Want to know how to use Branch? Well, this application is a game-changer in managing one’s finances, making it so easy to handle loans and payments as never before.

With its user-friendly interface and powerful features, Branch empowers you to take control of your financial life right from your smartphone.

Be it to send money, request a loan, or track your spending-the Branch app has got you covered.

You might be wondering about branch usage and how it can fit into your daily routine. Don’t worry; we’ll break everything down into simple steps.

In this guide, we’ll explore how to use the Branch app effectively, from setting up your account to navigating its various features.

By the end of this article, you will be well equipped in using Branch for efficient and easy financial management. So let’s get started to explore how this application can change the paradigm of money management.

Table of Contents

What is Branch, and How Does It Work?

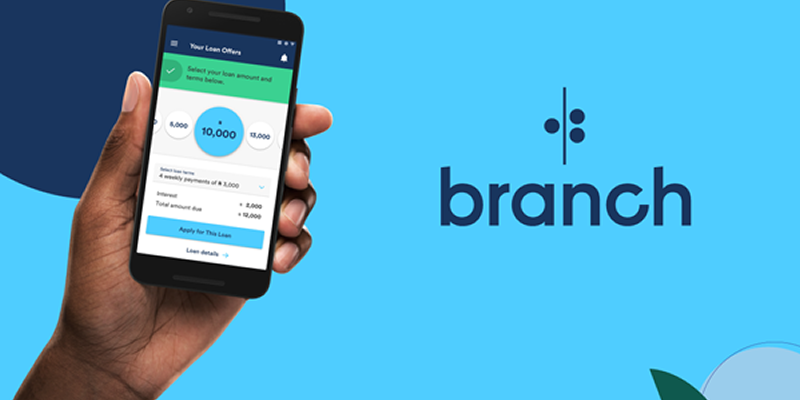

Branch is a mobile application that seeks to make banking and other financial services more accessible and convenient, especially for people in emerging markets like Nigeria and India.

It offers a number of features that enable users to make the most of managing money without any need for an underlying banking infrastructure in conventional terms.

Branch evaluates one’s creditworthiness through data from your smartphone-what’s in your call records and SMS.

That means that even without a credit record, access is available to every type of financial service one may want. The App looks so friendly that any person can orient himself easily with its features.

Branch helps one rise by empowering him with those facilities in which he gets financial stability by just using this small application of Branch on their cell phones.

Related – A Comprehensive Guide on How to Use Carbon App For Beginners

Application Features of Branch

The simplicity, accessibility, and customer-centricity of Branch lie in its appeal; some of the key features include:

- Instant Loans: Probably one of the most utilized features of Branch is the fact that it gives instant loans. Users can apply for small personal loans directly through the app, and often receive funds within minutes.

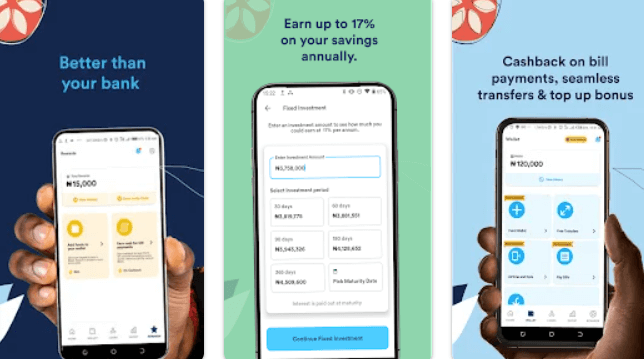

- Money Transfers: Branch simplifies the work of sending and receiving money. This option is quite important because those people who want to send cash to their families or friends do not necessarily have to go to a bank.

- Bill Payments: It is possible to pay bills, right from the comfort of one’s house after paying through the application, thus easing the burden of managing one’s monthly expenses.

- Savings and Investments: The Branch is also meant to save money for investment options to help in financial growth over time.

How to Use Branch App : Step by Step Guide

To know how to use Branch app for loans, follow these steps:

- Download the App: Search for “Branch Loan App” on Google Play Store or App Store and install it.

- Create an Account: Open the app, tap “Sign Up,” and enter your details. Verify your phone number with a One-Time Password (OTP).

- Complete Your Profile: Provide personal information, including BVN and a selfie.

- Apply for a Loan: You choose your required loan amount and select your payment term. After which you can apply.

- Get Fund: Once approved, cash would be transferred into your bank account soon.

Read Also – How to Use MFS Africa as a First Time User

Branch Loan Requirement

The most interesting part, perhaps, which you may want to know and also how to borrow a loan from the Branch app.

