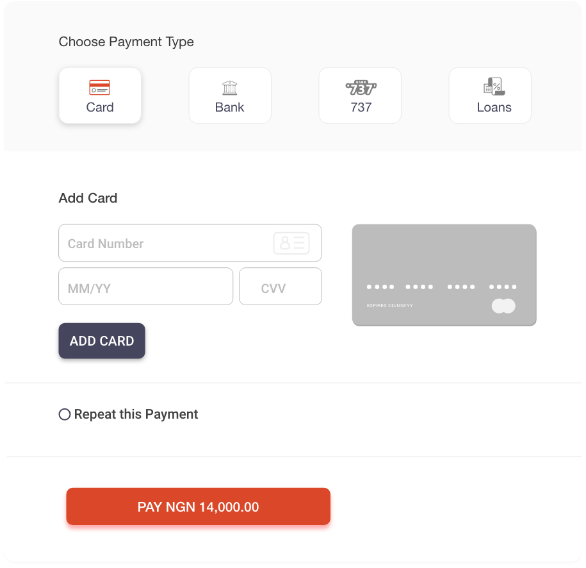

The payment process with GTpay is straightforward. When a customer makes a purchase on a merchant’s website integrated with GTpay, they can choose to pay using their debit or credit card (Visa or MasterCard). The steps involved include:

Integration with Merchant Websites: Merchants must integrate the GTpay gateway into their online platforms, allowing customers to make payments directly through the site.

Real-Time Transaction Processing: Once the customer inputs their card details and confirms the transaction, GTpay processes the payment instantly. This means that funds are deducted from the customer’s card immediately while the merchant’s account is credited within 24 hours.

Security Measures: To ensure safe transactions, GTpay employs advanced security protocols such as SSL encryption and 3D Secure authentication. These measures protect sensitive customer information from potential threats.

Setting Up GTpay for Your Business

To start using GTpay, businesses must meet certain requirements:

Website Necessity: A functional website is essential for integrating the GTpay payment gateway.

Initial Setup Costs: There is an initial setup fee of approximately ₦75,000 for businesses wishing to use GTpay.

Step-by-Step Guide on How to Set Up GTpay:

1. Contacting GTBank for Onboarding: Businesses should reach out to GTBank to initiate the onboarding process.

2. Technical Integration: After receiving necessary credentials (like Merchant ID and Hash Key), businesses can integrate these into their existing systems or e-commerce platforms.

3. Testing: It’s crucial to test the integration thoroughly before going live to ensure everything works smoothly.

How to Use GTpay to Send and Receive Payments

Using GTpay is simple for both businesses and individuals.

For Businesses:

- Accepting Payments Through GTpay: Once integrated, merchants can start accepting payments from customers using various card options.

- Customizing Payment Options: Businesses can tailor their payment options on their websites based on customer preferences.

- Managing Transactions: Merchants can track transactions in real time and receive notifications about successful payments.

For Individuals:

Steps to Make Payments Using GTpay:

- Input your card details along with the payment amount.

- Confirm your transaction.

- Wait for confirmation of your payment via email or SMS notification.

Related: How to Use Cellulant for Seamless Online Payments

Benefits of Using GTpay

GTpay offers several advantages that make it appealing for both businesses and consumers:

Convenience of Online Payments: Users can make transactions from anywhere without needing physical cash.

Global Reach: Businesses can accept payments from international customers easily.

Cashless Transactions: Promotes financial inclusion by providing easy access to payment solutions without needing traditional banking methods.

Fees Associated with GTpay Transactions

Understanding the cost structure is essential when using any payment gateway:

Local Transactions: A fee of 1.5% of the transaction amount applies.

International Transactions: These incur higher fees due to processing costs, typically around ₦5,000 monthly in addition to transaction charges.

When compared with other payment gateways like Paystack or Flutterwave, which may have different fee structures or lower initial costs, it’s important for businesses to evaluate which service aligns best with their needs.

Common Use Cases for GTpay

GTpay is particularly beneficial in various sectors including:

E-commerce: Online retailers can easily integrate GTpay into their websites for seamless transactions.

Education: Institutions can collect fees online efficiently.

Utilities: Service providers can facilitate bill payments through their platforms.Many businesses in these sectors have successfully implemented GTpay as their primary payment solution due to its reliability and user-friendly interface.

Troubleshooting Common Issues with GTpay

While using any digital platform may present challenges, common issues with GTpay include:

Transaction Failures: Users may occasionally experience failed transactions due to network issues or incorrect card details. To resolve these issues:

- Check your internet connection.

- Verify card details are entered correctly.

- Contact customer support if problems persist for assistance.

Related: How to Use JUMO: What You Need to Know

Future of Payments with GTpay

The future looks promising for digital payments in Africa, including innovations planned for GTpay:

Upcoming features may include enhanced mobile payment options and additional integrations with other fintech services.

The role of fintech continues to grow as companies like GTBank lead efforts in transforming how payments are processed across the continent.

Conclusion

Adopting digital payment solutions like GTpay is essential for both businesses and individuals looking to thrive in today’s economy.

With its robust features, strong security measures, and ease of use, GTpay stands out as a reliable option for sending and receiving payments online.

As more people embrace cashless transactions, knowing how to use GTpay will be beneficial in navigating this evolving landscape effectively.

Frequently Asked Questions on How to Use GTPay to Send and Receive Payments

1. What types of payments does GTPay accept?

GTPay accepts local debit cards as well as international credit cards from major networks like Visa and MasterCard.

2. How long does it take for funds to be settled into merchant accounts?

Funds processed through GTPay are typically settled within 24 hours into merchant accounts.

3. Are there any setup fees associated with using GTPay?

Yes, there is an initial setup fee of approximately ₦75,000 required for merchants wishing to use GTPay.

4. How does GTPay compare with other payment gateways?

While similar gateways like Paystack offer lower setup fees, GTPay provides strong security features backed by GTBank’s reputation in Nigeria’s banking sector.

Recommendations

Understanding How to Use MyBucks