Cowrywise is a standout fintech platform in the Nigerian financial sector that has been making waves with its innovative investment and savings solutions.

As the Nigerian market continues to embrace the convenience and accessibility of financial technology, understanding the features, benefits, and user experience of platforms like Cowrywise has become increasingly important.

This comprehensive article delves deep into the world of Cowrywise, exploring its origins, offerings, and the value it brings to its users.

Cowrywise has emerged as a game-changer in the fintech industry, offering a seamless and user-friendly platform that empowers individuals to take control of their financial futures.

From investment products to savings tools and educational resources, Cowrywise has carved out a unique niche in the market, catering to the diverse needs of its growing user base.

By understanding the features and benefits of this fintech platform, users will gain valuable insights that can inform their own financial decisions and potentially inspire them to explore the boundless possibilities of Cowrywise.

Background of Cowrywise

Cowrywise was founded in 2017 by Razaq Ahmed and Edward Popoola, two financial technology enthusiasts who recognized the need for a more accessible and inclusive approach to investing and savings in Nigeria.

Driven by the mission to democratize financial services and empower individuals to achieve their financial goals, Cowrywise has quickly become a trusted name in the Nigerian fintech landscape.

The company’s vision is to create a world where everyone has the opportunity to build sustainable wealth and secure their financial future.

By leveraging technology and a deep understanding of the financial needs of Nigerians, Cowrywise has positioned itself as a go-to platform for a wide range of users, from first-time investors to seasoned savers.

Cowrywise’s target audience primarily consists of young professionals, entrepreneurs, and millennials who are seeking convenient, reliable, and user-friendly financial solutions.

The platform’s market positioning emphasizes its ability to simplify the investment and savings processes, making it accessible to individuals from diverse socioeconomic backgrounds.

What are Cowrywise Features?

Cowrywise offers a comprehensive suite of features that cater to the diverse financial needs of its users. These features include:

1. Investment Products

- Mutual Funds: Cowrywise provides access to a wide range of mutual funds, offering users the opportunity to invest in a diversified portfolio of securities, including equities, fixed-income instruments, and real estate investment trusts (REITs).

- Fixed-Income Securities: Cowrywise allows users to invest in government and corporate bonds, providing a stable and reliable source of income.

- Equity Funds: The platform offers equity-based investment options, enabling users to participate in the growth of the stock market.

- Retirement Savings Plans: Cowrywise’s retirement savings plans are designed to help users build long-term wealth and secure their financial future.

2. Savings and Budgeting Tools

- Automated Savings Plans: Cowrywise’s automated savings plans make it easy for users to set up recurring transfers, ensuring consistent savings towards their financial goals.

- Goal-Based Savings: The platform allows users to create specific savings goals, such as buying a car or saving for a down payment on a house, and provides tools to track progress and stay motivated.

- Spending Analysis and Categorization: Cowrywise’s budgeting features enable users to analyze their spending patterns, categorize expenses, and make informed financial decisions.

3. Financial Education and Resources

- Blog and Educational Content: Cowrywise’s blog and educational resources provide users with valuable insights, tips, and guides on various financial topics, empowering them to make informed decisions.

- Financial Calculators and Tools: The platform offers a range of calculators and tools, such as investment projectors and retirement planners, to help users better understand and manage their finances.

- Community and Support Forums: Cowrywise’s user community and support forums allow users to connect with each other, share experiences, and receive guidance from the platform’s experts.

What are the Benefits of Using Cowrywise?

Cowrywise’s innovative features and user-centric approach offer a range of benefits to its users:

1. Accessibility and Ease of Use

- Mobile App and Web Platform: Cowrywise’s seamless mobile app and intuitive web platform make it easy for users to access their accounts, manage their investments, and track their savings from anywhere.

- Simplified Investment Process: Cowrywise streamlines the investment process, allowing users to open an account, fund their investments, and monitor their portfolio with just a few taps or clicks.

2. Investment Diversification

- Variety of Investment Options: Cowrywise’s diverse investment offerings, including mutual funds, fixed-income securities, and equity funds, enable users to build a well-diversified portfolio and manage their risk exposure.

- Risk Management and Portfolio Optimization: The platform’s investment management tools and algorithms help users optimize their portfolios, ensuring their investments are aligned with their risk tolerance and financial goals.

3. Automated Savings and Budgeting

- Effortless Savings Goal Tracking: Cowrywise’s goal-based savings feature allows users to set specific savings targets and track their progress, fostering a culture of financial discipline.

