How to use eTranzact to make payments. Talking about managing money in today’s digital world, it’s no secret that digital payments have become incredibly important.

We’re constantly looking for quick, easy, and safe ways to handle our finances, whether it’s paying bills, sending money to family, or shopping online.

It can feel a bit overwhelming to keep up with all the different payment options available, right? That’s where platforms like eTranzact come in.

eTranzact has become a major player in the African financial technology scene, offering a range of electronic payment solutions designed to make life easier.

Think of them as a bridge connecting banks, businesses, and everyday people, helping money move smoothly and securely between them.

Now, understanding how to use these digital tools is key. It’s not just about keeping up with the times; it’s about taking control of your finances and making them work for you.

Knowing how to use eTranzact to make payments, for instance, can save you time, reduce stress, and open up a world of convenience.

Imagine being able to pay your electricity bill from your phone in the middle of the night or sending money to a loved one instantly, no matter where they are. That’s the power of digital payments done right.

This article is designed to be your friendly guide to navigating the world of eTranzact. We’re going to break down everything you need to know, step by step, about how to use eTranzact to make payments.

We’ll start with the basics, explaining what eTranzact is and why it’s so useful. Then, we’ll walk you through the process of setting up an account, which is simpler than you might think, and lots more! So let’s get started.

Table of Contents

What is eTranzact?

eTranzact is a Nigerian-owned electronic payment platform that provides financial services to individuals, businesses, and government agencies.

Founded in 2003, the company has become one of Africa’s leading fintech providers, processing millions of transactions daily. The platform operates across multiple channels, including online payments, mobile banking, POS systems, ATMs, and corporate disbursements.

eTranzact is licensed by the Central Bank of Nigeria (CBN) and partners with top financial institutions across Africa. Its flagship products include PocketMoni (mobile money), Corporate Pay (bulk disbursement service), and Switching & Processing Services (connecting banks, merchants, and customers).

The meaning of eTranzact is derived from “electronic transactions.” It represents the company’s mission to simplify payments using technology. Instead of relying on manual cash handling or lengthy bank processes, eTranzact enables quick, secure, and cashless transactions through multiple channels.

At its core, eTranzact is a payment switch that connects banks, merchants, and users, allowing them to process different types of transactions on one platform. It covers card payments, mobile money, internet banking, and POS services.

The meaning of eTranzact also extends to financial inclusion. Through PocketMoni, its mobile money service, unbanked individuals can access financial services via agents and mobile phones. This makes it an essential tool in bridging the gap between urban and rural financial access in Nigeria and beyond.

With eTranzact Nigeria, users can send and receive money, pay bills, purchase airtime, and shop online conveniently. It also supports international remittances, making it a flexible solution for global payments. Today, eTranzact International Plc operates not only in Nigeria but also in Ghana, Zimbabwe, and several other countries.

Related: A Comprehensive Guide on How to Use the Yoco App for Seamless Transactions

What is an eTranzact Payment?

eTranzact payment refers to any financial transaction carried out using the eTranzact platform. It covers a wide range of services, including online shopping payments, mobile money transfers, utility bill payments, airtime top-ups, school fees settlement, and government service payments.

When a customer chooses eTranzact at a checkout portal or payment gateway, the system connects directly with the bank or wallet, ensuring secure and real-time processing. Businesses and merchants also rely on eTranzact payment solutions for bulk payouts, such as salary disbursements or vendor payments, through the Corporate Pay platform.

Unlike traditional banking systems, eTranzact payments are fast, cashless, and available 24/7. It also provides users with digital receipts and detailed transaction histories. Whether made via the PocketMoni app, eTranzact POS, or web portal, these payments are encrypted for security.

In short, eTranzact payment ensures seamless financial transactions for both individuals and organizations, bridging the gap between digital finance and real-world needs.

Setting Up Your eTranzact Account

To start using eTranzact, you need to create an account. Here’s how:

Visit the official website or download the app: You can access eTranzact through its website or by downloading the mobile app available on Android and iOS.

Provide necessary personal information: Fill out the registration form with your details such as name, phone number, and email address.

