How to use Payday App. Managing money can be a challenge nowadays. With the rise of fintech platforms, handling payments has become easier and more efficient.

One app that stands out in this space is the Payday App. This handy tool lets you send and receive money across the globe, create virtual cards, and manage different currency wallets all in one place.

Knowing how to use Payday effectively can help freelancers, remote workers, and anyone needing international payments to take control of their finances.

In this article, we’ll walk you through how to use Payday app, from getting started to making transactions.

Table of Contents

What is the Payday App?

The Payday App is a powerful fintech platform that makes financial transactions simple and quick. Here’s what it can do:

Send and Receive Money Globally: You can easily send money to friends or clients anywhere in the world, which is perfect for freelancers and remote workers.

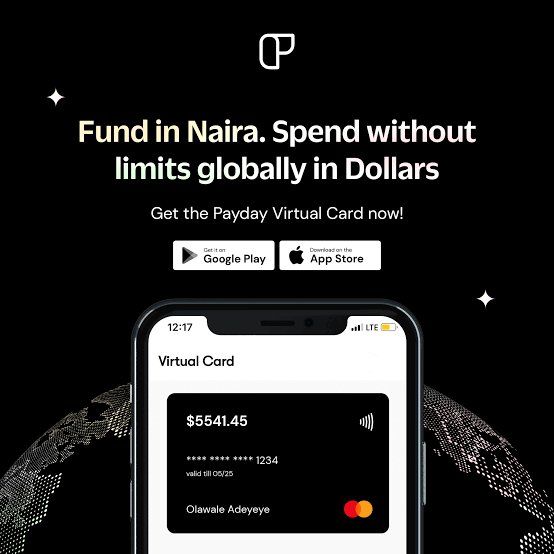

Create Virtual Mastercard and Visa Cards: The app allows you to create virtual cards for online shopping, adding an extra layer of security.

Manage Multiple Currency Wallets: You can hold wallets in several currencies like USD, EUR, GBP, and RWF. This feature is especially useful if you work with international clients or travel often.

The app is designed for freelancers, remote workers, expatriates, and anyone who needs a reliable way to manage international payments.

Read Next: How to Use Kuda for Daily Banking: A Beginner’s Guide

Getting Started with the Payday App

To start using the Payday app, follow these simple steps:

1. Downloading the App: You can find the Payday app on both the Google Play Store and Apple Store. Just search for “Payday,” click download, and install it on your device.

2. Creating an Account: To set up your account, you’ll need some important information:

- For users in Nigeria: Your Bank Verification Number (BVN).

- For users in Rwanda: Your National ID.

Here’s how to create your account:

- Open the app and select “Create Account.”

- Fill in your details.

- Verify your identity by taking a selfie and submitting your BVN or National ID.

Navigating the Payday App

Once your account is set up, navigating the app is easy:

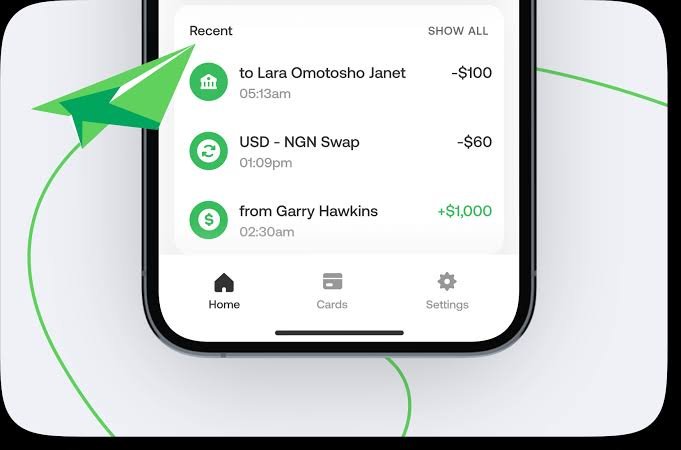

- User Interface Overview: The home screen shows your wallet balance, recent transactions, and quick buttons for sending money or creating virtual cards.

- Setting Up Your Wallet: To manage different currency wallets:Go to the “Wallet” section.

Click “Add Wallet” to create wallets in various currencies.You can fund your wallet through bank transfers or currency swaps from your existing balances.

Using the Payday Virtual Card

The virtual card feature is one of the most exciting parts of the Payday app:

Requesting a Virtual Card: To get a virtual card:

- Go to the “Cards” tab.

- Click “Request Virtual Card.”

- Choose between Mastercard or Visa based on what you prefer.

Funding Your Virtual Card: To add money to your virtual card:

- Select “Fund Card” within the card settings.

