Nowadays, e-commerce has revolutionized the way we shop and conduct business, a seamless and secure payment gateway is paramount.

GTPay, a product of GTBank, has emerged as a leading player in Nigeria’s fintech landscape, offering a reliable and efficient solution for both businesses and individuals.

Imagine a world where online transactions are as smooth as a well-oiled machine. A world where you can effortlessly purchase your favorite products or services with just a few clicks.

This is the vision that GTPay strives to achieve. By providing a robust and user-friendly platform, GTPay has become an indispensable tool for businesses of all sizes, from small-scale entrepreneurs to large corporations.

But what exactly makes GTPay stand out from the crowd? How does it work its magic behind the scenes? And what are the benefits it brings to the table?

In this comprehensive review, we’ll look into GTPay, exploring its features, advantages, and the overall user experience.

History and Development of GTPay

GTPay was launched as part of GTBank’s broader strategy to enhance digital banking services and facilitate online transactions for both businesses and consumers.

Since its inception, GTPay has evolved to support various payment methods, catering to the growing demand for online shopping and digital payments in Nigeria.

Founded in 1990, GTBank has established itself as one of Nigeria’s leading financial institutions.

Known for its innovative banking solutions, GTBank has consistently pushed the envelope in terms of technology adoption within the banking sector.

The bank’s focus on customer-centric services has made it a trusted name among consumers and businesses alike.

Furthermore, the FinTech revolution has transformed how financial services are delivered, enabling faster, more efficient transactions while enhancing security measures.

GTPay embodies this shift by leveraging technology to provide a robust platform for online payments.

As businesses increasingly adopt digital solutions, GTPay stands out as a vital tool for navigating the complexities of e-commerce.

What are the Services Offered by GTPay?

GTPay offers a comprehensive suite of services designed to meet the diverse needs of merchants and consumers alike.

1. Payment Processing

- Types of Payments Accepted: GTPay supports payments from local debit cards as well as international credit cards, allowing businesses to cater to a broad audience.

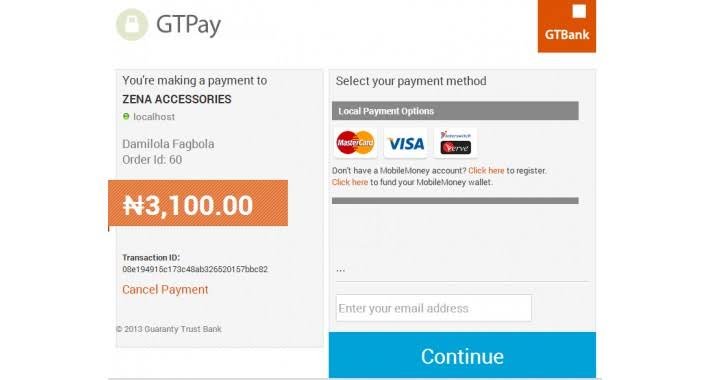

- Supported Card Networks: The platform is compatible with major card networks including Visa, MasterCard, and Interswitch, ensuring wide acceptance.

- Instant Transaction Processing Capabilities: Transactions are processed in real-time, providing immediate confirmation for both merchants and customers.

2. Merchant Integration

Setting up GTPay is straightforward for merchants:

- Steps for Merchants: Merchants can easily integrate GTPay into their existing websites through a simple onboarding process.

- Requirements for Integration: To set up GTPay, merchants need a Merchant ID and a Hash Key provided by GTBank.

- Cost Structure: The initial setup fee is approximately ₦75,000, with transaction fees typically around 1.5% per transaction.

3. User Interface and Experience

From a user perspective:

- Description of the Payment Interface: The payment interface is designed with user-friendliness in mind, featuring intuitive navigation that simplifies the checkout process.

- Ease of Use for Customers During Checkout: Customers can complete their purchases quickly without unnecessary steps or complications.

- Mobile Optimization and Accessibility Features: GTPay is optimized for mobile devices, making it accessible for users on smartphones and tablets.

Key Features of GTPay

GTPay boasts several key features that enhance its functionality as a payment gateway. They include:

1. Security Measures

- Overview of Security Protocols: GTPay employs advanced security measures including SSL encryption and 3D Secure protocols to protect sensitive customer information.

- Comparison with Other Payment Gateways Regarding Security: When compared to competitors like Paystack or Flutterwave, GTPay maintains competitive security standards that ensure safe transactions.