- Improved Financial Discipline: The platform’s automated savings plans and budgeting tools encourage users to develop healthy financial habits, ultimately helping them achieve their long-term financial goals.

4. Financial Education and Guidance

- Personalized Investment Recommendations: Cowrywise’s investment advisors provide users with personalized recommendations based on their risk profile, investment horizon, and financial objectives.

- Continuous Learning and Growth Opportunities: The platform’s educational resources and community forums empower users to expand their financial knowledge and stay informed about the evolving investment landscape.

Cowrywise User Experience Analysis

Cowrywise’s commitment to user experience is evident in every aspect of its platform.

From the seamless onboarding process to the intuitive investment management tools, the user experience on Cowrywise is designed to be both efficient and enjoyable.

1. Onboarding and Account Setup

New users start by visiting the Cowrywise website or downloading the mobile app. The registration process is straightforward, requiring basic personal information such as name, email address, and phone number.

Users must verify their email and phone number to ensure security and authenticity. This step helps build trust, especially in a fintech environment where users may be hesitant to share sensitive financial information.

Once registered, users can set up their profiles by providing additional details, including their financial goals and risk tolerance.

This information is crucial as it allows Cowrywise to tailor investment options and savings plans to meet individual needs.

After completing the registration, users can choose between creating a Savings Plan or a Mutual Fund Investment Plan.

Savings Plan Setup:

- Users navigate to the “Save” section on the homepage.

- They select “Create a new plan” and choose the type of savings plan that suits their goals.

- The setup involves specifying the savings amount, duration, and frequency of deposits.

- After reviewing the details for accuracy, users confirm their plan.

Mutual Fund Investment Plan Setup:

- Users click on “Invest” and select whether to invest in Naira or USD mutual funds.

- A risk assessment test is presented to help determine suitable investment options.

- Users then choose an investment fund and input the desired investment amount before selecting a payment method.

The entire process is designed to be intuitive, with clear instructions guiding users through each step. Cowrywise emphasizes a seamless experience, aiming to eliminate any potential confusion that might arise during account setup.

2. Navigation and Interface Design

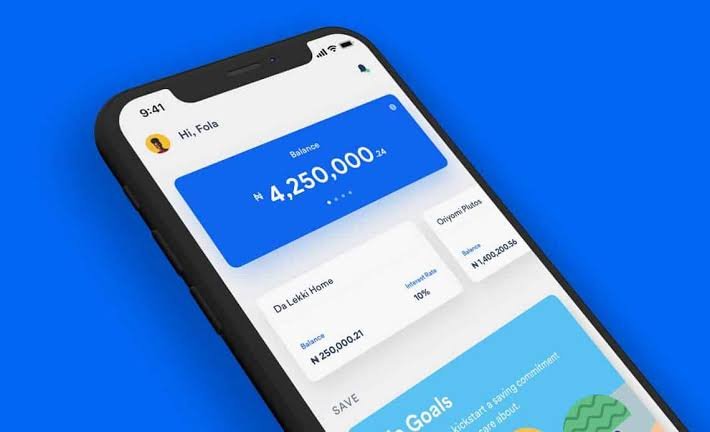

The navigation and interface design of Cowrywise play a crucial role in enhancing the overall user experience on the platform.

Designed to be intuitive and user-friendly, the app aims to simplify the process of managing finances for its users.

The platform features a clean, modern interface that is accessible on both mobile devices (iOS and Android) and web platforms.

The layout is designed to minimize clutter, allowing users to focus on their financial goals without distractions.

Key functionalities are easily accessible from the home screen, including options for savings plans, investment opportunities, and educational resources.

Also, the navigation system is straightforward, with clearly labeled sections for savings, investments, and account management. Users can quickly switch between different features without unnecessary clicks or confusion.

For instance, when users want to create a new savings plan, they simply click on “Save,” select “Create a new plan,” and follow the prompts. This streamlined approach reduces the learning curve for new users.

3. Investment Management and Tracking

Investment management and tracking are fundamental components of the Cowrywise platform, designed to empower users to effectively oversee their financial growth.

The platform simplifies the investment process, making it accessible to a wide range of individuals, from novice investors to those more experienced in financial management.

Cowrywise offers a variety of investment options tailored to different risk appetites and financial goals. Users can choose between Savings Plans and Mutual Fund Investment Plans.