- Enter how much you want to transfer.

Keep in mind there may be limits on how much you can fund at once.

Making Transactions with Your Virtual Card: Use your virtual card for online shopping on sites like Amazon or Netflix. Be aware of spending limits, usually $3,000 for Visa cards and $10,000 for Mastercards each month, and any transaction fees that might apply.

What is the Difference Between Payday Virtual Account and Wallet?

Payday offers two distinct financial tools: virtual accounts and wallets.

- Wallets: Each user has wallets in USD, EURO, GBP, and RWF for storing and swapping currencies. Funds in the wallet can be used to fund virtual cards for transactions.

- Virtual Accounts: These accounts are utilized to receive external funds, such as Naira via VFD and Providus accounts, or USD and GBP through IBANs. They facilitate incoming transfers that reflect in the user’s wallet.

In summary, wallets store funds for spending, while virtual accounts enable receiving money from outside sources.

Read Next: Understanding the Benefits and How Social Lender Works for Borrowers and Lenders

Sending and Receiving Money with Payday App

The main purpose of the Payday app is to make sending and receiving money easy:

Sending Money: To send money:

- Tap “Send Money” from your wallet.

- Enter the recipient’s details (either another Payday user or a bank account).

- Type in how much you want to send.

- After confirming everything, you’ll receive an OTP (One-Time Password) for verification before completing the transaction.

Receiving Money: You can receive payments from clients or employers using your unique $tag. Just share this tag with them for instant transfers.

Be aware that there might be fees when receiving funds depending on where they come from.

What Countries Can I send Money to?

Currently, you can send money from your Payday account to:

- Local Nigerian Bank Accounts: This allows users in Nigeria to transfer funds directly to any bank account within the country.

- MOMO Accounts in Rwanda: Rwandan users can send money to their MOMO accounts, facilitating local transactions.

Payday focuses on these specific channels for money transfers, ensuring secure and efficient transactions within these frameworks.

What is the Transfer Limit?

Understanding the transfer limits on your Payday account is crucial for effective financial management. Here’s a detailed breakdown of the current limits:

1. Nigerian Naira (NGN)

- Daily Limit: You can transfer up to 1,000,000 NGN per day.

- Per Transaction Limit: Each individual transaction is also capped at 1,000,000 NGN.

2. US Dollars (USD)

- Daily Limit: The maximum amount you can send in USD is $1,333 per day.

- Per Transaction Limit: Similar to the daily limit, each transaction in USD cannot exceed $1,333.

3. Rwandan Francs (RWF)

- Daily Limit: For transactions in RWF, the limit is set at 1,000,000 RWF per day.

- Per Transaction Limit: Each transaction in RWF is also limited to 1,000,000 RWF.

How do I Withdraw to My Local Bank Account?

Withdrawing money from your Payday wallet to your local bank account is a straightforward process. Follow these steps to ensure a smooth transaction:

1. Tap “Send Money” from Your Payday Wallet

- Open the Payday app and navigate to your wallet.

- Select the option labeled “Send Money.” This will initiate the withdrawal process.

2. Click on “Bank Account”

- After selecting “Send Money,” you will see various options for transferring funds.

- Choose the “Bank Account” option to proceed with a withdrawal to your local bank.

3. Input the Amount

- Enter the specific amount you wish to withdraw from your Payday wallet.

- Ensure that this amount does not exceed your daily transfer limit.

4. Input Bank and Account Number

Provide the necessary details for your local bank account:

- Bank Name: Select or type in the name of your bank.

- Account Number: Enter your bank account number accurately to avoid any errors.

5. Receive an OTP (One-Time Password)

- After entering your bank details, an OTP will be sent to your registered mobile number.

- Check your phone for this OTP, which serves as a security measure to confirm the transaction.

6. Complete the Transaction

- Input the OTP in the designated field within the app.

- Once verified, the funds will be processed and sent to your local bank account.

What is the Withdrawal Fee?

When withdrawing funds from your Payday wallet to your local bank account, it’s important to be aware of the associated withdrawal fees.

These fees vary depending on the currency and destination of the transaction. Here’s a detailed breakdown of the withdrawal fees:

1. Withdrawals to Nigerian Bank Accounts

Fee: ₦35 per transaction

- This fee applies to each transaction made from your Payday wallet to any local bank account in Nigeria.

- The fee is relatively low, making it an economical option for users who frequently withdraw funds.

2. Withdrawals to Rwandan Accounts/MOMO Accounts

Fee: RWF 600 per transaction

- For transactions directed to local Rwandan bank accounts or MOMO accounts, a fee of RWF 600 is charged

- This fee is designed to cover the processing costs associated with transferring funds within Rwanda.