Verification process: Depending on your region and the services you wish to use, you may need to verify your identity through email or SMS.

How to Use eTranzact?

Using eTranzact depends on whether you’re an individual, a merchant, or a corporate user. For individuals, the easiest way is through the PocketMoni app, which lets you:

- Open a mobile wallet.

- Fund it through your bank or an agent.

- Transfer money, buy airtime, and pay bills.

- Withdraw cash at an eTranzact agent.

For businesses, eTranzact offers Corporate Pay, which allows bulk salary or vendor disbursements directly to employees’ bank accounts or wallets. Merchants can also integrate WebConnect for online payments or use eTranzact’s POS devices for card transactions.

The platform is highly versatile, functioning as a payment switch, mobile money operator, and transaction processor. By providing multiple financial services in one ecosystem, eTranzact makes payments simple, inclusive, and borderless.

eTranzact offers multiple payment methods that cater to different user needs:

- Mobile money transfers

- Credit and debit card payments

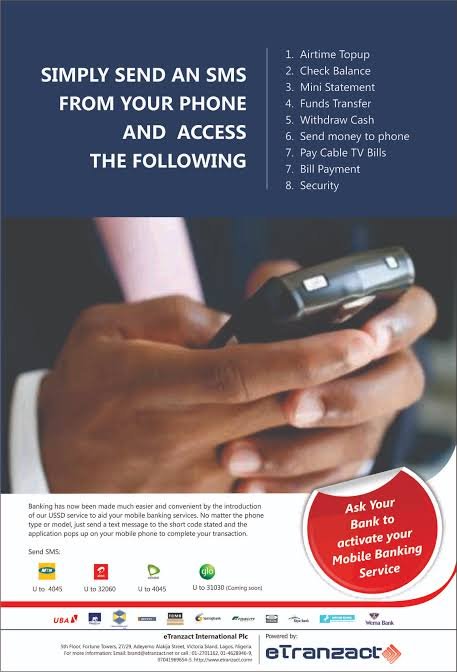

- USSD transactions

Step-by-Step Payment Process

1. Using Mobile Money

- Dial the USSD code *389# on your mobile phone.

- Select the payment option from the displayed menu.

- Enter the amount you wish to pay and confirm the transaction.

- You will receive a transaction confirmation via SMS.

2. Using Credit/Debit Cards

- Access an online merchant site that accepts eTranzact.

- Choose products or services and proceed to checkout.

- Select eTranzact as your payment method.

- Enter your card details securely (card number, expiry date, CVV).

- Confirm your payment and receive a receipt via email or SMS.

3. Using WebConnect

- Navigate to the WebConnect platform through the eTranzact website.

- Select the type of transaction you want (e.g., bill payments).

- Fill in all required details accurately.

- Submit your transaction for processing.

How to Pay with eTranzact Online?

To pay online using eTranzact, follow these steps:

- Select eTranzact at Checkout – While shopping or paying for services online, choose eTranzact as your payment provider.

- Enter Payment Details – Provide your card number, wallet ID, or bank account linked to the eTranzact system.

- Verify Your Identity – Confirm the transaction using a PIN or OTP sent to your registered phone/email.

- Payment Confirmation – Once processed, you’ll receive an eTranzact receipt showing the transaction details.

Online payments with eTranzact are supported by multiple banks and can be made via the PocketMoni app or eTranzact web portal. This ensures users can pay bills, tuition fees, shop online, or subscribe to services without stress.

The system is secure, fast, and reliable, using encryption technology to protect sensitive financial data. Businesses also benefit from webconnect payment integration, which allows customers to pay seamlessly on e-commerce websites.

Types of Payments You Can Make with eTranzact

eTranzact supports a wide range of payments:

- Bill payments: Pay for utilities like electricity, water, and internet services seamlessly.

- Purchasing airtime and data bundles: Easily recharge your mobile phone or buy data plans.

- Making donations: Contribute to charitable organizations or causes directly through the platform.

- Bulk payments for businesses: Efficiently handle payroll disbursements or supplier payments.