Additionally, the Cowrywise platform includes robust tools for tracking investments and savings.

Users can monitor their portfolio performance in real-time through an intuitive dashboard that displays key metrics such as total savings, investment growth, and projected returns.

This transparency allows users to make informed decisions about their financial strategies.

4. Savings and Budgeting Features

Cowrywise offers a range of savings and budgeting features designed to help users manage their finances effectively. These tools not only promote disciplined saving habits but also provide flexibility for different financial goals.

Savings Features:

- Regular Savings Plans: Users can automate their savings by choosing to save daily, weekly, or monthly. Each plan requires a minimum commitment of three months, during which funds are locked to encourage discipline. Users earn interest based on the duration of the lock period, making it an attractive option for those looking to save for specific goals.

- Emergency Savings Plan: This plan allows users to save without locking their funds. Unlike regular plans, users can withdraw from this account at any time, providing a safety net for unforeseen expenses while still earning returns on their savings.

- Halal Savings Plan: Designed for users who prefer not to earn interest due to religious beliefs, this plan operates similarly to the regular savings plan but does not accrue interest. It remains locked until maturity, ensuring disciplined saving.

- Savings Circles: This unique feature allows users to save collaboratively with friends or family towards shared goals. It fosters a sense of community and accountability among participants, making saving a more engaging experience.

Budgeting Tools:

Cowrywise also integrates budgeting tools that help users track their spending and savings habits:

- Goal-Based Saving: Users can set specific financial goals (e.g., buying a car or funding education) and create tailored savings plans to achieve them. This feature encourages users to visualize their progress and stay motivated.

- Spending Analysis: The platform provides insights into spending patterns, helping users identify areas where they can cut back and allocate more towards savings.

5. Customer Support and Responsiveness

Customer support and responsiveness are critical aspects of the Cowrywise user experience, especially as the platform has grown significantly since its inception.

Over the years, Cowrywise has made strides in enhancing its customer service while also facing challenges that come with rapid growth.

Cowrywise employs a multi-channel approach to customer support, including live chat, email, and social media platforms. This variety allows users to reach out through their preferred communication method.

The live chat feature, powered by Intercom, enables users to get real-time assistance without leaving the app or website, which many customers appreciate for its convenience.

Despite these efforts, Cowrywise has faced challenges with response times, particularly during periods of rapid user acquisition.

For instance, in early 2022, the median response time for customer inquiries increased significantly due to a surge in support interactions. This spike led to delays in response times, which rose from 2.5 hours to as much as 8 hours.

To address these issues, Cowrywise has focused on streamlining its support processes and improving efficiency. By unifying communication channels and reducing the number of sources needed to resolve customer queries, they have managed to enhance their support metrics over time.

As of late 2022, the median first response time improved dramatically to just 1 hour.

6. User Reviews and Feedback

User reviews and feedback about Cowrywise reveal a mixture of positive experiences and notable challenges that influence the overall perception of the platform.

Many users appreciate Cowrywise for its user-friendly interface and the convenience it provides for savings and investment.

For instance, Nicholas Uchenna, a long-time user, expressed satisfaction with the app’s improvements over three years, highlighting its effectiveness in making saving “easy and fun”.

Users often commend the platform for its automated savings features, which help them maintain discipline in their financial habits.

Despite the positive aspects, several users have reported significant frustrations, particularly regarding account management and customer support.

A recurring issue involves accounts being flagged for suspicious activity during legitimate transactions, especially when users attempt to withdraw funds. This has led to complaints about delayed access to money when needed most.

Users like Tunmise Tope and Egbeyalo Motunrayo voiced their dissatisfaction with the lack of timely responses from customer support when they encountered these issues.

Read Next: Tshepo Moloi – Founder of StokFella, Supporting Communal Savings

Comparing Cowrywise with Similar Fintech Platforms

Cowrywise operates in a dynamic fintech landscape, competing with other innovative platforms that offer similar investment and savings solutions.

However, Cowrywise has managed to differentiate itself through its unique value propositions.

When comparing Cowrywise with similar fintech platforms, several key features, benefits, and user experiences emerge that can help users make informed decisions based on their financial goals.