What is the Payday Tag?

The Payday Tag is a unique identifier designed to simplify transactions within the Payday platform. Here’s a detailed overview of its features and benefits:

Key Features of the Payday Tag

- Replacement for Account Numbers: The Payday Tag eliminates the need for traditional account numbers, making it easier for users to send and receive money. This streamlines the payment process, reducing the chances of errors associated with long numerical identifiers.

- Instant Transfers: With a Payday Tag, users can send money to any other Payday user instantly. This feature is particularly beneficial for international transactions, allowing users across different continents to transfer funds quickly without delays.

- No Transfer Charges: One of the standout advantages of using the Payday Tag is that it facilitates free transactions between users. This means you can send or receive money without incurring any fees, making it an economical choice for frequent transfers.

How It Works

To use your Payday Tag:

1. Share Your Tag: Provide your unique tag to friends or clients who wish to send you money.

2. Receive Funds Instantly: Once they enter your tag in their Payday app, they can transfer funds directly to you, which will appear in your wallet immediately.

Use Cases

- International Payments: Freelancers or remote workers can easily receive payments from clients worldwide using their tags, enhancing convenience and efficiency.

- Peer-to-Peer Transfers: Friends and family can quickly send money to each other without worrying about bank details or transfer fees.

Is There a Spending Limit on My Card?

Payday offers two types of virtual cards: Visa and Mastercard, each with distinct spending limits designed to cater to different user needs.

1. Payday Visa Card

- Monthly Spending Limit: The maximum amount you can spend using the Visa card is $3,000.

- Daily Withdrawals: Users can withdraw funds up to 5 times per day.

- Minimum Balance Requirement: You must maintain a minimum balance of $1 on the card.

2. Payday Mastercard

- Monthly Spending Limit: The Mastercard allows for a higher spending limit of $10,000 per month.

- Daily Withdrawals: Similar to the Visa card, you can withdraw funds up to 5 times per day.

- Minimum Balance Requirement: Like the Visa card, a minimum balance of $1 is required.

Additional Information

- Holding More Than the Limit: While there are spending limits, users can hold more than their monthly spending limit on their cards. This allows for flexibility in managing funds without impacting the ability to spend.

- Transaction Fees: Both cards incur a creation fee of $5, and a decline fee of $1 applies if a transaction exceeds the available balance.

Managing Transactions on Payday App

Keeping track of your transactions is essential:

Tracking Transactions: You can view your transaction history by going to the “Transactions” tab in the app. Here you will see details about pending, completed, or failed transactions.

Resolving Issues: If something goes wrong, like a failed transaction:

- Check your internet connection.

- Make sure all recipient details are correct. If problems persist, reach out to customer support through the app’s help section.

Security Features of the Payday App

Security is very important when dealing with financial transactions:

1. The Payday app has strong security features such as two-factor authentication during login and withdrawals to protect user accounts from unauthorized access.

2. Users must verify their identity through government-issued IDs during registration to prevent fraud.

3. Additional security features include biometric authentication options like fingerprint or facial recognition for quick access while ensuring safety.

Also, to keep your account secure:

- Regularly update passwords.

- Avoid sharing sensitive information like OTPs or passwords with anyone.

Conclusion

Knowing how to use Payday app effectively can greatly improve how you manage your finances.

By taking advantage of its features, like sending and receiving money globally, creating virtual cards, and managing multiple currency wallets, you can handle your financial needs easily.

As you explore all that the Payday App offers, whether you’re a freelancer managing international payments or someone looking for a reliable way to handle finances, remember that user reviews highlight both positive experiences and areas for improvement.

Using this platform could change how you manage money efficiently in today’s digital world.

For further assistance or inquiries regarding how to use Payday app:

Visit official FAQs on their website.

Contact customer support through in-app channels for personalized help.

Frequently Asked Questions (FAQs)

1. How long do transfers take?

Transfers between Payday users are instant; however, bank transfers may take longer depending on banking hours.

2. Are there any hidden fees?

While there are fees associated with certain transactions (like sending money to bank accounts), most transfers between Payday users are free.

3. What currencies can I hold in my wallet?

You can hold wallets in USD, EUR, GBP, and RWF within the app.

4. How secure is my information on the Payday app?

The app uses several security measures including two-factor authentication (2FA), biometric login options, and regular monitoring for fraudulent activities.

Recommendations

An Overview of Jumiapay’s Payment Processing System in Nigeria

A Comprehensive Review of JUMO: Analyzing Its Services, Features & User Experience

GTPay Review: Analyzing Its Services, Features & User Experience