Tired of the tussles and stress which surround making online payments? Worry no more! Learning how to use Flutterwave will make all the difference.

In this post, we are going to take your hands through all that one should know on how to use Flutterwave for cashless seamless online transactions.

As we delve into the world of Flutterwave, you will find out how to use Flutterwave for payment as a business owner, freelancer, or individual who wants to make online payments with ease.

We are also going to dive into details on how to use the Flutterwave app to make it easy for you to use and maximize the benefits that come with it.

You should have confidence by the end of this article and, surely, be able to kick-start your journey into making magic happen with Flutterwave. Now, let’s take an intriguing journey on how to use Flutterwave and simplify online payment processes.

Table of Contents

About Flutterwave

Flutterwave is a payment technology company founded in 2016, based in Nigeria and San Francisco. Its mission is to make it easier for businesses to accept payments both locally and internationally, making it as easy as possible for African entrepreneurs to thrive globally.

With its user-friendly platform, Flutterwave makes it swift for businesses to integrate the only pan-African payment solution with different payment methods, including card and mobile money payments. Such services are secure, cost-effective, and provide quality customer service.

Among other services, Flutterwave offers invoicing and online stores, thus making running a business a whole lot easier with little or no technical knowledge.

Related – How to Use Paga for Seamless Transactions

What Exactly Does Flutterwave Do?

The key features of Flutterwave are as follows:

- Payment processing: Collect payments in multiple currencies and pay out to almost anyone, anywhere in the world with Flutterwave’s APIs and business tools.

- Store: Flutterwave houses an online store that will help you find customers and receive payments from anyone to grow your business with ease.

- Payment Links: You can create a payment link through Flutterwave and share it with customers, and they can click to send money directly to you upon their convenience.

- Invoicing: You will be able to create an invoice for payment, and its invoicing tool will allow tracking of payments.

- Capital: This is the loan product offered by Flutterwave to help businesses grow with easy, flexible loans without any need for collateral.

- Grow: Grow on Flutterwave, seamlessly register your business in the US, UK, or Nigeria from anywhere. Its aim is to remove complexity around paperwork and legal procedures, and it just opened a waitlist for businesses to join.

- Card issuance: You can create, update, and retrieve both virtual and physical cards from the Flutterwave dashboard or through integrating its API. You can request and manage cards for customers or employees for physical Naira cards to keep full control and manage the employee’s expenses at scale.

Read Also – How to Use Cellulant for Seamless Online Payments

What are the Requirements for Using Flutterwave?

The following are the requirements you must have for an easy and efficient experience.

Individual Requirements

- An active email address is needed because it is required during sign-up on Flutterwave.

- A registered phone number is required; it is compulsorily needed at the time of sign-up.

- You must create a strong, unique password to secure your account.

- In some cases, a government-issued ID may be requested, like your driver’s license or passport.

Business Requirements

- Register your business name and obtain any necessary licenses and permits.

- Use a business email address to sign up for a Flutterwave account.

- Provide a business phone number to complete your registration.

- You may be required to provide your tax identification number, such as a VAT number or tax ID.

- Link a business bank account to your Flutterwave account to receive payments.

Technical Requirements

- You will need to have a stable internet connection for access to the Flutterwave platform.

- Access the Flutterwave platform using a compatible device, which includes a smartphone, tablet, or computer. Also, the browser should be updated for better performance.

By meeting these requirements, you can start the process of using Flutterwave to ease your online payment complications.

Also Read – How to use Aella Credit App: Everything you need to know

How to Use Flutterwave

Having understood the basics of Flutterwave, here is how to use Flutterwave.

Ready to simplify your online payment needs with Flutterwave? Here is a step-by-step guide to get you up and running:

Step 1: Creating a Flutterwave Account

- Log onto the Flutterwave website and click the “Sign Up” tab.

- Create an account by entering your email, phone number, and password.

- Verify your email address by clicking the link that Flutterwave will send to your email.

Step 2: Complete Your Profile

- Log in to your Flutterwave account and click “Complete Your Profile”.

- Fill in your personal details, including your name, date of birth, and address.

