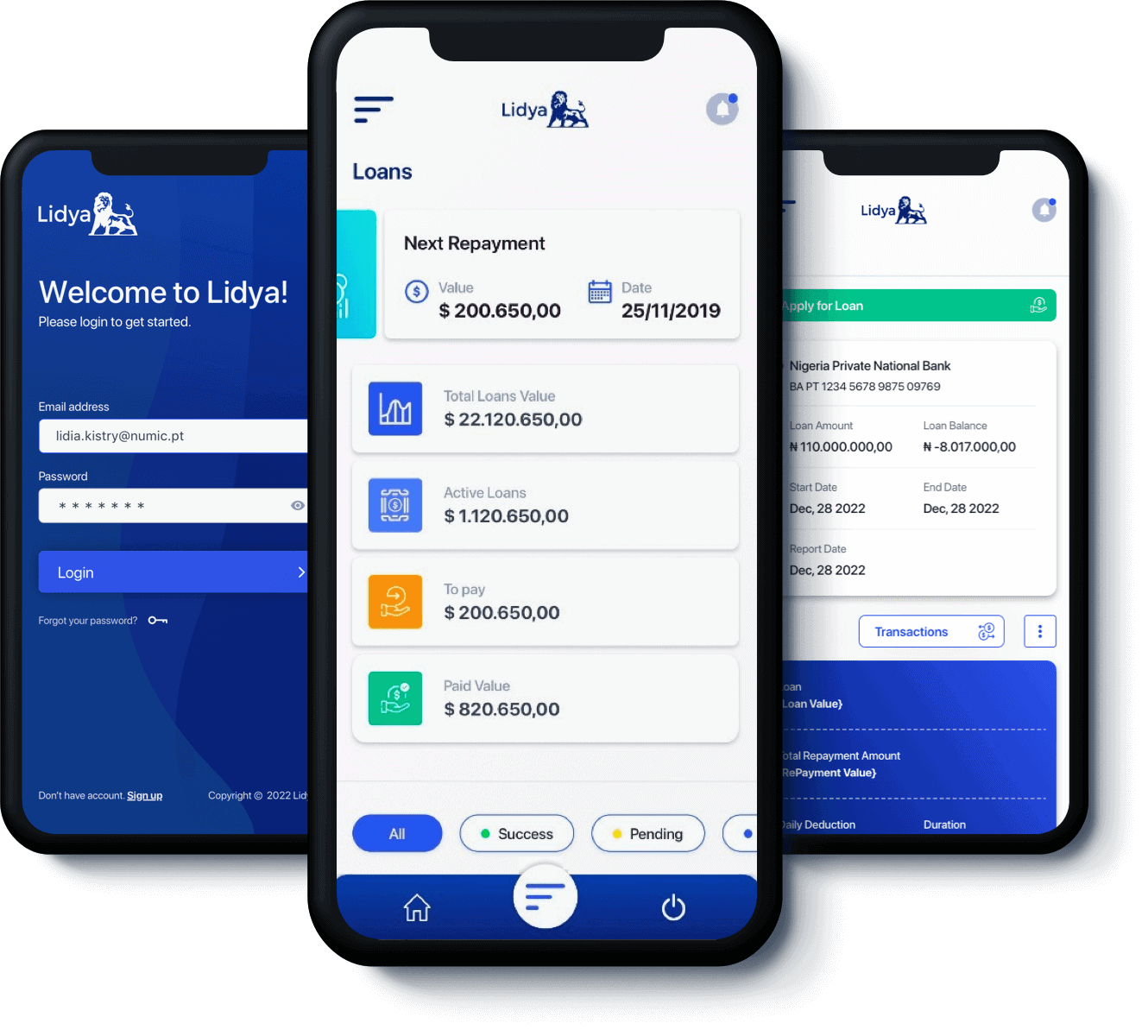

Are you in need of quick and easy access to cash, but not sure where to start? Look no further than the Lydia Loan App! With its user-friendly interface and straightforward application process, Lydia is revolutionizing the way we access credit.