Related: A User’s Guide on How to Use Social Lender to Request and Repay Loans

eTranzact Mobile Money

eTranzact mobile money is branded as PocketMoni, a service that brings financial services to people without traditional bank accounts. With PocketMoni, users can:

- Open a mobile wallet with just a phone number.

- Send and receive money instantly.

- Pay bills (electricity, DSTV, water, etc.).

- Purchase airtime and data.

- Withdraw cash at agent locations.

PocketMoni agents are spread across Nigeria, providing last-mile access to rural communities. This service is regulated by the Central Bank of Nigeria and works in partnership with multiple banks.

For businesses, PocketMoni provides bulk disbursement services for salary payments and financial aid programs. It has helped promote financial inclusion, giving millions of Nigerians easy access to digital payments.

In short, eTranzact mobile money (PocketMoni) is a reliable, secure, and convenient solution for everyday financial transactions.

How to Use eTranzact PocketMoni

eTranzact PocketMoni is a mobile money service in Nigeria that allows users to send and receive money, pay bills, and perform various financial transactions conveniently.

It operates through a mobile application and offers instant processing of transactions across multiple channels. Users can register via SMS or the app, and it provides a secure platform with customer support.

PocketMoni is licensed by the Central Bank of Nigeria, making it a trusted option for mobile payments and financial services in the country.

To use eTranzact PocketMoni, follow these steps:

1. Register: Create an account via the PocketMoni portal or mobile app.

2. Fund Your Account: Deposit money into your PocketMoni account using bank transfers or other supported methods.

3. Transact: You can send money, pay bills, or perform other transactions through:

- Online Portal: Log in to your account on the website.

- Mobile App: Use the app for easy access and transactions.

- USSD Code: Dial *389*00# from your registered mobile number for quick access.

eTranzact App

The eTranzact app, known as PocketMoni, is a mobile application that enables seamless transactions from smartphones. Available on Android and iOS, the app allows users to:

- Register for a mobile money wallet.

- Fund their accounts using bank transfers or agents.

- Send and receive money across Nigeria.

- Pay utility bills, school fees, and subscriptions.

- Withdraw money through agents or linked bank accounts.

The eTranzact app download is free, and once installed, users can manage their financial activities conveniently. It also features transaction receipts, account management, and agent locators.

For corporate users, there are customized eTranzact apps for bulk payments and transaction monitoring. The PocketMoni app ensures that both urban and rural users enjoy financial services at their fingertips, promoting cashless transactions and financial inclusion.

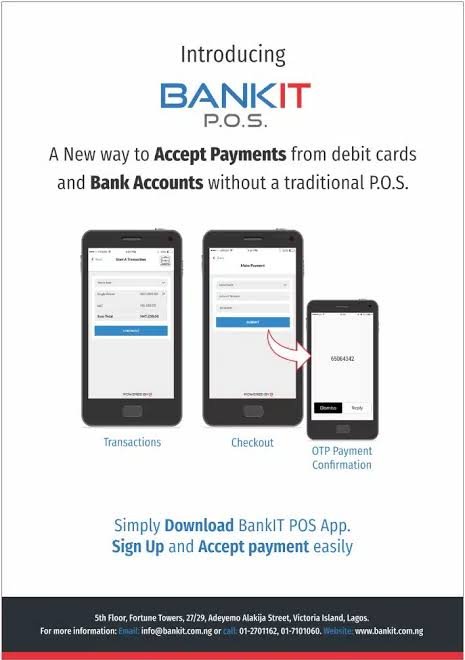

How to Use eTranzact BankIT P.O.S

eTranzact BankIT P.O.S is a mobile point-of-sale application that enables merchants to process debit card and direct bank account payments using their smartphones.

Launched by eTranzact International PLC, it eliminates the need for additional hardware, allowing businesses to accept payments directly through the app.

This solution is designed to enhance transaction efficiency and accessibility for merchants, facilitating seamless payment processing without the traditional constraints of physical POS terminals.

BankIT P.O.S integrates with various banking systems, making it a convenient option for both online and in-person transactions.

To use eTranzact BankIT P.O.S, follow these steps:

1. Download the App: Install the BankIT P.O.S application from your mobile device’s app store.

2. Register: If you are a new merchant, register for the service. Existing BankIT merchants can log in with their credentials.