- Upload a valid government-issued ID, such as a driver’s license or passport.

Step 3: Link Your Bank Account

- Click on “Link Bank Account” and select your bank from the list.

- Enter your bank account details, including your account number and routing number.

- Verify your bank account by entering the verification code sent to you by Flutterwave.

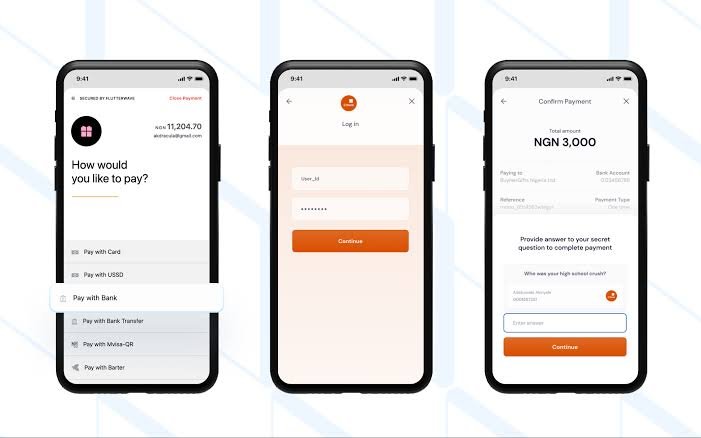

Step 4: Set Up Your Payment Methods

- Click on “Payment Methods” and select your payment options; for example, credit/debit cards and mobile wallets.

- Add payment method details, such as the card number and expiration date.

- Verify your payment method by entering the verification code sent to you by Flutterwave.

Step 5: Make a Payment

- Click “Make a Payment” and fill in the amount to pay.

- Fill in your chosen payment option and details of the payee.

- Verify the information to be correct, confirm payment.

Step 6: Tracking Your Transactions

- Click “Transactions.”

- Track the list of transactions, payments made, and received.

- View Account Balance and Statements of Transactions.

How To Create A Flutterwave Payment Link

- On your Flutterwave dashboard, if you navigate to the Payment Links page, you’ll see an option to >Create Payment Link.

- For a single payment, select >Single Charge while for a payment plan select >Recurring Charge.

- Fill in details of the payment; if you wish to allow your customers to specify the amount to be paid, leave the >Amount field empty otherwise fill in a specific amount.

- Then, click >Create Link to create the link to your payment page.

The payment link will be shown on your dashboard. You can copy and share the link with your clients to make payments using their cards, bank accounts, USSD, etc., as may apply.

Read Also – How to use Risevest for dollar investment, stocks & more

How To Set Up A Flutterwave Store

- In your dashboard, click on >Store, select, >Set up your store.

- Fill in the required information: store name, stall description, store URL, store image, store category, and submit.

Your store is now created! You can now add your product images.

Again, by selling and receiving payments with your already generated payment link, which Flutterwave allows, you can withdraw at any time. This brings us to the final guide.

How To Withdraw Your Money From Flutterwave

Additionally, for you to have your money withdrawn from Flutterwave, follow the steps outlined below.

- From your dashboard, click on >Transfer, then select >New transfer.

- You will select the currency you need to make a transfer in, and enter the amount.

- Enter a new account detail or select an existing recipient.

- Click on >Proceed tab to complete your transfer.

Also Read – How to Use Renmoney: A Step-by-Step Guide

How Much Does Flutterwave Charge?

The fee structure for Flutterwave transaction fees depends on your country or region, your customer’s location, and payment channel.

In Africa, local card transactions start at 1.4%, up to 3.8%, while international cards attract up to 3.8% in fees. In the USA, Flutterwave charges 2.9% for local cards, 4.8% for international cards, and 2.9% for mobile money.

For large-volume or high-value businesses, Flutterwave has a custom pricing deal.

Paystack, Stripe, and DPO Group transaction fees will be different, and so forth. Some are above Flutterwave’s prices, but some may fall in similar ranges.

Moreover, with Flutterwave, you are able to accept many types of currency, and you may not need to worry about extra currency conversion fees.

What Payment Methods Does Flutterwave Support?

