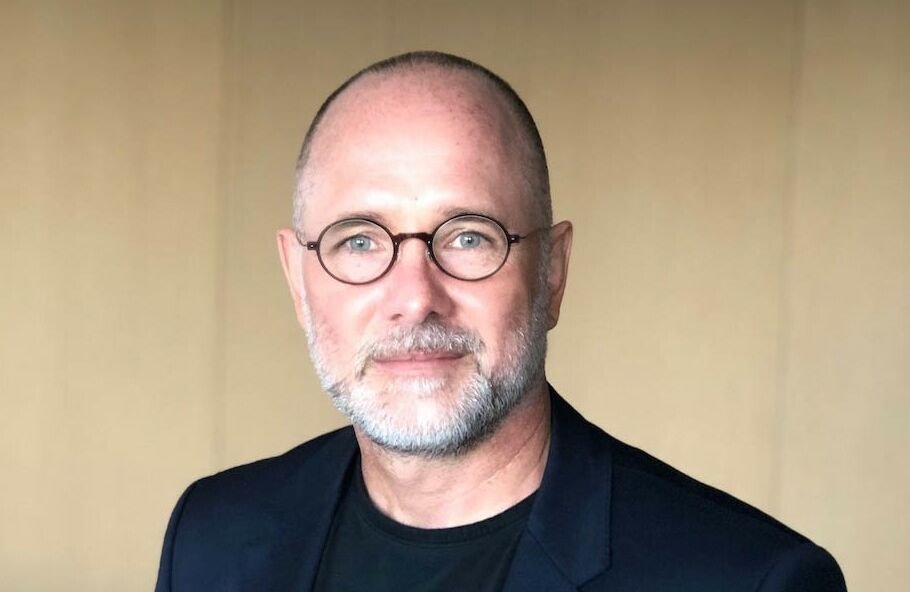

Coenraad Jonker, a prominent figure in the fintech landscape, is the co-founder of TymeBank, a revolutionary digital banking platform that has reshaped how individuals and businesses access financial services in South Africa.

Launched in 2018, TymeBank stands out for its commitment to financial inclusion, targeting underserved communities and providing them with secure and accessible banking solutions.

The rise of digital banking and fintech in Africa is particularly significant as it addresses long-standing issues of financial exclusion, offering innovative solutions that cater to the unique needs of the continent.

Background and Career of Coenraad Jonker

Coenraad Jonker was born and raised in South Africa, where he developed a keen interest in finance and technology.

He pursued his education at the University of the Free State, earning an LLB (cum laude) in 1993, followed by an MBA (cum laude) from the Gordon Institute of Business Science in 2001.

This academic background laid a strong foundation for his future endeavors in the financial sector.

Before co-founding TymeBank, Jonker amassed extensive experience in various leadership roles within the banking industry.

He served as the Director of Inclusive Banking at Standard Bank and held executive positions at Deloitte South Africa and Commonwealth Bank.

His diverse experiences equipped him with a deep understanding of both traditional banking and the emerging fintech landscape, ultimately shaping his vision for TymeBank.

Jonker’s motivation for establishing TymeBank stemmed from a desire to drive economic inclusion and provide accessible financial services to those who have been historically marginalized.

He envisioned a digital banking platform that could leverage technology to simplify banking processes, reduce costs, and empower individuals with tools to manage their finances effectively.

Read Next: Derrydean Dadzie- Founder of Slydepay, A Mobile Payment Platform

TymeBank and its Role in African Fintech

TymeBank operates as a fully digital bank designed to meet the needs of South Africa’s underbanked population.

Its mission centers on creating an inclusive financial ecosystem where every individual has access to essential banking services.

The bank offers a range of core services, including low-cost transactional accounts, high-yield savings accounts, and innovative payment solutions.

Innovative Digital Banking Offerings

1. Fully Digital Platform: TymeBank’s digital-first approach allows customers to open accounts online or at kiosks without the need for extensive paperwork. This streamlined onboarding process is crucial for attracting users who may be intimidated by traditional banking methods.