But for a person in the initial stages of acquaintance with digital lending, it can become a bit cumbersome. That is why we have prepared this step-by-step guide on how to use Lydia for beginners.

Through this article, you’ll be guided through downloading and installing the Lydia app to understand how to use it. You will learn how to go through the features, make applications for loans, and know the ways of repayment.

By the end of this tutorial, you will be able to know how to use Lydia Loan App with confidence as you reach your financial goals. So let’s dive right into the world of Lydia!

Table of Contents

About Lydia

Lidya is a digital finance company that makes working capital loans to small businesses around the world. It was founded in 2015 and is based in New York City, operating currently in Nigeria, Poland, and the Czech Republic.

Lidya loans are cash-flow-based and don’t require traditional collateral. The goal of Lydia is to make credit access easy, fast, and headache-free to help users cover unexpected expenses, finance big purchases, or build credit.

To apply, businesses will be required to create an account through the Lidya platform and upload some basic information about their business and financial history. Lidya then evaluates the creditworthiness of the business and makes a loan offer.

If the business accepts the loan offer, they will be required to link their bank account to the Lidya platform. Lidya will then disburse the loan funds directly into the business’s bank account.

Related – A User’s Guide on How to Use Social Lender to Request and Repay Loans

What Features Does Lydia Offer?

So, you want to know what Lydia offers? Well, let me tell you-it’s packed with features that make managing your finances a breeze! Here are some of the awesome things you can do with the Lydia App:

- Easy Loan Applications: Need some extra cash? The Lydia App lets you apply for loans quickly and easily, right from your phone. No more tedious paperwork or long lines!

- Fast Approval and Disbursement: Once you’ve applied, the Lydia App gets to work fast. You’ll get approved in no time, and the funds will be disbursed directly into your bank account.

- Flexible Repayment Options: Well, we do realize that life is unexpected; thus, Lydia App gives flexible repayment options. You can choose a plan that works for you so that you can stay on top of your finances.

- Real-time Transaction Updates: Through the Lydia App, you will never be out of the loop. You get real-time updates on your transactions that help in keeping up with your financial standing.

- Secure and Reliable: Security is the orientation of Lydia’s app. Your data is secured, and your transactions are protected. Rest assured, your finances are safe with Lydia App.

Also Read – How to use LemFi: A beginner’s comprehensive guide

How to Use Lydia: Step-by-Step Guide

Here’s a step-by-step guide on how to use Lydia:

Downloading and Installing the Lydia App

- Go to the App Store or Google Play Store: Depending on the device used, the Lydia App shall be searched in the App Store for iOS devices or on Google Play Store for Android devices.

- Download and Install the App: Click the “Get” or “Install” button to download and install the Lydia App on your device.

- Launch the App: Tap the Lydia App icon after installation to open it.

Signing Up and Creating an Account

- Tap “Sign Up”: On the Lydia App home screen, tap the “Sign Up” button to create a new account.

- Enter Your Details: Provide the required personal details, including your name, email address, phone number, and password.

- Account verification: Lydia sends the code via SMS/call or email, in which you are to validate such an account.

Loan Application Process

- Tap “Apply for a Loan”: Once landed on Lydia App home/dashboard, tap “Apply for a Loan”.

- Amount Application: You will select the loan amount to borrow with your preferred repayment term.

- Provide Additional Information: You will be required to give more information such as your income, employment status, or bank account details.

- Submit Your Application: Check your application and submit for approval.

Repaying Your Loan

- Check Your Repayment Schedule: Once your loan is approved, check your Lydia App for your repayment schedule.

- Make Repayments: You shall make your repayments by following the instructions on the Lydia App.

- Track your Repayment: Follow your repayment on the Lydia App dashboard.

Manage Your Account

- Check Balance: See your account balance and transaction history on the Lydia App.

- Profile Update: Change your name, email, and phone number on your profile.