With Flutterwave, there are different means by which one could make any payment; hence, more options are opened to the customer for preference. Amongst these options include the following:

- Pay with Cards: Payment via credit or debit card is allowed.

- Pay with Bank Accounts: The payment can be done by bank account transfers.

- Pay with MPesa: Paying through mobile money is allowed.

- Pay with QR Code: It can make the payment via QR code, ensuring speed and safety.

- Pay with Mobile Money: Mobile money payment can be allowed.

- Pay with USSD: USSD payments are also quite available.

- Pay with Bank Transfer: Bank transfers, traditionally.

- Pay with Apple Pay: For customers on Apple devices.

- Pay with Google Pay: Google Pay users will have no problem making the transaction.

Flutterwave is present in several countries, and it allows you to receive payments from all Mastercard and Visa Cards, ensuring that you can cater to a global audience.

Read Also – How To Use Zeepay to Send and Receive Money in Ghana

Benefits of Using Flutterwave

Flutterwave offers a lot of advantages that will make your online transactions very easy. Let’s dive in and explore the advantages of using Flutterwave!

Convenience at Its Best

With Flutterwave, you can make payments and receive money from anywhere in the world, at any time! No more worrying about bank hours or queues. Just log in, make your payment, and you’re done!

Secure Transactions

Flutterwave deploys the highest level of security for your transactions. Your sensitive information is encrypted to ensure your payments are safe and secure. Be rest assured, knowing too well your money is safe!

Multi-payment Options

One of the best things about Flutterwave is that it offers numerous payment options, from credit/debit cards and bank transfers to mobile wallets. You can choose whatever works for you!

Fast and Reliable

Flutterwave processes your payments in a quick and efficient manner. Your transactions go through in real time, meaning you are not wasting any time waiting for the money to arrive.

Easy to Use

The Flutterwave platform is very user-friendly. Even if you aren’t tech-savvy, you’ll find it very easy to maneuver through it and make your desired payments. Besides, the customer support team is always there to help out.

Cost-Effective

With Flutterwave, you enjoy low transaction fees hence its affordability for business and individuals as well. You will be in a position to save some money on transaction fees and invest in growing your business!

Scalability

Whether you are a small or big business, Flutterwave can handle your payments. Their platform is scalable, hence you can grow your business without limitation when it comes to payment!

Real-Time Updates

Flutterwave provides real-time updates on your transactions to track your payments and stay on top of your finances.

In a nutshell, Flutterwave presents convenience, security, and affordability in making and receiving online payments. Its ease of use, variety of payment options, and real-time updates make it the ideal choice for businesses and individuals alike!

Frequently Asked Questions

Is Flutterwave secure?

Yes, Flutterwave is secure. It uses the best security features, like encryption and two-factor authentication, to ensure your transaction and sensitive information are properly safeguarded.

How long does it take for a payment to be processed on Flutterwave?

Payments on Flutterwave are processed in real-time. Once you confirm your payment, it gets immediately processed, and the money will be received instantly by the recipient.

Can I make use of Flutterwave in international transactions?

Yes, Flutterwave supports international transactions. You can make a payment to someone in another country or accept the payments from an international clientele.

What are the transaction charges on Flutterwave?

Flutterwave charges from 1.4 to 3.8 percent in low transaction fees per transaction for different types of transactions and payment methods. To find the most current pricing for Flutterwave, go to the website.

Conclusion

Knowing how to use Flutterwave means changing one’s life and making life much easier concerning online payment.

From our steps on how to use Flutterwave for payment, with time you should be able to conduct smooth transactions. In addition, it will accord you flexibility in terms of managing your payments while on the move.

With Flutterwave, making and receiving payments has never been easier. Try Flutterwave today and see this for yourself!

Recommendations

- How to Use PiggyVest: A Guide to Investing and Saving

- Step-by-Step Process on How to Use eTranzact to Make Payments

- A Comprehensive Guide on How to Use the Yoco App for Seamless Transactions

- A User’s Guide on How to Use Social Lender to Request and Repay Loans

- How to Use GTPay to Send and Receive Payments