2. Accessibility and User-Friendliness: The bank prioritizes user experience by providing an intuitive interface that caters to individuals with varying levels of technological proficiency.

3. Mobile Technology Integration: Recognizing the prevalence of mobile devices in Africa, TymeBank integrates mobile technology into its services, enabling users to conduct transactions conveniently from their smartphones.

Addressing Challenges in the African Fintech Landscape

TymeBank plays a vital role in addressing several challenges that hinder financial inclusion across Africa:

- Limited Financial Access: By offering affordable banking solutions tailored for low-income individuals, TymeBank helps bridge the gap between traditional banking services and underserved communities.

- Infrastructure Issues: The bank’s reliance on digital platforms mitigates some infrastructure challenges faced by traditional banks, allowing it to reach customers in remote areas.

- Building Trust: Through transparent operations and customer-centric services, TymeBank works to instill confidence among users who may be skeptical about digital banking.

Read Next: Michael Oluwole: Providing Cashless Transit Solutions as Co-founder of Touch and Pay (TAP)

TymeBank’s Impact and Growth

Since its inception, TymeBank has rapidly expanded its customer base, onboarding over four million clients within just a few years.

Its strategic partnerships with major retail chains like Pick n Pay have facilitated this growth by providing convenient access points for customers.

Collaborations with retail partners not only enhance accessibility but also integrate loyalty programs such as Smart Shopper, which rewards customers for using their TymeBank accounts during everyday purchases.

TymeBank’s focus on low-income customers has resulted in significant impacts on financial inclusion.

The bank’s offerings are designed to meet essential needs while maintaining affordability, thereby improving the quality of life for many users.

With approximately 110,000 new customers joining each month, TymeBank’s growth trajectory indicates strong demand for its services.

The bank’s commitment to innovation ensures it remains competitive within the rapidly evolving fintech landscape.

Challenges and Future Outlook

As with any financial institution, navigating regulatory frameworks is critical for TymeBank’s continued success. Compliance with local laws will remain a priority as the bank scales its operations.

The fintech sector is becoming increasingly competitive with both traditional banks and new entrants vying for market share. TymeBank must continuously innovate to maintain its edge.

Looking ahead, there are opportunities for TymeBank to expand beyond South Africa into other African markets where similar challenges exist regarding financial access.

As digital banking evolves, maintaining customer trust through robust cybersecurity measures will be essential. Investing in technology and customer service will help ensure long-term loyalty.

Conclusion

Coenraad Jonker’s leadership at TymeBank exemplifies the transformative potential of digital banking in fostering economic inclusion across Africa.

By addressing critical barriers to financial access through innovative solutions, TymeBank not only enhances individual lives but also contributes significantly to broader economic development on the continent.

As the fintech landscape continues to evolve, TymeBank is well-positioned to play a pivotal role in shaping the future of banking in Africa.

FAQs Section

1. What is Coenraad Jonker’s main contribution to fintech?

Coenraad Jonker has significantly contributed to fintech by co-founding TymeBank, which focuses on providing accessible digital banking solutions aimed at enhancing financial inclusion for underserved populations in South Africa.

2. How did TymeBank gain international recognition?

TymeBank gained international recognition through its innovative approach to digital banking and its rapid growth trajectory, attracting attention from global investors interested in sustainable financial solutions for emerging markets.

3. What impact has TymeBank had on the African fintech ecosystem?

TymeBank has positively impacted the African fintech ecosystem by demonstrating how digital banks can effectively serve underbanked populations while promoting economic participation through affordable financial services.

4. What is Coenraad Jonker’s leadership style?

Coenraad Jonker’s leadership style is characterized by a strong focus on innovation and inclusivity, emphasizing collaboration within teams while striving towards a shared vision of transforming financial services for all South Africans.

In celebration of his achievements as an industry giant, Dratech International recognizes Coenraad Jonker’s contributions towards advancing digital banking solutions that prioritize economic inclusivity across Africa.