- Support: For any questions or problems, Lydia’s customer support is available to assist you.

That’s it! Follow these easy steps to get started with Lydia for loan access and financial management.

Read Also – How to use Trove: buy stocks, invest abroad & more

What Information Does One Need to Apply for a Loan?

The following are the details one needs to apply for a loan on Lidya:

- Personal Information: Full name, residential and business addresses, and BVN.

- Financial Documents: Last 6 months of bank statements in PDF and TIN.

- Identification: A government-issued photo ID and a utility bill.

- Business Documentation: CAC Certificate. This is not needed for an individual.

- Contact Details: Next of kin’s name, address, phone number, and relationship.

With these, you have it easy to apply for a loan on Lydia.

Is Lidya legit?

You may ask if Lidya is the real deal. Let us allay your fears! Lidya is quite legitimate, and they have all the credentials to prove it.

For instance, Lidya is incorporated under the Securities and Exchange Commission, Nigeria, meaning that their accountability and transparency are at very great heights.

They boast of being members of the Fintech Association of Nigeria, which goes to underscore our commitment to innovating and improving the financial landscapes within this space.

That’s not all, Lidya is also backed by some of the big names in the industry, like Google Ventures, Visa, and Partech. These investors believe in Lydia’s mission to make finance more accessible and affordable for everyone.

Whether you are a business owner looking for a loan or an individual seeking financial guidance, you can trust Lidya has got your back.

Also Read – How to use Aella Credit App: Everything you need to know

Benefits of Using Lydia For Loans

If you are considering Lydia for a loan application, here are great benefits of it that would make the application stand out:

1. Seamless Application Process

Application for a loan with Lydia is pretty easy: just link your bank account and upload recent bank statements. Easy peasy, in just a few clicks from your phone!

2. Fast Approval

The best thing, though, with Lydia is the speed: you can get a loan proposal in 1-2 business days. No long queues here!

3. Fast Disbursement

After approval, you actually get quick access to funds in just 2-3 days. That is ideal for any business in dire need of cash flow support.

4. No Collateral Needed

Unlike traditional loans, Lydia does not require collateral, which is probably an easier way for lots of users to get money without risking their properties.

5. Real-Time Financial Insights

Through the app, insights into one’s financial health are availed. This helps in better cash flow management and making prudent decisions about finances.

6. User-Friendly Interface

The Lydia application is friendly and intuitive; it’s very easy to use, even for non-tech-savvy people. You can find whatever you need without any problem.

7. Flexible Loan Options

Depending on your needs, Lydia offers various loan amounts and repayment terms, letting you choose what works for you.

With Lydia, it’s going to be a quantum leap for persons and businesses into simplified loan access. Why wait? Create your Lydia account and dive into this whole new world of easy financing today!

Frequently Asked Questions

How long does it take for loan approval on Lydia Loan App?

The time taken varies in most cases, but many get their results in minutes from the time the application was thrown.

How does Lydia charge interest rates, and are there fees on the loans?

Interest rates and fees on Lydia loans vary depending on the amount you will be borrowing, your repayment term, and possibly many more other factors. You’ll have an opportunity to see the loan’s terms and conditions, such as interest rates and associated fees, before accepting the offer of credit.

Is It Possible to Repay Lydia Early?

Yes, you can repay your Lydia loan without penalty. In fact, paying off early will save you some interests accrued on the loan.

Is my personal and financial information safe with the Lydia Loan App?

Yes, the Lydia Loan App secures your personal and financial information by deploying robust security through encryption and secure servers.

Conclusion

These few steps should have taught you how to use Lydia and, importantly, the Lydia Loan App. You can now be more sure and navigate the different features that come with this application with complete assurance.

This will put you in a position whereby you can always use Lydia whatever respect and nothing would seem particularly challenging for its usage, such as loan request, balance, and repayments.

Take control of your money with Lydia: simple, easy, and at the tip of your fingers.