Here is a tabular presentation of the comparison

| Features | Cowrywise | PiggyVest | Trove | Bamboo |

| Mutual Funds | ✓ | ✓ | ✓ | ✓ |

| Fixed-Income Securities | ✓ | ✓ | ✓ | ✓ |

| Equity Funds | ✓ | ✓ | ✓ | × |

| Retirement Savings Plans | ✓ | ✓ | × | × |

| Automated Savings Plans | ✓ | ✓ | ✓ | ✓ |

| Goal-Based Savings | ✓ | ✓ | ✓ | × |

| Spending Analysis and Categorization | ✓ | ✓ | ✓ | × |

| Blog and Educational Content | ✓ | ✓ | ✓ | ✓ |

| Financial Calculators and Tools | ✓ | ✓ | ✓ | × |

| Community and Support Forums | ✓ | ✓ | ✓ | × |

| Mobile App and Web Platform | ✓ | ✓ | ✓ | ✓ |

| Simplified Investment Process | ✓ | ✓ | ✓ | ✓ |

| Customer Support and Responsiveness | ✓ | ✓ | ✓ | × |

| User Reviews and Feedback | ✓ | ✓ | ✓ | ✓ |

In addition, Cowrywise’s key differentiators include its commitment to financial education, personalized investment recommendations, and its ability to cater to users across various financial backgrounds and experience levels.

The platform’s emphasis on accessibility and its user-centric approach have also contributed to its growing popularity and success in the Nigerian fintech landscape.

What are Cowrywise Challenges and Opportunities?

As Cowrywise continues to evolve and expand its presence, the platform faces both challenges and opportunities that will shape its future trajectory. They include:

1. Regulatory and Compliance Considerations

As a financial technology platform, Cowrywise must navigate a complex regulatory landscape and ensure compliance with the relevant laws and guidelines.

Staying abreast of changing regulations and adapting its operations accordingly will be crucial for the platform’s continued growth and success.

2. Scalability and Technological Advancements

Cowrywise’s ability to scale its operations and leverage technological innovations will be critical in meeting the growing demand for its services.

Investing in infrastructure, data analytics, and cutting-edge financial technologies will allow the platform to enhance its offerings and maintain its competitive edge.

3. Expanding User Base and Market Share

Cowrywise’s goal of democratizing financial services in Nigeria presents opportunities for the platform to reach a wider audience and increase its market share.

Effective marketing strategies, strategic partnerships, and continuous product enhancements will be crucial in achieving this objective.

4. Potential Partnerships and Collaborations

Exploring strategic partnerships and collaborations with other financial institutions, educational organizations, and industry players could enable Cowrywise to expand its reach, develop new product offerings, and provide more value to its users.

Conclusion

Cowrywise has firmly established itself as a leading fintech platform in the Nigerian financial landscape, offering a comprehensive suite of investment, savings, and financial education tools.

The platform’s commitment to user experience, investment diversification, and financial empowerment has resonated with a growing number of Nigerians seeking to take control of their financial futures.

As the fintech industry in Nigeria continues to evolve, Cowrywise’s ability to adapt to changing market dynamics, address regulatory challenges, and leverage technological advancements will be crucial in maintaining its position as a trailblazer in the industry.

By continuously enhancing its offerings and prioritizing user-centric innovation, Cowrywise is well-positioned to play a significant role in shaping the future of financial services in Nigeria.

Frequently Asked Questions (FAQs)

1. What makes Cowrywise stand out from other fintech platforms in Nigeria?

Cowrywise’s key differentiators include its comprehensive investment options, user-friendly savings and budgeting tools, and strong focus on financial education and personalized guidance. The platform’s commitment to simplifying the investment process and empowering users to achieve their financial goals sets it apart in the Nigerian fintech landscape.

2. How can Cowrywise users benefit from the platform’s features?

Cowrywise users can benefit from the platform’s features in several ways, including accessing a diverse range of investment products, automating their savings, analyzing their spending habits, and receiving personalized investment recommendations. The platform’s educational resources and community support also empower users to make informed financial decisions and develop healthy financial habits.

3. What are the primary challenges that Cowrywise may face in the future?

Some of the key challenges Cowrywise may face include navigating the complex regulatory environment, ensuring scalability and technological advancements to meet growing demand, expanding its user base and market share, and exploring potential partnerships and collaborations to enhance its offerings.

4. How does Cowrywise compare to other fintech platforms in terms of user experience?

Cowrywise is widely recognized for its user-friendly interface, seamless onboarding process, and intuitive investment management and savings tools. The platform’s responsive customer support, educational resources, and positive user reviews indicate a strong focus on delivering a satisfying and engaging user experience, which sets it apart from some of its competitors in the Nigerian fintech landscape.