Each loan application has a set of requirements and interest rates they work within to comfortably offer their services to the customers, and Branch is no different; they have some loan limits depending on the customers’ repayment status and history.

You have to have made transactions using the Branch Loan app in the past months, verify your account with all the means of verification, before you can borrow a loan.

It is much more than an online loan app with which to borrow instant cash. It is also an online banking app in Nigeria through which you can transfer money, get 2% cash back for every bill you pay, invest to earn up to 15% returns, and borrow money. It’s the ultimate cash app with over 40 million downloads and counting.

What Are the Benefits of Using Branch?

Basically, Branch is a digital finance platform that comes with numerous benefits, especially for users in Nigeria. The following are some of its benefits.

- No Charges on Money Transfers, No Limitations: No more transaction fees! With Branch, transfer and receive money as much as you want without extra charges.

- Instant Loans: Need cash in a hurry? Branch offers instant loans of up to ₦500,000 with no paperwork or collateral. It’s an easy way out to get financial help in your hour of need.

- High-Interest Return Investments: Grow your savings with Branch! The platform offers a competitive **20% annual return** on investments, way higher than what is usually offered by traditional banks.

- Easy-to-use Interface: Never had it easier with your finances. The Branch application is intuitively designed; hence, managing one’s money becomes really simple for any person.

- Convenient Bill Payments: Sick of juggling between bills? Well, you could pay your bills directly from the Branch application without any extra hustle.

- Financial Insights and Management Tools: Be ahead in the understanding of your money through valuable insights and tools that assist in tracking expenses, setting budgets, and meeting your goals.

- Security and Security Measures: We believe that security matters most. Accordingly, Branch incorporates heavy security in personal and financial data.

- 24/7 Customer Support: Stuck with any questions? For whatever help or support needed anytime, it’s been accountable through reliable customer care of Branch.

Using Branch not only simplifies your financial transactions but also empowers you to make smarter financial decisions!

Read Also – A Beginner’s Guide on How to Use the M-Pesa App: What You Need to Know

Can You Trust Branch?

Branch is generally considered a legitimate financial service provider, offering instant loans and investment options with competitive interest rates.

Users report positive experiences with quick loan disbursements and low fees, although some have noted issues with customer service and repayment notifications.

The app has over 10 million downloads and is backed by reputable investors, which adds to its credibility.

However, as with any financial service, it’s wise to exercise caution and read user reviews to ensure it meets your needs4.

How to Manage Your Loans on Branch?

So, you’ve taken out a loan on Branch and now you’re wondering how to use Branch to manage it effectively? Managing your loan on Branch is easy and straightforward. Here’s a step-by-step guide to help you stay on top of your loan repayments.

- Check Your Loan Details: First, log in to your Branch account and navigate to the “Loans” section. Here, you’ll find all the details of your loan, including the loan amount, interest rate, and repayment schedule.

- Make Repayments: To make a repayment, simply click on the “Make a Payment” button and follow the prompts. You can repay your loan using your debit card, bank account, or mobile money.

- Track Your Repayment Progress: Branch allows you to track your repayment progress easily. You can view your repayment history, see how much you’ve paid, and check your outstanding balance.

- Adjust Your Repayment Schedule (If Needed): If you’re having trouble making repayments, you can adjust your repayment schedule on Branch. Simply contact Branch’s customer support team, and they’ll work with you to find a solution.

By following these steps and tips, you’ll be able to manage your loans on Branch effectively and achieve financial stability.

Frequently Asked Questions

How long does it take to get approved for a loan on the Branch app?

Approval times on the Branch app vary, but most users receive a decision within minutes of submitting their application.

Can I repay my loan early on the Branch app?

Yes, you can repay your loan early on the Branch app without penalty. In fact, repaying your loan early can help you save on interest charges.

Is my personal and financial information secure on the Branch app?

Absolutely! The Branch app uses robust security measures, including encryption and secure servers, to protect your personal and financial information.

What are the fees associated with using the Branch app?

Branch is transparent about its fees, which include interest rates on loans and late payment fees. You can view the terms and conditions of your loan, including fees, before accepting the loan offer.

Conclusion

And there you have it! With this comprehensive guide, you’re now well-equipped to navigate the Branch app like a pro.

You’ve learned how to use Branch to apply for loans, manage your account, and track your finances. By following these simple steps, you’ll be able to make the most out of the Branch app and achieve financial stability.

Remember, effective branch usage is all about staying on top of your finances and making smart decisions.