Now, you might be wondering—how to use LemFi for seamless transactions? That’s exactly what we’re about to explore.

You’re working in Canada, the United States, or the United Kingdom, but you have family in Ghana, Nigeria, Kenya, and other countries. You’ve just received your paycheck and want to send money back home.

This is where LemFi (formerly Lemonade Finance) comes in—a fintech app that makes money transfers as easy as sending a text message.

With just a few taps on your smartphone, your loved ones receive the funds instantly. But the best part? These transfers are immediate and free—yes, absolutely free of charge!

And there’s more—LemFi allows you to hold and manage multiple currencies in your account. So whether you’re from Ghana, Nigeria, or Kenya, LemFi has you covered. It’s like carrying a financial powerhouse in your pocket.

In this guide, we’ll take a deep dive into LemFi, showing you how to use LemFi to send and receive funds, hold currencies, and manage your finances—all with ease.

By the end, you’ll fully understand how to use LemFi and make the most of its features. So, let’s get started!

You might also like – How to Use KoraPay: A Comprehensive Guide

Table of Contents

How lemonade finance works exactly?

Lemonade Finance, now rebranded as LemFi, is a financial technology company launched in 2020 with a mission to support immigrants seeking better opportunities abroad.

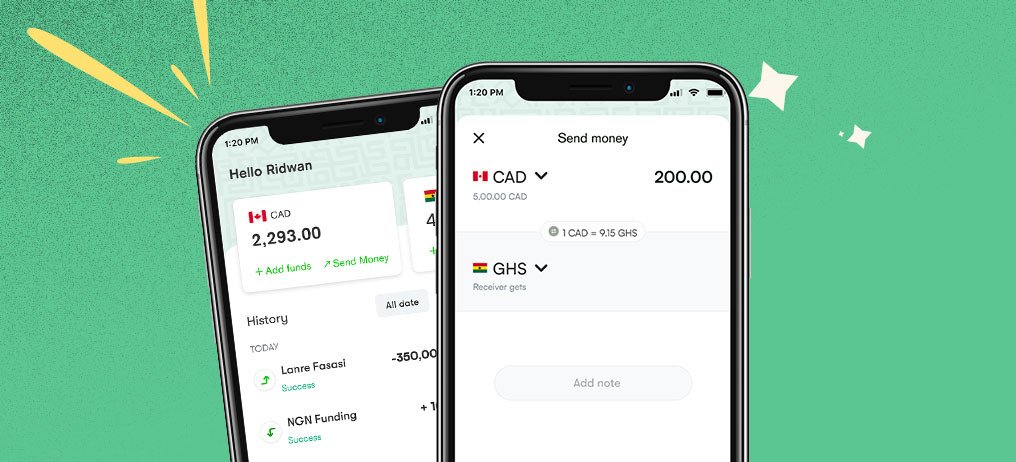

The LemFi app was specifically designed to make international transactions simple, affordable, and secure. For Africans living in the United States, Canada, and the United Kingdom, LemFi provides a fast and reliable way to send money to their families back home without paying expensive fees.

Through LemFi money transfer, users can instantly send funds to countries like Nigeria, Ghana, Kenya, Uganda, Tanzania, Senegal, Cameroon, Benin, Ivory Coast, and Rwanda.

With just a few taps on your smartphone, you can fund your LemFi account and transfer money directly to a recipient’s bank account or mobile wallet. Unlike traditional services, LemFi charges no hidden fees and offers competitive exchange rates.

The LemFi app also allows users to hold and manage multiple currencies such as USD, CAD, and GBP, making it one of the most flexible international money transfer apps available.

Whether you need to send money for family support, bills, or emergencies, LemFi ensures your funds arrive instantly and securely, proving why it has become a trusted solution for Africans abroad.

Is LemFi App Legit?

Yes, the LemFi app is legit. It is operated by RightCard Payment Services Ltd, which is licensed by the Central Bank of Nigeria (CBN) and regulated as an Electronic Money Institution in the UK. These approvals show that LemFi complies with strict financial rules.

On Trustpilot, LemFi has a 4.5-star rating, with many users praising its instant transfers, low costs, and responsive support team. However, some customers report delays and account restrictions, so experiences may vary.

