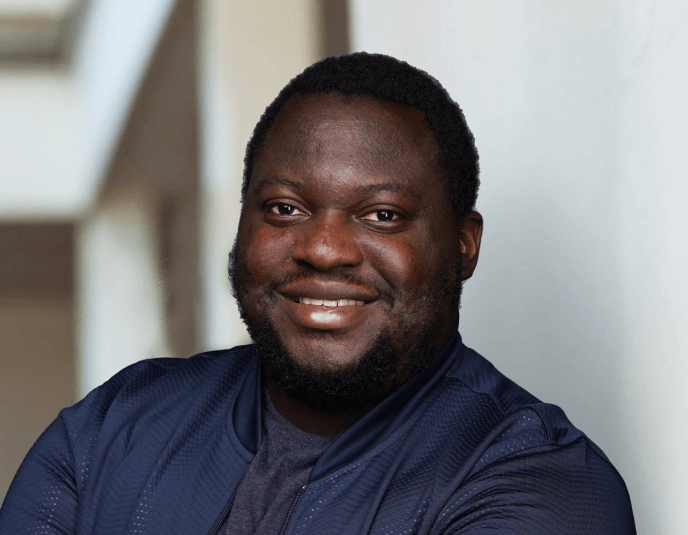

Walid Hassouna is a prominent figure in the fintech landscape of the Middle East and North Africa (MENA) region, best known as the co-founder of ValU, a leading Buy-Now-Pay-Later (BNPL) service.

With a robust background in finance and banking, Hassouna has played a crucial role in shaping ValU into a transformative platform that enhances financial accessibility for consumers and businesses alike.

The Founding of ValU

Established in 2017 as a subsidiary of EFG Hermes, ValU was created to address the growing demand for flexible payment solutions in Egypt.

The platform quickly positioned itself as the first BNPL service in the MENA region, offering customizable financing plans that allow consumers to purchase goods and services while spreading payments over time.

Under Hassouna’s leadership, ValU has expanded its offerings significantly, catering to a diverse range of sectors including electronics, healthcare, and education.

Read Next: Yanmo Omorogbe: Pioneering Investment Access for Nigerians as COO of Bamboo

Driving Financial Inclusion Through Technological Innovation

Hassouna’s vision for ValU extends beyond mere financial transactions; it is about driving financial inclusion through innovative technology.

By leveraging digital solutions, ValU enables consumers, especially those underserved by traditional banking systems, to access credit easily.

The platform’s user-friendly interface allows for instant credit decisions, making it accessible for over one million active users across more than 5,500 points of sale and 1,500 online platforms.

ValU’s approach not only empowers individual consumers but also supports small and medium-sized enterprises (SMEs) by providing them with tools to offer flexible payment options to their customers.

This has been pivotal in boosting consumer spending and stimulating economic growth within the region.

ValU’s Milestones and Global Recognition

Since its launch, ValU has achieved significant milestones, expanding its footprint beyond Egypt into other African markets.

In 2023, ValU underwent a strategic rebranding to reflect its evolution from a Buy-Now, Pay-Later (BNPL) platform to a universal financial technology powerhouse.

This rebranding marks a pivotal shift in its brand architecture and showcases its expanded suite of financial solutions.

The platform has broadened its offerings to include instant cash redemption programs, savings solutions, investment products, and a B2B services platform. This expansion demonstrates its commitment to providing comprehensive financial services.

ValU has been consistently listed among the ‘Top Fintech Companies’ by Forbes Middle East in 2021, 2022, and 2023. It was also named ‘Fintech Company of the Year’ at the Gulf Business Tech Awards in 2021 and 2022.

These strategic growths are crucial for establishing a robust fintech ecosystem on the continent.

The company has attracted substantial investment from global investors, highlighting Africa’s burgeoning fintech potential and placing it on the international stage.

ValU’s success has drawn attention not only from consumers but also from investors eager to tap into the growing demand for flexible payment solutions in emerging markets.

This influx of capital is indicative of a broader trend where African fintech startups are increasingly recognized for their innovation and scalability.

Walid Hassouna’s Leadership and Strategic Vision in Fintech

Hassouna’s leadership style is characterized by a strong emphasis on client-centricity and technological innovation.

His extensive experience in banking, having held significant positions at institutions like Bank Audi, has equipped him with the expertise necessary to navigate complex financial landscapes.

Under his guidance, ValU has not only expanded its product offerings but also enhanced its technological capabilities to better serve its clients.

Hassouna believes that fostering strategic partnerships with industry leaders is crucial for driving growth and innovation.

This vision has led ValU to collaborate with various stakeholders across different sectors, further solidifying its position as a key player in the fintech ecosystem.

Read Next: Shola Akinlade: Driving Innovation in Africa’s Fintech Ecosystem as Co-founder of Paystack

The Broader Impact of Walid Hassouna on Africa’s Tech Ecosystem

Walid Hassouna’s contributions extend beyond ValU; he is actively involved in shaping Africa’s tech landscape through his roles on various boards within the financial sector.

His efforts have significantly impacted financial inclusion initiatives across the continent, empowering individuals and businesses alike.

Through ValU’s innovative solutions, Hassouna is helping to create a more inclusive financial environment that supports economic growth and development in Africa.

His work exemplifies how fintech can be leveraged to address pressing economic challenges while fostering entrepreneurship and consumer empowerment.

Conclusion

Walid Hassouna stands out as a visionary leader in the fintech space, driving significant change through his work with ValU.

By focusing on technological innovation and financial inclusion, he has positioned ValU as a trailblazer in the MENA region’s financial landscape.

As ValU continues to evolve and expand its offerings, it remains committed to enhancing access to financial services for all segments of society.

FAQs

1. What is Walid Hassouna’s main contribution to fintech?

Walid Hassouna’s main contribution lies in establishing ValU as a pioneering BNPL service that enhances financial accessibility for consumers and SMEs across Egypt and beyond.

2. How did ValU gain international recognition?

ValU attracted significant investment from global investors due to its innovative approach and rapid expansion across African markets.

3. What impact has ValU had on the African fintech ecosystem?

ValU has enhanced financial inclusion by enabling SMEs to offer flexible payment options, thereby boosting consumer spending and economic growth.

4. What is Walid Hassouna’s leadership style?

Hassouna’s leadership style emphasizes client-centricity, technological innovation, and strategic partnerships aimed at fostering growth within the fintech sector.

Dratech International is celebrating Walid Hassouna as an industry giant, recognizing his pivotal role in advancing fintech through ValU.

As a co-founder of a leading Buy-Now-Pay-Later service in Africa, Hassouna embodies the spirit of innovation that Dratech champions.