3. Set Up Your Account: Follow prompts to set up your account, including entering necessary business information.

4. Process Payments: Use your mobile phone to accept card payments directly from customers without needing additional devices.

5. Transaction Management: Monitor transactions through the app, allowing you to print receipts and manage sales records.

Ensure your phone is charged and connected to the internet for seamless operations.

Related: How To Use Zeepay to Send and Receive Money in Ghana

Using the eTranzact Platform

The eTranzact platform is a multi-channel payment processing system that supports individual, business, and government transactions. It integrates card payments, bank transfers, POS services, mobile money, and online payment gateways into one ecosystem.

For individuals, it means easy access to financial services through PocketMoni. For businesses, it offers tools like Corporate Pay for bulk disbursements and WebConnect for e-commerce integration. Governments also use eTranzact to process taxes, levies, and utility bills.

What makes the eTranzact platform unique is its switching technology, which connects banks and merchants for real-time payment processing. It is scalable, secure, and built to handle millions of transactions daily.

By bridging traditional banking with modern fintech solutions, the eTranzact platform ensures seamless, safe, and convenient financial services for everyone.

Can i use eTranzact in Ghana?

Yes, you can use eTranzact in Ghana, as the company has expanded its services beyond Nigeria into several African countries, including Ghana. The eTranzact platform in Ghana enables individuals, businesses, and government institutions to carry out seamless electronic payments such as bills, tuition, airtime, and fund transfers.

Users can also rely on the eTranzact app (PocketMoni) for mobile money services, allowing them to send and receive funds instantly without needing a traditional bank account.

Businesses in Ghana benefit from eTranzact payment solutions like Corporate Pay for bulk salary disbursements and WebConnect payment for e-commerce transactions. With regulatory approval, the platform integrates with banks and financial institutions in Ghana, ensuring safe and reliable transactions.

In addition, eTranzact Ghana supports international payments, making it easier for users to transact across borders. Whether through eTranzact mobile money, POS, or online portals, it provides a secure and cashless way to manage finances in Ghana.

Troubleshooting Common Issues

Even with a reliable platform like eTranzact, issues may arise. Here’s how to address them:

What to do if a transaction fails:

- Contact customer support via email or phone by calling 02017101060 or 09087989094 (Lagos Office), Calling 02092927336 (Abuja Office), and Using WhatsApp at 08188639818 for assistance.

- Check for SMS notifications regarding your transaction status.

- Explore FAQs and guides on the official website for self-help options.

Solutions for common problems:

- If your mobile wallet is blocked, reach out to customer support for unblocking instructions.

- For issues with debited amounts not reflecting in accounts, verify transaction details and contact support if discrepancies persist.

Security Measures on the eTranzact app

eTranzact employs robust security protocols, such as:

Data encryption: All transactions are protected with industry-standard encryption technologies ensuring user data remains confidential.

User authentication processes: Multi-factor authentication adds an extra layer of security by requiring additional verification steps during login or transactions.

Conclusion

Making payments using eTranzact is not only easy but also secure and efficient. With its wide range of features catering to both personal and business needs, users can confidently manage their financial transactions.

Whether you’re paying bills or making bulk payments for your business, understanding how to use this platform effectively will enhance your payment experience.

Embrace the convenience of digital payments with eTranzact.

Frequently Asked Questions

1. What is eTranzact?

eTranzact is a Nigerian fintech company that provides electronic payment solutions including mobile banking, online payments, and money transfers across Africa.

2. How does the eTranzact mobile app work?

The app allows users to manage their finances through features like money transfers, bill payments, and account management all from their smartphones securely.

3. What are the transfer fees associated with using eTranzact?

Transfer fees vary based on transaction type; typically around 1% for local transactions and competitive rates for international remittances compared to other providers.

4. How can I reset my eTranzact password?

To reset your password, visit the eTranzact website or open the mobile app. Look for the “Forgot Password” option and follow the instructions provided.

Recommendations

How to Use GTPay to Send and Receive Payments