Overall, LemFi is considered safe, reliable, and trustworthy for sending money internationally. Just ensure your LemFi account is verified before making large transfers to avoid transaction limits.

What is LemFi App Used For?

The LemFi app is mainly used for:

- Sending money abroad – Instant transfers to African countries.

- Holding multiple currencies – Manage USD, GBP, and CAD in one account.

- Paying bills – Send money for education, health, or household expenses.

- Shopping online – Use the LemFi virtual card for digital payments.

- Secure transactions – Protected with bank-level encryption.

In short, LemFi is designed for international money transfers and financial management across borders.

How to Use LemFi

- Download the App – Go to Google Play Store or Apple Store and download the LemFi app.

- Sign Up – Provide personal details like name, address, email, phone number, and proof of identification during registration.

- Verify Your Account – Complete the identity verification process within minutes to activate your account.

- Fund Your Account – Add money via bank transfer or card payment to start transactions.

- Send Money – Choose the recipient’s bank account or mobile wallet, follow the prompts, and send funds instantly.

Read also – How to use Trove: buy stocks, invest abroad & more

Key Features of LemFi

- Instant Transfers – Money arrives within minutes.

- No Transfer Fees – Send money for free without hidden charges.

- Multi-Currency Support – Manage and hold multiple currencies in one account.

- Secure Transactions – Uses bank-level encryption for data protection.

Now that you know how to use LemFi, you can effortlessly manage international transactions and stay connected with loved ones back home.

LemFi account verification

Lemonade Finance, now known as LemFi, is required by regulations to verify the identity of all its customers. This process ensures the security of transactions and compliance with financial laws.

What You’ll Need for Verification

- Email Access – Ensure you have access to your registered email address.

- Valid ID – Provide the data page of a government-issued ID (e.g., passport, driver’s license, or national ID).

- Selfie Verification – Use your mobile device’s camera to capture a selfie for identity confirmation.

Steps on How to Use LemFi for Verification

- Log In to LemFi App – Open the LemFi app on your device.

- Go to Profile Settings – Navigate to the verification section in your profile.

- Upload Documents – Submit a clear image of your government-issued ID.

- Take a Selfie – Capture a real-time selfie using the app’s camera to match your ID photo.

- Submit for Review – Confirm your details and submit your application for verification.

Verification Processing Time

- Fast Approval – Most verifications are approved within minutes.

- Notifications – You’ll receive an email confirmation once your account is verified.

Why Verification is Important

- Ensures secure transactions and protects against fraudulent activities.

- Allows users to send and receive funds without restrictions.

- Complies with anti-money laundering (AML) regulations.

Now that you know how to use LemFi for account verification, you’re ready to experience hassle-free and secure international transfers!

Read also – How to use Aella Credit App: Everything you need to know

How to send money with Lemonade Finance

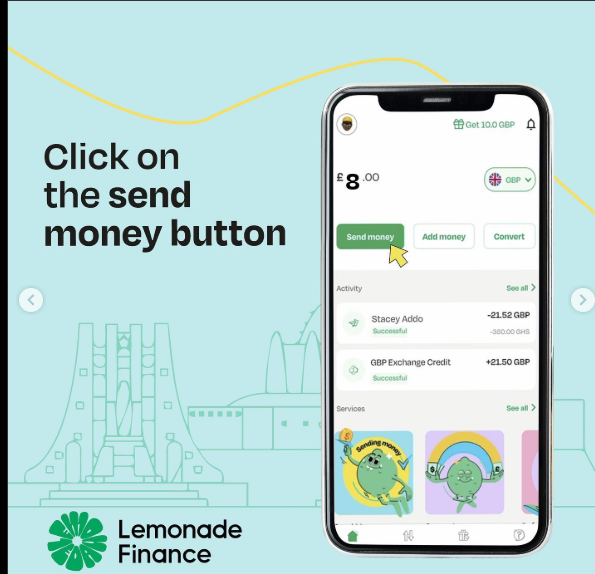

Here’s how to use lemfi to make an international transfer. LemFi, formerly known as Lemonade Finance, makes international money transfers simple and fast. Follow these easy steps to send money:

1. Select a Currency to Send

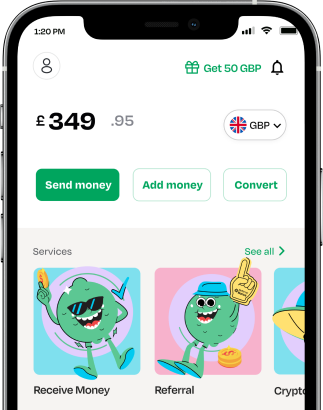

- Open the LemFi app and tap the “Send” icon.

