The fintech landscape in Africa has witnessed remarkable growth over the past few years, driven by increasing smartphone penetration, a young population, and a pressing need for accessible financial services.

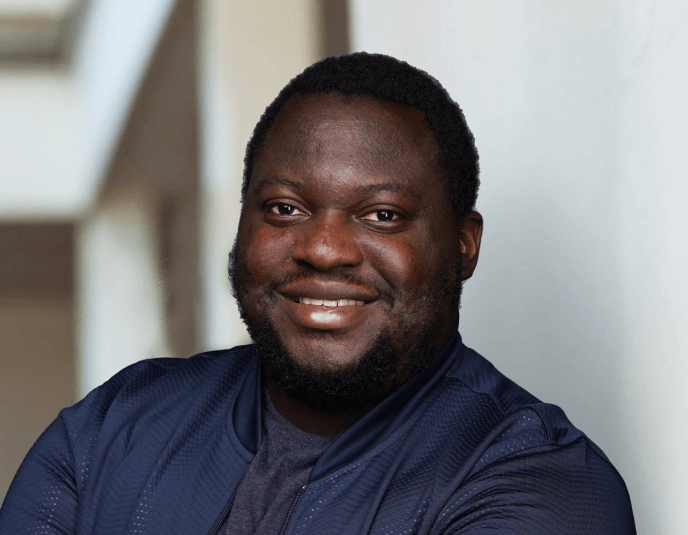

Among the key players in this transformative space is Ham Serunjogi, the co-founder and CEO of Chipper Cash, a company that has revolutionized cross-border mobile payments across the continent.

Background on Ham Serunjogi and Chipper Cash

Ham Serunjogi was born in Uganda, where he was exposed to the challenges of financial transactions from an early age. He pursued higher education at Grinnell College in Iowa, graduating in 2016 with a degree in Economics.

His academic background laid the foundation for his future endeavors in fintech, equipping him with insights into economic systems and financial operations.

In 2018, Serunjogi co-founded Chipper Cash alongside Maijid Moujaled, whom he met during their studies at Stanford University.

Their shared experiences as international students grappling with the complexities of sending money home inspired them to create a solution that would simplify cross-border payments.

Chipper Cash launched with a vision to provide a zero-fee platform for peer-to-peer money transfers across Africa.

The company’s business model leverages mobile technology to facilitate seamless transactions without the high costs typically associated with traditional remittance services.

Overview of Chipper Cash’s Business Model and Services

Chipper Cash offers a range of services that cater to various financial needs:

- Cross-Border Mobile Money Transfers: The core service allows users to send money across several African countries without incurring fees.

- Buy-Now-Pay-Later (BNPL): This feature enables users to purchase goods and pay for them over time, enhancing financial flexibility.

- Investment Opportunities: Users can also invest in various financial products through the platform.

Chipper Cash operates in multiple countries, including Nigeria, Ghana, Uganda, Kenya, Tanzania, and Rwanda, making it one of the most expansive fintech services on the continent.

Read Next: Marwen Amamou- Founder of Paymee, Offering Online Payment Gateway for Businesses

Chipper Cash’s Approach to Cross-Border Payments in Africa

Cross-border payments in Africa face several hurdles:

- Fragmented Financial Systems: Diverse currencies and varying regulations complicate transactions.

- High Costs: Traditional remittance channels often involve exorbitant fees and lengthy processing times.

Chipper Cash addresses these challenges through innovative strategies:

- Mobile Money Integration: By allowing users to link their existing mobile money accounts, Chipper Cash facilitates easy transfers across different networks.

- Low-Cost Transfers: The platform’s zero-fee model significantly reduces costs for users compared to traditional methods.

- Partnerships with Local Banks: Collaborating with local banks and mobile operators enhances service delivery and expands reach.

This approach is particularly beneficial for underbanked populations who may lack access to traditional banking services.

Impact and Growth of Chipper Cash

Since its inception, Chipper Cash has experienced explosive growth:

- User Adoption: The platform has attracted millions of users across its operational territories, highlighting its appeal and effectiveness.

- Strategic Partnerships: Collaborations with financial institutions like Standard Chartered Bank have enabled Chipper Cash to enhance its service offerings.

- Market Expansion: The company continues to explore new markets and services, including plans for further geographical expansion into Zambia through its acquisition of local fintech Zoona.

Chipper Cash’s achievements have not gone unnoticed; it has garnered numerous awards recognizing its impact on financial inclusion across Africa.

Read Next: Tshepo Moloi – Founder of StokFella, Supporting Communal Savings

Challenges and Future Outlook

Despite its successes, Chipper Cash faces several challenges:

- Regulatory Compliance: Navigating different regulatory environments across African countries can be complex.

- Competition: The fintech space is crowded with both startups and established financial institutions vying for market share.

To sustain its growth trajectory, Chipper Cash is focusing on:

- Innovative Solutions: Continuously enhancing its product offerings to meet evolving customer needs.

- Strengthening Partnerships: Expanding collaborations with global players like Visa to enhance its service capabilities.

As a leader in the fintech sector, Chipper Cash plays a crucial role in driving financial inclusion and economic development across Africa.

Conclusion

Ham Serunjogi’s vision for Chipper Cash embodies a commitment to making financial services accessible and affordable for all Africans.

Through innovative solutions that address the unique challenges of cross-border payments, Chipper Cash has established itself as a significant player in the African fintech landscape.

With ongoing growth potential and an expanding suite of services, the future looks promising for both Ham Serunjogi and Chipper Cash as they continue to redefine mobile-based payment solutions across the continent.

FAQs Section

1. What is Ham Serunjogi’s main contribution to fintech?

Ham Serunjogi’s primary contribution lies in founding Chipper Cash, which has transformed cross-border payments by providing zero-fee transfer services across several African nations.

2. How did Chipper Cash gain international recognition?

The company gained international recognition through rapid user growth, innovative solutions tailored to local needs, strategic partnerships, and significant investment from prominent venture capital firms.

3. What impact has Chipper Cash had on the African fintech ecosystem?

Chipper Cash has enhanced financial inclusion by offering affordable payment solutions that cater to underbanked populations while fostering competition among fintech players.

4. What is Ham Serunjogi’s leadership style?

Ham Serunjogi’s leadership style is characterized by innovation-driven decision-making, a focus on customer needs, and strategic partnerships that empower his team and enhance service delivery.

Dratech International celebrates industry giants like Ham Serunjogi for their contributions to technological advancement and economic empowerment within Africa’s burgeoning fintech sector.

References