2. Transaction Fees

- Breakdown of Local vs. International Transaction Fees: Local transactions incur lower fees compared to international ones, which are typically higher due to additional processing costs.

- Monthly Charges and Additional Costs: Merchants should be aware of any monthly fees associated with maintaining their GTPay accounts alongside transaction costs.

3. Transaction Timeliness

- Details on Fund Transfers to Merchants: Funds from transactions processed through GTPay are usually settled within 24 hours, which is advantageous for cash flow management.

- Comparison with Other Payment Gateways in Terms of Transaction Speed: This settlement speed positions GTPay favorably against other gateways that may take longer to process payments.

GTPay’s User Experience

User experience is critical when evaluating any payment gateway. Here is an overview of GTPay’s user experience:

1. Customer Feedback

- Summary of User Reviews: Overall feedback from users indicates satisfaction with the speed and reliability of transactions; however, some users have noted areas for improvement.

- Common Praises and Complaints About GTPay: Users often praise its ease of use but have raised concerns about occasional technical glitches during peak transaction periods.

2. Comparison with Competitors

When compared with other popular payment gateways like Paystack or Rave by Flutterwave:

| Feature | GTPay | Paystack | Rave by Flutterwave |

| Setup Fee | ₦75,000 | ₦20,000 | ₦0 |

| Local Transaction Fee | 1.5% | 1.5% + ₦100 | 1.4% + ₦10 |

| International Transaction Fee | Higher rates | 3.9% + ₦100 | 3.8% + ₦10 |

| Settlement Time | Within 24 hours | Within 24 hours | Within 24 hours |

GTPay’s unique selling points include its strong backing from GTBank and its focus on local market needs.

Read Also: Cellulant Review: All You Should About the Payment Solution Provider

How to Use GTPay

Using GTPay involves a few straightforward steps:

1. Merchants need to register on the GTBank website.

2. After receiving their Merchant ID and Hash Key, they can integrate these into their e-commerce platforms.

3. Customers can make payments through the integrated interface using their debit or credit cards during checkout.

Challenges and Limitations of GTPay

While GTPay offers many advantages, it also faces certain challenges, such as:

1. Integration Issues

- Common Challenges Faced During Onboarding: Some merchants report difficulties during integration due to technical issues or lack of support documentation.

- Lack of User Dashboard Implications: The absence of a comprehensive user dashboard can hinder merchants’ ability to track transactions effectively.

2. Market Competition

The competitive landscape in Nigeria’s payment gateway market is fierce:

- Analysis of Competitive Landscape: With numerous players like Paystack and Flutterwave emerging rapidly, maintaining market share requires continuous innovation from GTPay.

- Potential Threats from Emerging Fintech Solutions: New fintech startups are constantly entering the market with disruptive technologies that could challenge established players like GTBank.

Future Outlook of GTPay

Looking ahead, GTPay has several exciting prospects:

- Planned Upgrades or New Features: GTBank is reportedly working on enhancing GTPay’s features by integrating more payment options such as mobile money.

- Expansion Plans into New Markets or Additional Services: There are indications that GTBank may expand GTPay’s reach beyond Nigeria into other West African markets where it operates.

Conclusion

GTPay offers a robust solution for businesses looking to accept online payments efficiently. Its strengths lie in its strong security measures, quick transaction processing times, and seamless integration capabilities.

However, challenges such as integration issues and market competition must be addressed for it to remain competitive.

For businesses considering adopting GTPay as their payment gateway solution, it is advisable to weigh these strengths against potential limitations based on specific business needs.

Overall, GTPay represents a solid choice within Nigeria’s evolving fintech landscape.

Frequently Asked Questions

1. What types of payments does GTPay accept?

GTPay accepts both local debit cards and international credit cards from major networks like Visa and MasterCard.

2. How long does it take for funds to be settled into merchant accounts?

Funds processed through GTPay are typically settled within 24 hours into merchant accounts.

3. Are there any setup fees associated with using GTPay?

Yes, there is an initial setup fee of approximately ₦75,000 required for merchants wishing to use GTPay.

4. How does GTPay compare with other payment gateways?

While similar gateways like Paystack offer lower setup fees, GTPay provides strong security features backed by GTBank’s reputation in Nigeria’s banking sector.