- Choose the principal currency (USD, CAD, or GBP).

- Select the destination currency for the recipient.

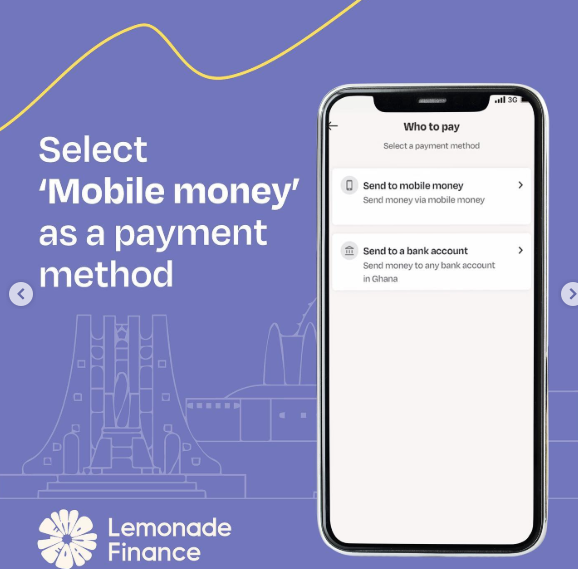

2. Choose Payment Method

- Select your preferred payment method—either a bank account or mobile transfer.

- Enter the recipient’s details, including account number or mobile wallet information.

3. Review and Confirm

Once satisfied, tap “Send” to complete the transfer.

Double-check the exchange rate, transaction fees, and total amount before proceeding.

Options for transfer on the Lemfi App

LemFi (formerly Lemonade Finance) provides multiple funding options for users across different countries. Here’s how to use LemFi to deposit money and send funds internationally:

1. Funding Your LemFi Wallet

United States:

- Use auto-deposit to add funds to your LemFi wallet.

United Kingdom:

- Fund your wallet in Pound Sterling (GBP) via Open Banking powered by TrueLayer or Clear Junction.

Canada:

- Add funds using Interac e-Transfer or auto-deposit.

2. Sending Money to Recipients

- Open the LemFi app and tap the “Send” button.

- Choose your currency (USD, CAD, or GBP) and enter the recipient’s country and details.

3. Payout Options for Recipients

- Nigeria – Send money to banks or mobile wallets like MTN Mobile Money.

- Ghana – Transfer funds via AirtelTigo, Vodafone Cash, or bank accounts.

- Kenya, Uganda, Tanzania, Senegal, and more – Options vary between mobile wallets and bank transfers based on country regulations.

Related – How to use Risevest for dollar investment, stocks & more

4. Confirm and Complete Transactions

- Review all transaction details, including exchange rates and any fees.

- Tap “Send” to finalize the process. Funds are typically delivered instantly.

Now that you know how to use LemFi, you can easily send money to loved ones anywhere, quickly and securely!

How to Transfer Money from LemFi to Bank Account?

To transfer money from LemFi to your bank account:

- Open the LemFi app.

- Tap “Withdraw”.

- Select your linked bank account.

- Enter the amount and confirm.

Funds are usually transferred instantly, though some banks may take a few hours. This makes LemFi a flexible option for both sending money abroad and withdrawing it locally.

How to Add Money to LemFi Account?

Adding money to your LemFi account is simple and depends on your country of residence. If you are in Canada, you can fund your wallet using Interac e-Transfer by sending money to deposit@lemfi.com.

Users in the United Kingdom can use Open Banking or Clear Junction to transfer GBP, while those in the United States can fund their account via auto-deposit linked to their bank.

To add funds, open the LemFi app, tap “Add Money”, choose your preferred funding method, and follow the instructions. Once completed, your wallet is credited instantly or within a few minutes. After funding your account, you can use the balance for international money transfers or local transactions.

This flexibility makes it easy for users to manage their finances across multiple currencies, including USD, CAD, and GBP.

Does LemFi Accept Credit Card?

Currently, LemFi does not directly accept credit cards for deposits in most regions. The app primarily supports bank transfers, debit cards, and Interac e-Transfers depending on your location.

While some users in the UK may have limited options for funding through card-linked services, the safest and most reliable methods remain bank-based.

If you prefer using a card, you can link your debit card to the LemFi app for faster deposits. For those in Canada, Interac e-Transfer remains the go-to method, while UK users benefit from Open Banking integration.

Although credit card payments aren’t a core feature, LemFi ensures zero transfer fees and competitive exchange rates with the available funding methods. This way, users enjoy smooth transactions without the risk of high card fees.

How to Withdraw Money from LemFi?

Withdrawing money from LemFi is straightforward. Once you receive funds in your LemFi wallet, you can transfer them to your linked bank account. Simply log in to the LemFi app, tap “Withdraw”, select the bank account you’ve added, enter the withdrawal amount, and confirm.

The withdrawal process is usually instant, though in some cases it may take a few hours depending on the recipient’s bank. For recipients in Africa, LemFi supports payouts to both bank accounts and mobile money wallets, ensuring flexibility and convenience.

LemFi withdrawals are free, with no hidden charges, making it a cost-effective alternative to traditional money transfer services. However, ensure your LemFi account verification is complete, as unverified accounts may face limits on withdrawals or transfers.

How Much Time Does LemFi Take to Receive Money?

Most LemFi transfers are instant, meaning your recipient gets the money within minutes. However, in rare cases, it can take a few hours depending on the payout method or bank. For example:

- Nigeria: Bank and mobile wallet transfers are usually instant.

- Ghana: AirtelTigo, Vodafone Cash, and MTN payments are instant.

- Kenya/Uganda: Bank transfers may take longer.

Overall, LemFi is one of the fastest international money transfer apps available.

LemFi Transfer Limit Per Day

The daily transfer limit on LemFi depends on your verification status:

- Unverified accounts: Low limits (often capped at $200–$500).

- Verified accounts: Higher limits, often several thousand dollars daily.

Completing your LemFi verification ensures you can send larger amounts without restrictions.

How to Delete LemFi Account?

If you want to close your LemFi account:

- Open the app and go to Profile Settings.

- Select “Delete Account”.

- Confirm your choice.

Alternatively, contact support@lemfi.com or the LemFi customer service number for assistance.

Does LemFi Work in the USA and Canada?

Yes, LemFi works in both the USA and Canada. In the US, users can fund accounts via auto-deposit, while in Canada, the main method is Interac e-Transfer. From these countries, you can send money to multiple African nations instantly.

This makes LemFi one of the best fintech solutions for immigrants in North America supporting their families back home.

Is LemFi Safe?

Yes, LemFi is safe to use. It is licensed and regulated by authorities in the UK, Nigeria, and Canada. The app uses bank-level encryption to secure transactions and requires identity verification (KYC) to prevent fraud.

While some users report occasional delays, the majority of transfers are fast, reliable, and secure. Combined with zero transfer fees, LemFi stands out as a trustworthy financial tool.

Conclusion

LemFi (formerly Lemonade Finance) has gained popularity for its quick money transfers and the simplicity of holding multiple currencies in one virtual wallet.

If you’re wondering how to use LemFi, the app makes it easy to send and receive money across borders, manage various currencies, and complete transactions securely—all in just a few steps.

Frequently asked questions

Is it possible to convert Naira to pounds using Lemonade?

You can use the Lemonade Finance app to send and receive money from Africa and save funds in different currencies.

What is the maximum amount I can send on Lemonade?

Your bank may limit you to $5,000 per day, or it may not. Lemonade’s prior daily transfer limit was $2000 (CAD) for Canada and £1000 for the United Kingdom

Recommendations

How to Use KoraPay: A Comprehensive Guide

How to use Trove: buy stocks, invest abroad & more